The Lima Arizona Re-Hire Employee Information Form is a comprehensive document used by employers in Lima, Arizona to gather essential details from employees who are re-hired after a period of separation from the company. This form is designed to ensure that all necessary information is updated and in compliance with current regulations. It plays a vital role in maintaining accurate employee records and facilitating a seamless re-onboarding process. Key elements included in the Lima Arizona Re-Hire Employee Information Form typically cover personal information, employment history, emergency contacts, tax-related details, and other crucial data. This form serves as a central repository for information required for payroll processing, tax filing, and benefits enrollment purposes. Some specific types of Lima Arizona Re-Hire Employee Information Forms may include: 1. Basic Re-Hire Employee Information Form: This form collects essential information such as the employee's full name, address, Social Security number, date of birth, phone number, and email address. It may also have sections for the employee's position, department, and start date. 2. Employment History Re-Hire Form: Designed to capture detailed employment history, this form gathers data about the employee's previous positions held within the company, including job titles, dates of employment, and supervisors' names. It may also include questions regarding eligibility for rehire and reasons for separation from previous employment. 3. Benefits Re-Hire Form: This form focuses on gathering information related to the employee's benefits enrollment and preferences. It typically includes sections regarding health insurance, retirement plans, life insurance, and any other available benefits options. It may also require the employee to make selections and provide additional information for beneficiaries. 4. Tax Re-Hire Form: This form collects important tax-related information from the re-hired employee, including the filing status, allowances, and any additional tax withholding requirements. It helps ensure accurate withholding and proper reporting of income for tax purposes. By utilizing a well-structured and comprehensive Lima Arizona Re-Hire Employee Information Form, employers can easily update their records, comply with legal requirements, and effectively manage the re-onboarding process. This form assists in streamlining administrative tasks and ensures that all relevant employee information is accurate and up to date.

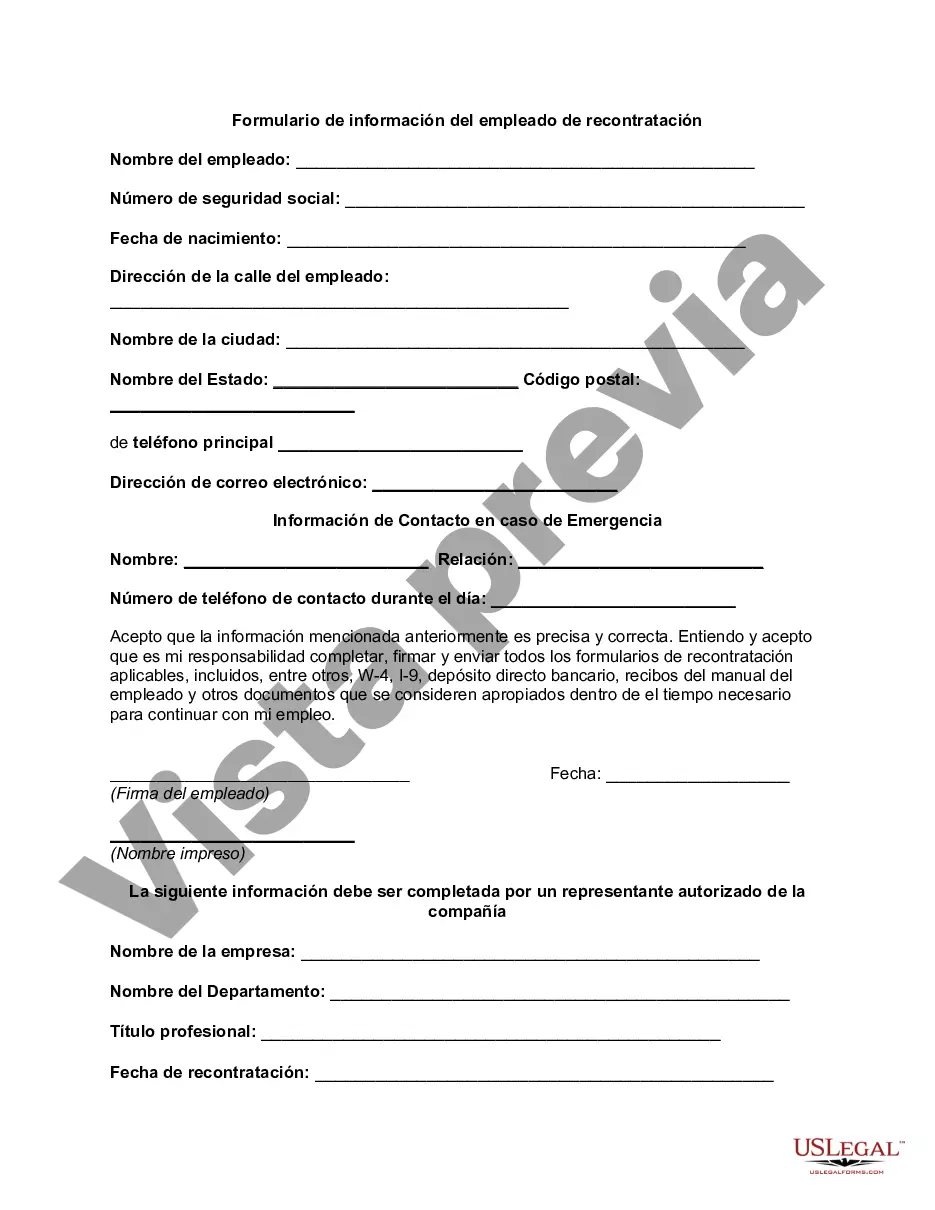

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Formulario de información del empleado de recontratación - Re-Hire Employee Information Form

Description

How to fill out Pima Arizona Formulario De Información Del Empleado De Recontratación?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Pima Re-Hire Employee Information Form meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Aside from the Pima Re-Hire Employee Information Form, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Pima Re-Hire Employee Information Form:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Pima Re-Hire Employee Information Form.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

To prove employment authorization, USCIS will accept: a Social Security card. a U.S. birth or birth abroad certificate. a Native American tribal document. a U.S. citizen ID card.

Suggested clip · 60 seconds TUTORIAL: Como completar el FORMULARIO I-9 (2020) - YouTube YouTube Start of suggested clip End of suggested clip

Verificacion de Elegibilidad de Empleo USCIS.

El Servicio de Impuestos Internos provee a los contribuyentes de Estados Unidos ayuda para entender y cumplir con sus responsabilidades tributarias segun la ley de impuestos.

Si despues de finalizar la auditoria, los agentes de inmigracion le informan al empleador que existen problemas con el formulario I-9 de un empleado y este mismo no puede presentar documentacion adicional para verificar su autorizacion de trabajo, el empleador puede correr el riesgo de multas y / o sanciones por seguir

Como solicitar una carta de verificacion de empleo Averigua quien envia las cartas de verificacion de empleo en la empresa. Sigue los procedimientos de la empresa. Especifica los detalles. Facilita la direccion del destinatario. Avisa al empleador con suficiente antelacion. Incluye tu informacion de contacto.

A traves de la pagina de la Administracion Federal de Ingresos Publicos (AFIP) se pueden saber si un trabajador esta debidamente registro, es decir "en blanco", asi como tambien cuales son los aportes que realiza el empleador, sin la necesidad de contar con clave fiscal.

Aqui hay algunos consejos que le ayudaran a completar una solicitud de empleo. Practique con un formulario de muestra.Siempre tenga dos copias del formulario de solicitud.Lea con cuidado las instrucciones en el formulario de solicitud.Utilice una lapicera y escriba de manera clara.

Those requesting employment or salary verification may access THE WORK NUMBER® online at using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.