A Chicago Illinois Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legally binding document that outlines the terms and conditions regarding the distribution of assets, liabilities, and the resolution of any disputes arising from the dissolution of a partnership. This agreement is crucial when a partner in a business or professional practice passes away, determining how the deceased partner's interests will be handled. Key Elements of a Chicago Illinois Settlement Agreement: 1. Identification of the Parties: The agreement should clearly state the names, addresses, and relevant details of the estate of the deceased partner and the surviving partners. The document should also specify the partnership involved. 2. Purpose: The agreement should provide a clear statement of purpose, which is to establish a comprehensive framework for the distribution of partnership interests, assets, liabilities, and any other relevant matters. 3. Partnership Assets and Liabilities: The agreement should address how the partnership assets and liabilities will be valued and divided among the surviving partners and the estate. This includes real estate, equipment, intellectual property, financial accounts, and outstanding debts. 4. Life Insurance or Buyout Provisions: If the partnership has a life insurance policy on each partner, the agreement may specify how the proceeds will be used to buy out the deceased partner's interest in the business. Alternatively, the document may outline a mechanism for the surviving partners to purchase the deceased partner's shares or interest. 5. Succession Plan: If the agreement aims to continue the partnership after the death of a partner, it should identify the roles, rights, and responsibilities of the surviving partners, along with any necessary adjustments to the partnership agreement. 6. Dispute Resolution: To avoid potential conflicts, the agreement should include a provision for resolving disputes, such as mediation or arbitration. This ensures that disagreements are handled in a fair and efficient manner. 7. Confidentiality: As with any legal agreement, confidentiality clauses are often included to protect the privacy and sensitive information of all involved parties. Different Types of Chicago Illinois Settlement Agreements between the Estate of a Deceased Partner and the Surviving Partners: 1. Full Liquidation Agreement: This type of agreement is used when the surviving partners decide to wind up the partnership and distribute all the assets and liabilities among themselves and the estate of the deceased partner. 2. Continuation Agreement: In cases where the surviving partners wish to continue the partnership, this agreement outlines the terms for the transfer of the deceased partner's interests to the surviving partners. 3. Buy-Sell Agreement: A buy-sell agreement is often used in businesses with multiple partners. It provides a mechanism for the surviving partners to buy out the deceased partner's shares, typically with the help of life insurance proceeds. In conclusion, a Chicago Illinois Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legal document that details the process of distributing assets, liabilities, resolving disputes, and determining the future of a partnership following the death of a partner. These agreements can take various forms depending on the specific circumstances and objectives of the involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de conciliación entre el patrimonio de un socio fallecido y los socios sobrevivientes - Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Chicago Illinois Acuerdo De Conciliación Entre El Patrimonio De Un Socio Fallecido Y Los Socios Sobrevivientes?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Chicago Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Chicago Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Chicago Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners:

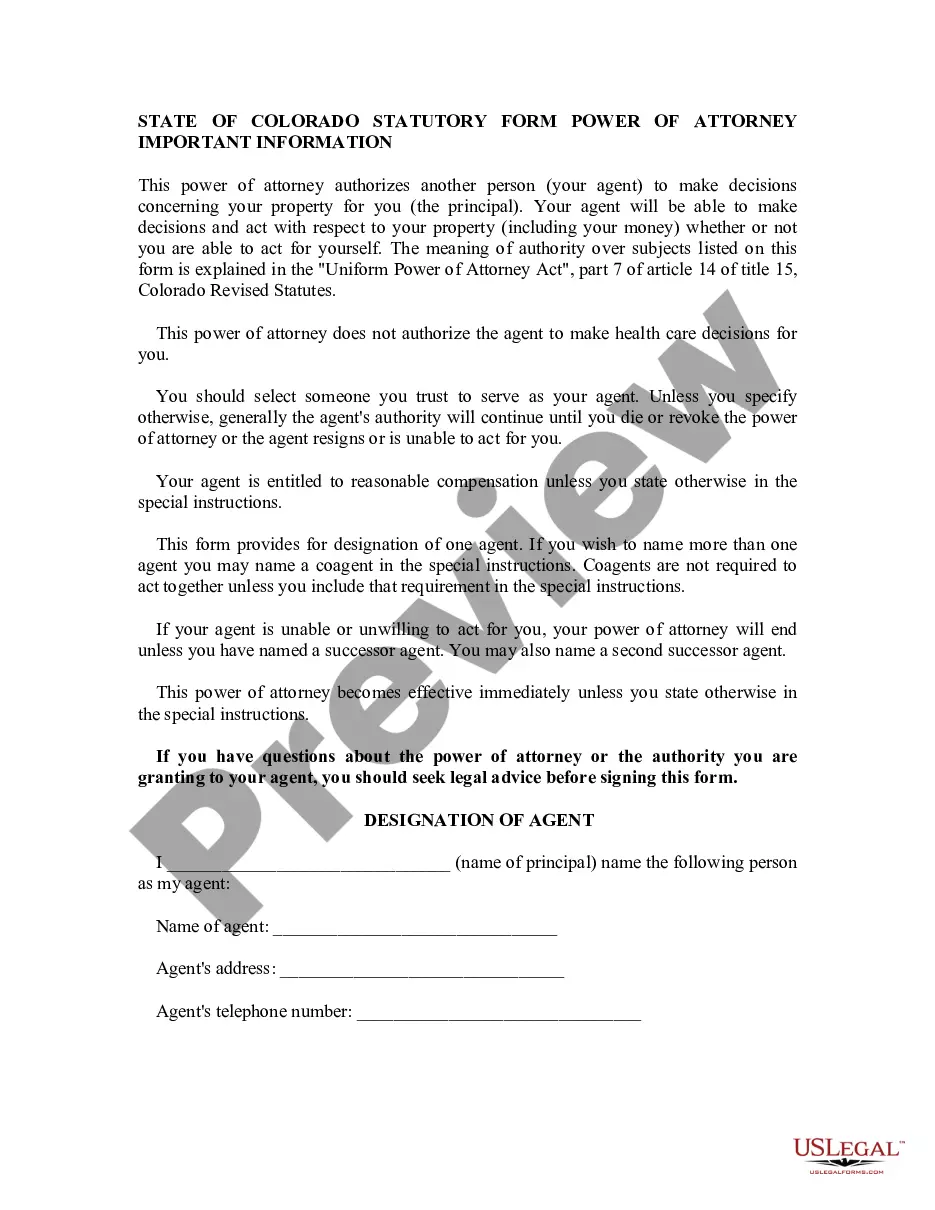

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!