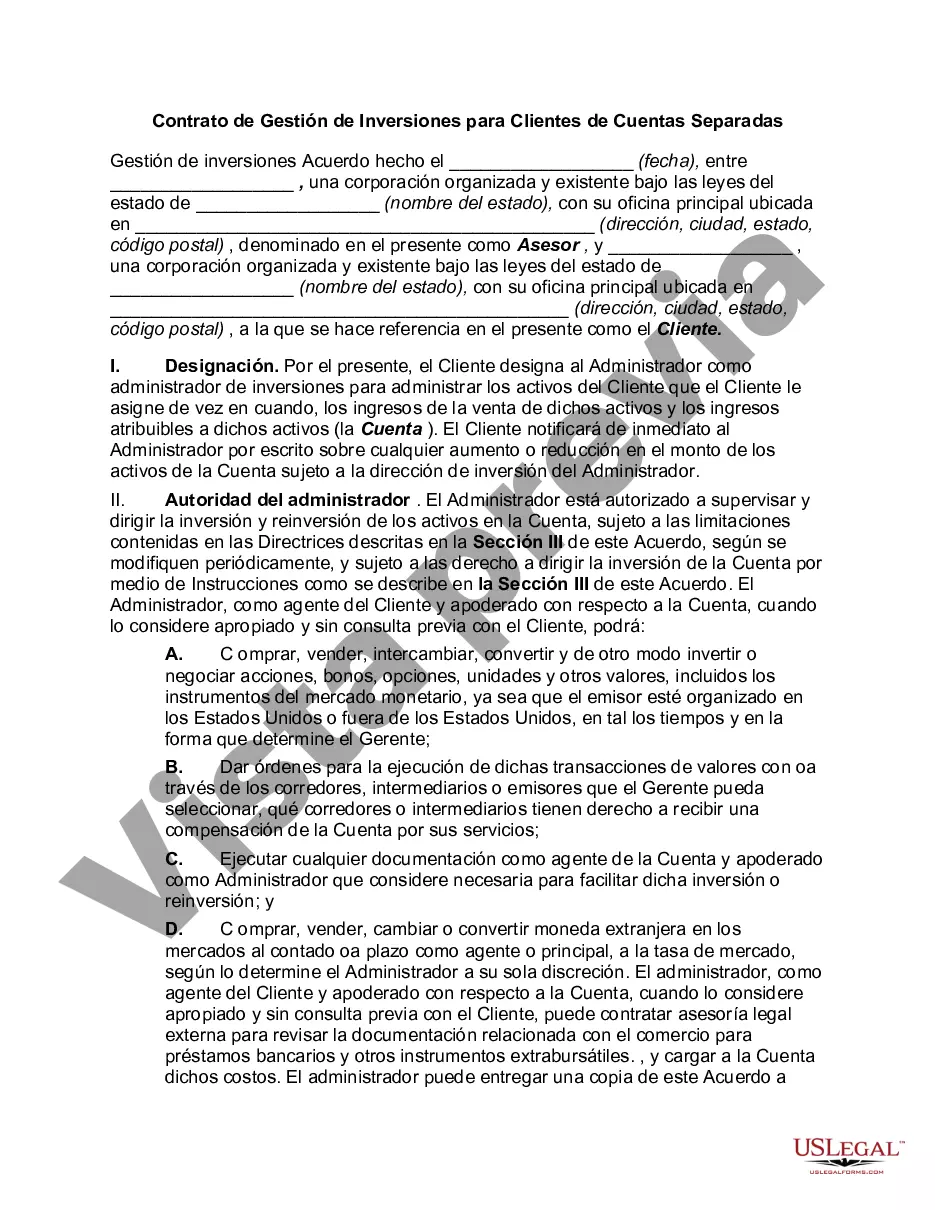

Kings New York Investment Management Agreement for Separate Account Clients is a comprehensive financial agreement designed to cater to the specific needs and goals of individual clients. As a renowned investment management firm, Kings New York aims to provide top-notch services to its clientele through this agreement. The Kings New York Investment Management Agreement for Separate Account Clients begins by outlining the terms and conditions under which the firm will manage the client's investments. It includes a detailed description of the client's investment objectives, risk tolerance, and any specific guidelines or constraints they may have. This agreement also establishes the responsibilities and duties of both parties. Kings New York is entrusted with overseeing the investment portfolio and making investment decisions on behalf of the client, while the client agrees to provide accurate information and timely communication regarding their financial situation and investment preferences. To ensure transparency, the agreement defines the fee structure, including management fees and any performance-based compensation. It also specifies the billing frequency and the method of calculating fees based on the client's assets under management. Kings New York Investment Management Agreement for Separate Account Clients covers the various investment strategies employed by the firm. This may include strategies such as growth, value, income, or a combination of these, depending on the client's objectives. Each strategy is tailored to suit the unique requirements of the client. Additionally, if applicable, the agreement may feature different types of investment accounts, such as individual or joint accounts, retirement accounts, or trust accounts. For each account type, specific regulations, tax implications, and account management guidelines will be detailed. The agreement emphasizes the importance of regular reporting and communication between Kings New York and its clients. It outlines the frequency and format of performance reports, including detailed information on portfolio holdings, performance metrics, and market analysis. This ensures that clients remain well-informed about their investments and enables them to align their goals accordingly. In conclusion, the Kings New York Investment Management Agreement for Separate Account Clients is a comprehensive and customized financial agreement aimed at providing clients with professional investment management services. With its focus on transparency, tailored investment strategies, and regular communication, Kings New York strives to build long-lasting relationships with its clients while helping them achieve their financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Contrato de Gestión de Inversiones para Clientes de Cuentas Separadas - Investment Management Agreement for Separate Account Clients

Description

How to fill out Kings New York Contrato De Gestión De Inversiones Para Clientes De Cuentas Separadas?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Kings Investment Management Agreement for Separate Account Clients suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Kings Investment Management Agreement for Separate Account Clients, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Kings Investment Management Agreement for Separate Account Clients:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Kings Investment Management Agreement for Separate Account Clients.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!