The Dallas Texas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legal document that outlines the terms and conditions that govern the distribution of assets, liabilities, and other matters relating to the dissolution of a partnership upon the death of one of its partners. This agreement ensures a smooth transfer of ownership and minimizes any potential conflicts or disputes that may arise during the dissolution process. Within Dallas, Texas, there are different types of Settlement Agreements that can be entered into between the Estate of a Deceased Partner and the Surviving Partners, depending on the specific circumstances and intentions of the parties involved. Some different types of settlement agreements include: 1. Buyout Agreement: This type of settlement agreement allows the surviving partners to purchase the deceased partner's share in the business. The buyout price can be predetermined or determined through a valuation process agreed upon by the parties. 2. Partnership Dissolution Agreement: In cases where the surviving partners do not wish to continue the partnership, this agreement outlines the terms for the dissolution of the partnership, including the distribution of assets, liabilities, and the winding up of the business. 3. Partnership Continuation Agreement: This type of settlement agreement allows the surviving partners to continue operating the partnership business without liquidation or dissolution. It addresses matters such as the purchase of the deceased partner's interest in the partnership and the distribution of profits moving forward. 4. Asset Distribution Agreement: If the partnership owns significant assets that need to be distributed among the surviving partners and the deceased partner's estate, this agreement outlines how those assets will be divided or sold, and the proceeds distributed accordingly. 5. Non-Compete Agreement: In some cases, the surviving partners may require the deceased partner's estate to enter into a non-compete agreement to prevent the estate from competing with the partnership or disclosing proprietary information. No matter the type of settlement agreement, it is essential to consult with legal professionals experienced in partnership law and estate planning to ensure that all relevant aspects are considered and appropriately addressed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de conciliación entre el patrimonio de un socio fallecido y los socios sobrevivientes - Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Dallas Texas Acuerdo De Conciliación Entre El Patrimonio De Un Socio Fallecido Y Los Socios Sobrevivientes?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Dallas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks related to document completion simple.

Here's how to locate and download Dallas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

