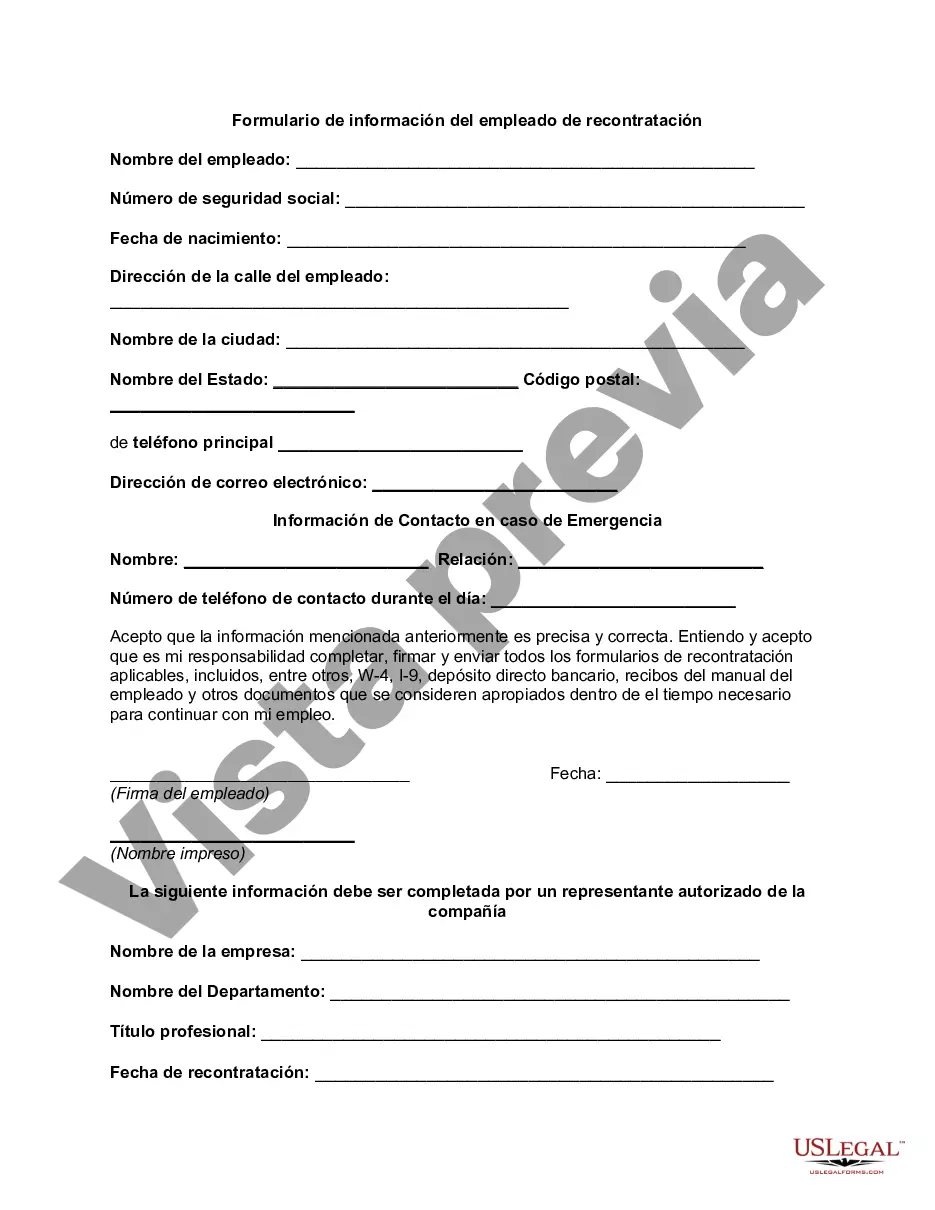

The Mecklenburg North Carolina Re-Hire Employee Information Form is a comprehensive document designed to collect essential information from employees who are being re-hired by a company within the Mecklenburg County area of North Carolina. This form serves as a means for employers to gather updated and accurate details about their returning employees and ensure compliance with legal requirements. Keyword: Mecklenburg North Carolina Re-Hire Employee Information Form Different types of Mecklenburg North Carolina Re-Hire Employee Information Forms may include: 1. Basic Employee Information: This form section collects fundamental details such as the employee's full name, social security number, contact information (address, phone number, email), and emergency contact information. It also requests the employee's preferred name and any other personal or contact details that have changed since their previous employment. 2. Employment History: Here, the form requests detailed information about the employee's previous employment within the company. It includes dates of previous employment, job title, department, supervisor's name, and reasons for leaving the company. This section allows employers to track the employee's career progression and evaluate their eligibility for rehire. 3. Acknowledgement of Policies: This section ensures that employees understand and agree to abide by the company's policies and procedures. It may cover topics such as code of conduct, ethics, non-disclosure agreements, technology usage, and safety regulations. By signing this section, employees indicate their commitment to comply with these policies. 4. Benefits and Compensation: In this portion, employees provide information related to their compensation package, benefits enrollment, and preferred payment method. It may include fields for salary, hourly wage, tax withholding preferences, insurance coverage, retirement plans, and other relevant benefit options. 5. Direct Deposit Authorization: If employees prefer to receive their wages via direct deposit, this section collects the required banking details, such as the bank name, routing number, and account number, ensuring their payment is transferred accurately and securely. 6. Tax Withholding: This section allows employees to specify their federal and state income tax withholding requirements accurately. It also collects information related to their dependents and exemptions to ensure accurate tax calculations. 7. Emergency Contacts and Medical Information: Here, employees provide additional emergency contact details and disclose any essential medical information that may affect their ability to perform certain tasks or require specific accommodations. 8. Employee Signatures: The form typically ends with employee signatures, confirming the accuracy and completeness of the provided information. It also acknowledges that the employee understands any legal implications related to the information provided and assures that it can be used as necessary by the employer. The Mecklenburg North Carolina Re-Hire Employee Information Form is a vital tool for employers in the region to gather comprehensive information from their re-hired employees, ensuring legal compliance, accurate record-keeping, and effective human resource management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carta De Verificacion De Empleo - Re-Hire Employee Information Form

Description

How to fill out Mecklenburg North Carolina Formulario De Información Del Empleado De Recontratación?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Mecklenburg Re-Hire Employee Information Form, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Mecklenburg Re-Hire Employee Information Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Re-Hire Employee Information Form:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Mecklenburg Re-Hire Employee Information Form and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!