Los Angeles, California Irrevocable Pot Trust Agreement is a legal document that establishes a trust for the purpose of managing and distributing assets in a specific manner after the creator's death. This type of trust is commonly used by individuals residing in Los Angeles, California, who wish to pass down their estate while ensuring its protection and proper distribution to their beneficiaries. The Irrevocable Pot Trust Agreement in Los Angeles, California allows the creator, also known as the granter, to transfer their assets, such as properties, investments, and funds, into the trust. The granter designates a trustee, who will oversee and manage the trust's assets according to the terms and instructions outlined in the agreement. One of the primary benefits of an Irrevocable Pot Trust Agreement is that it offers protection against estate taxes. By legally separating the assets from the granter's estate, the trust reduces the taxable value of the estate, potentially resulting in significant tax savings for the granter and beneficiaries. In Los Angeles, California, there are different types of Irrevocable Pot Trust Agreements tailored to meet specific needs and goals. Some of these variations include: 1. Irrevocable Life Insurance Trust (IIT): This type of trust combines the benefits of life insurance and the Irrevocable Pot Trust Agreement. The granter transfers life insurance policies into the trust, ensuring that the insurance proceeds are not subject to estate taxes, while providing financial protection for the beneficiaries. 2. Charitable Remainder Trust (CRT): This trust allows the granter to donate assets to a charitable organization while retaining an income stream from those assets during their lifetime. After the granter's passing, the remaining assets are distributed to the designated beneficiaries. 3. Special Needs Trust (SET): A Special Needs Trust is designed to provide financial support and care for individuals with disabilities or special needs without jeopardizing their eligibility for government benefits. This type of trust ensures that the beneficiary remains eligible for assistance programs, such as Medicaid and Supplemental Security Income (SSI). 4. Generation-Skipping Trust (GST): This trust is structured to benefit future generations, such as grandchildren or great-grandchildren, while avoiding estate taxes in each subsequent generation. It allows the granter to "skip" a generation and pass assets directly to beneficiaries in later generations. It is essential for individuals in Los Angeles, California, who are considering an Irrevocable Pot Trust Agreement to consult with a qualified estate planning attorney to understand the specific terms, legal requirements, and tax implications associated with the chosen trust type. The attorney can provide guidance on drafting a comprehensive trust agreement that reflects the granter's intentions and protects the interests of the beneficiaries.

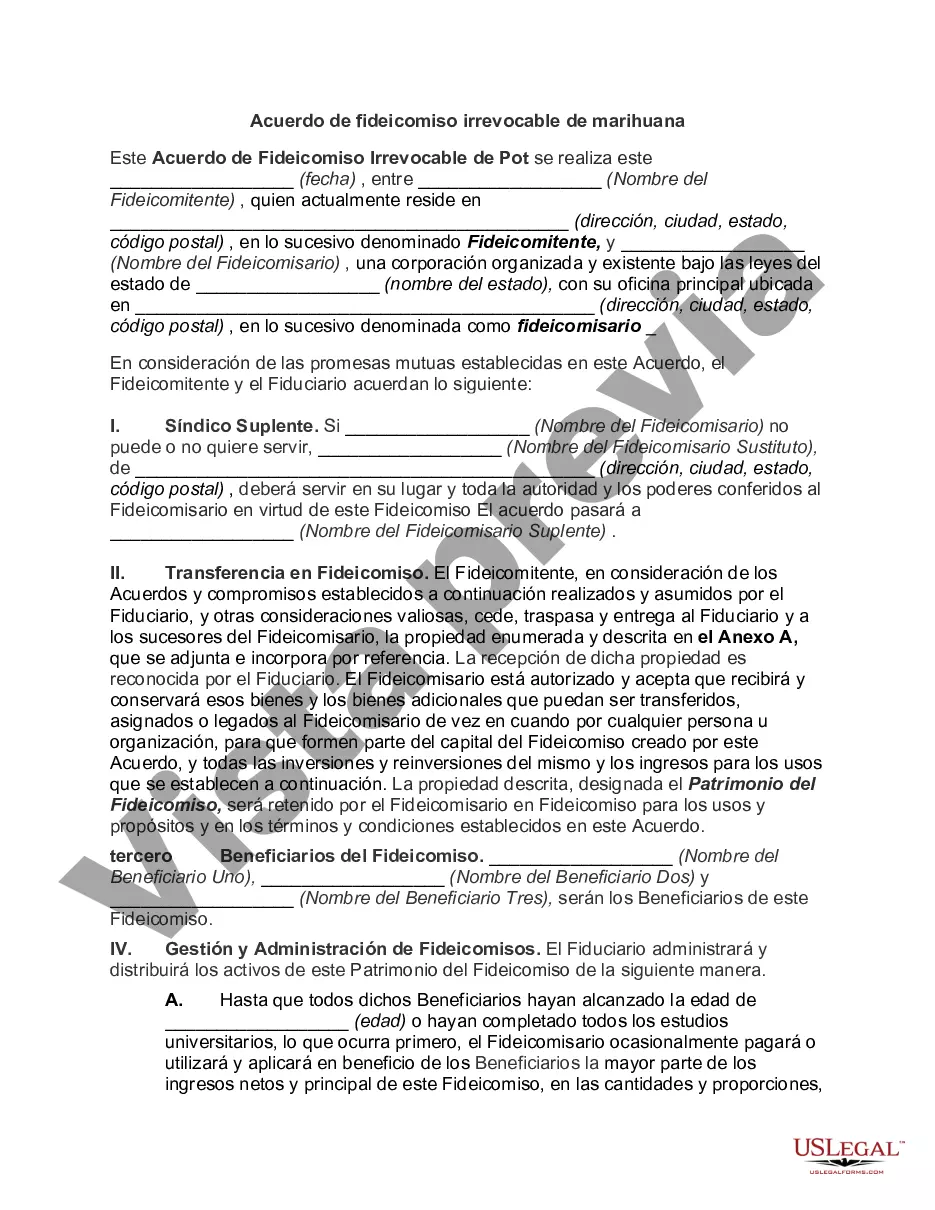

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out Los Angeles California Acuerdo De Fideicomiso Irrevocable De Marihuana?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Los Angeles Irrevocable Pot Trust Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Los Angeles Irrevocable Pot Trust Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Los Angeles Irrevocable Pot Trust Agreement:

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!