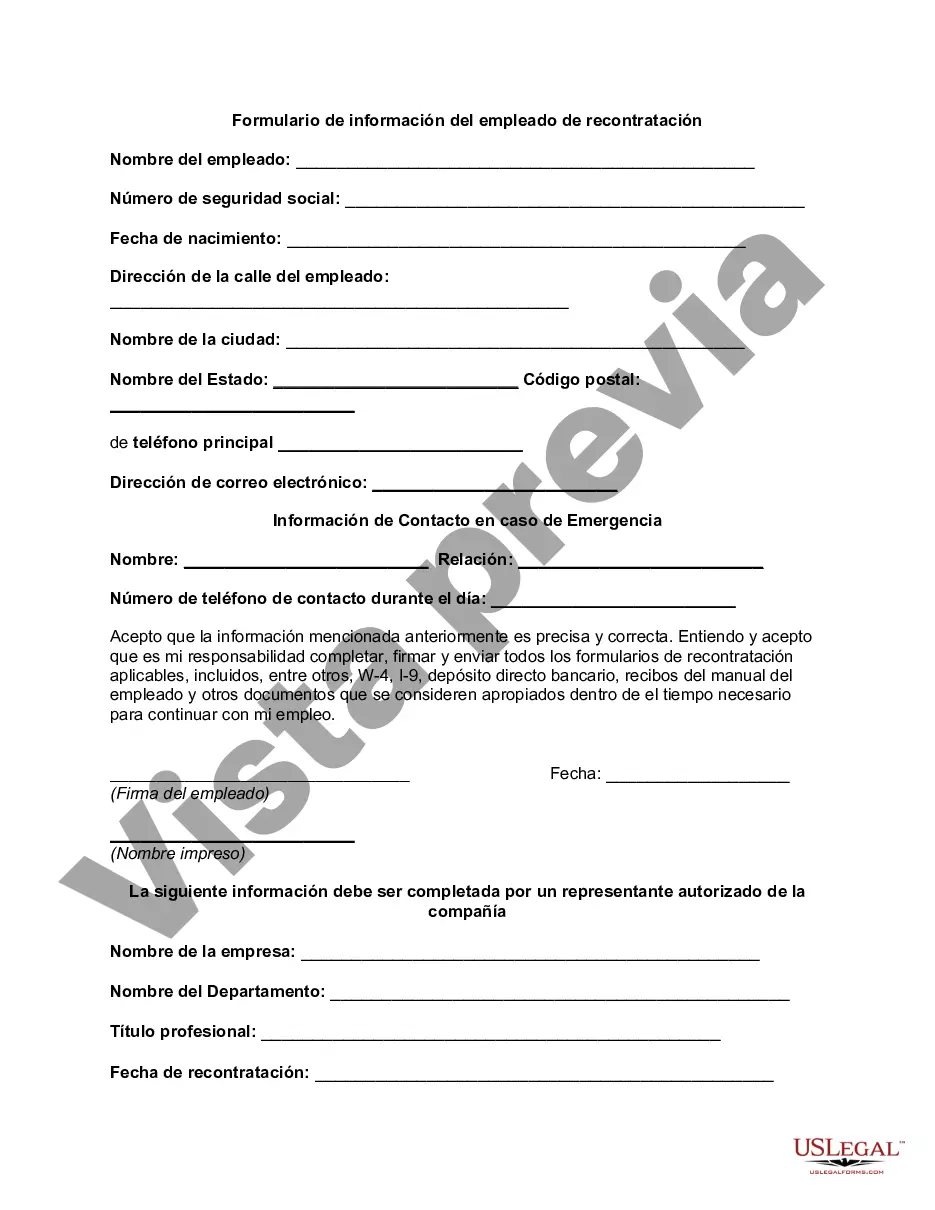

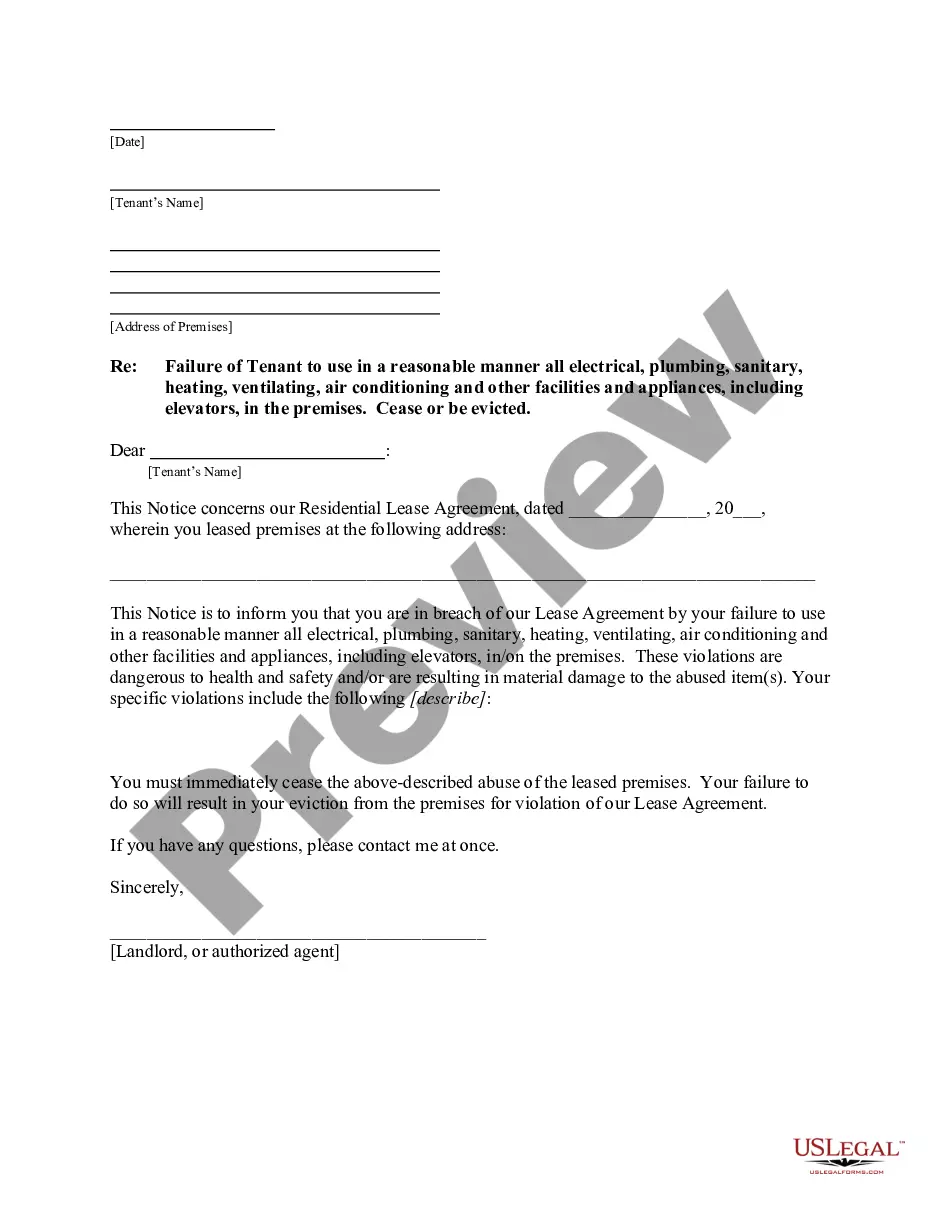

The Nassau New York Re-Hire Employee Information Form is a crucial document used by employers in Nassau County, New York, when re-hiring previous employees. This form collects essential information and updates from the individuals who are being re-hired by an organization. The purpose of the Nassau New York Re-Hire Employee Information Form is to ensure that employers have the most up-to-date and accurate information about rehired employees. By filling out this form, employers can effectively manage their workforce and comply with legal requirements. The content of the Nassau New York Re-Hire Employee Information Form can vary slightly depending on the specific needs of the organization. However, some common sections found in this form may include: 1. Personal Information: This section gathers details such as the employee's full name, date of birth, social security number, contact information, and emergency contact information. It is crucial to update any changes since the employee's previous employment. 2. Employment History: Here, employees provide information about their prior positions with the organization, including dates of employment, job titles, departments, and supervisors' names. This section ensures accurate record-keeping and facilitates the re-integration of the employee into the appropriate role. 3. Benefits and Compensation: This section captures data related to employee benefits and compensation. Employers may ask employees to specify their desired compensation, recent salary history, and any relevant information regarding benefits enrollment or adjustments. 4. Tax and Legal Documentation: Re-hiring employees often necessitates revisiting tax and legal documents. This section may include fields for the employee's tax withholding information, previous W-4 form updates, work eligibility verification, and acknowledgement of company policies and procedures. 5. Skills and Training: In this section, employers can gauge the skills and training the employee has acquired during their absence from the organization. Employees may be asked to indicate if they have completed any relevant certifications or undergone training that could enhance their productivity in the re-hired position. It is important to note that while the name "Nassau New York Re-Hire Employee Information Form" refers to a general template used in Nassau County, different organizations may have their own variations or specific addendums to this form. For example, a healthcare institution may include medical history or compliance-related sections, while a financial institution may focus on regulatory disclosures or non-disclosure agreements. Overall, the Nassau New York Re-Hire Employee Information Form serves as a valuable tool for employers to streamline the re-employment process and ensure that important employee information is accurately updated and maintained.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Formulario de información del empleado de recontratación - Re-Hire Employee Information Form

Description

How to fill out Nassau New York Formulario De Información Del Empleado De Recontratación?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Nassau Re-Hire Employee Information Form suiting all local requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Nassau Re-Hire Employee Information Form, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Nassau Re-Hire Employee Information Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Nassau Re-Hire Employee Information Form.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!