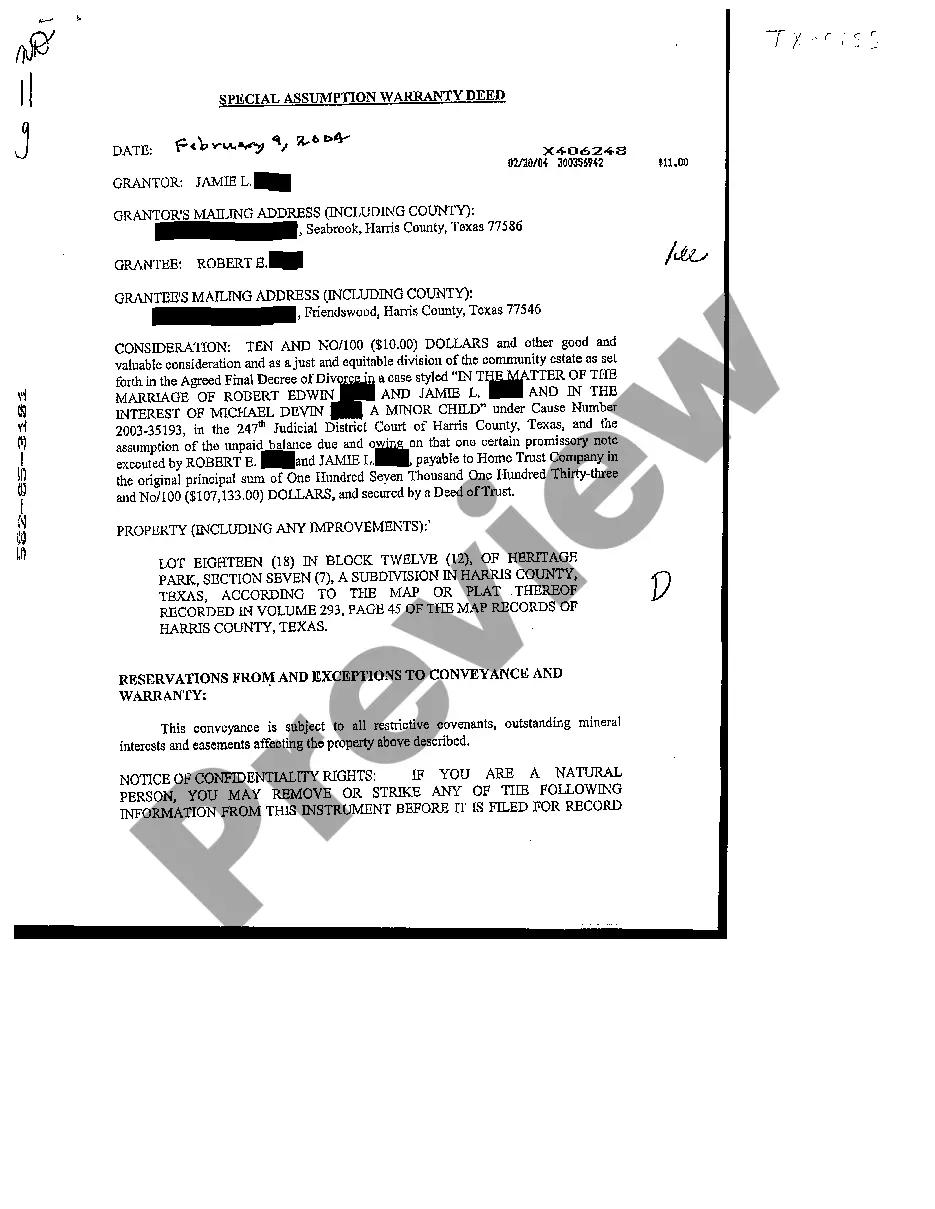

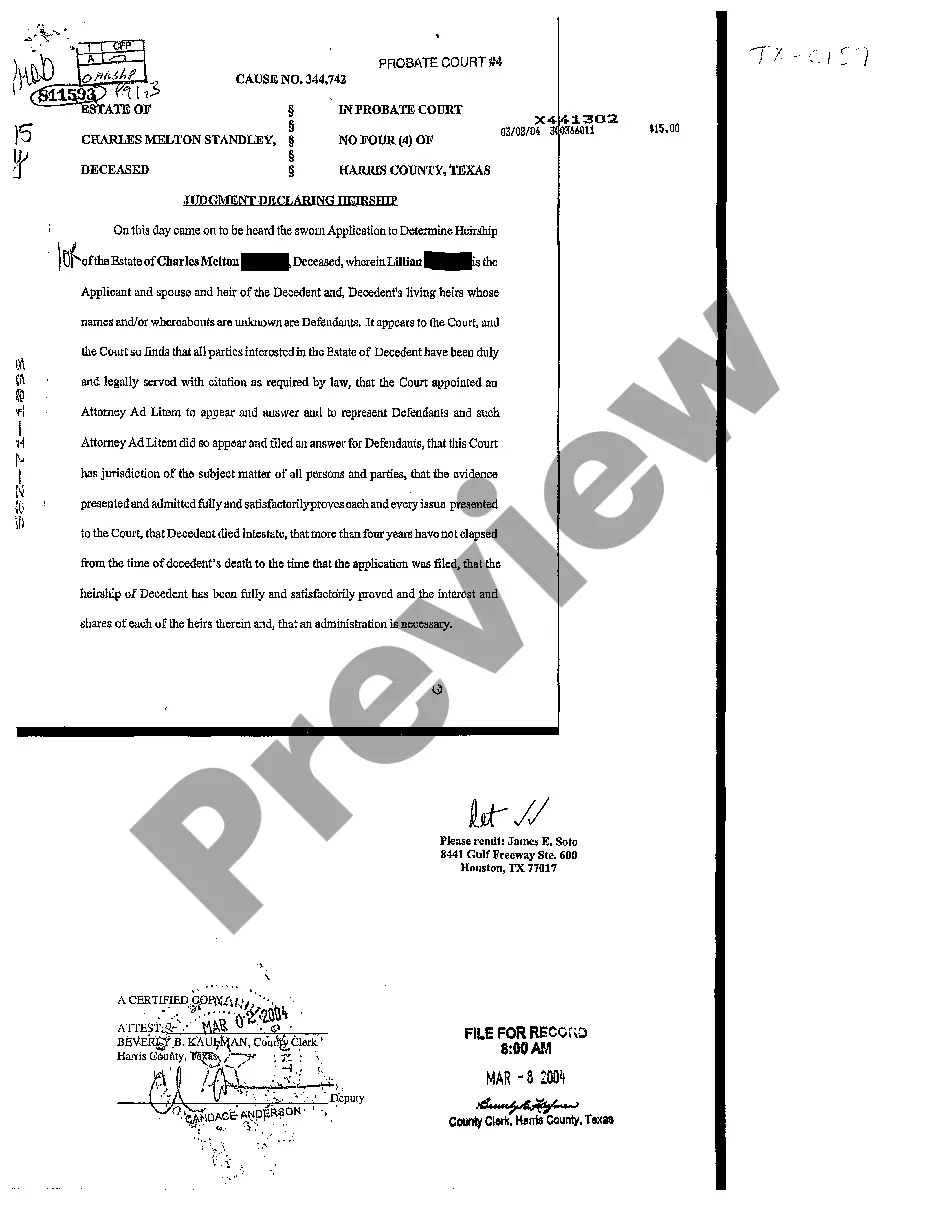

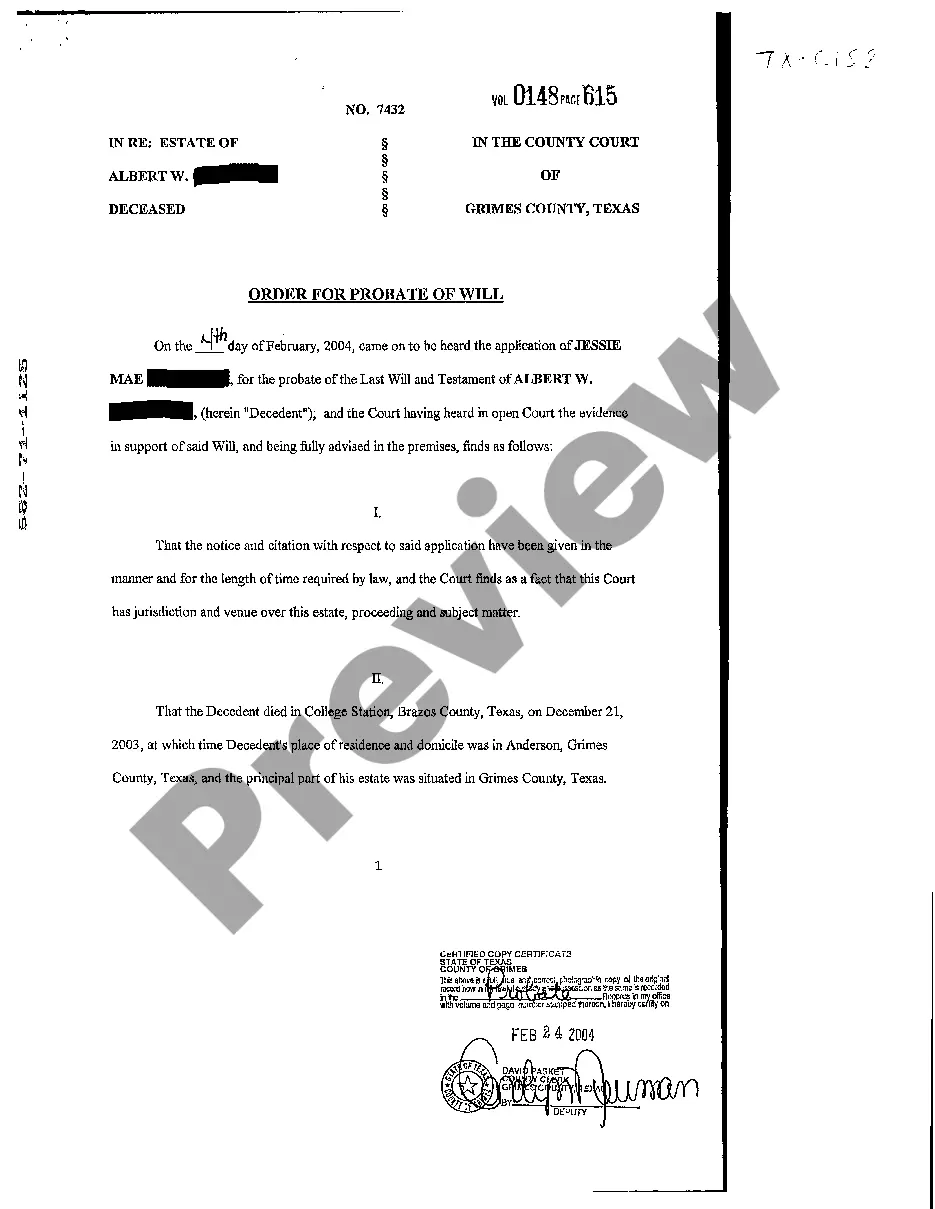

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Dallas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to deal with an extremely complicated situation, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific documents with ease!