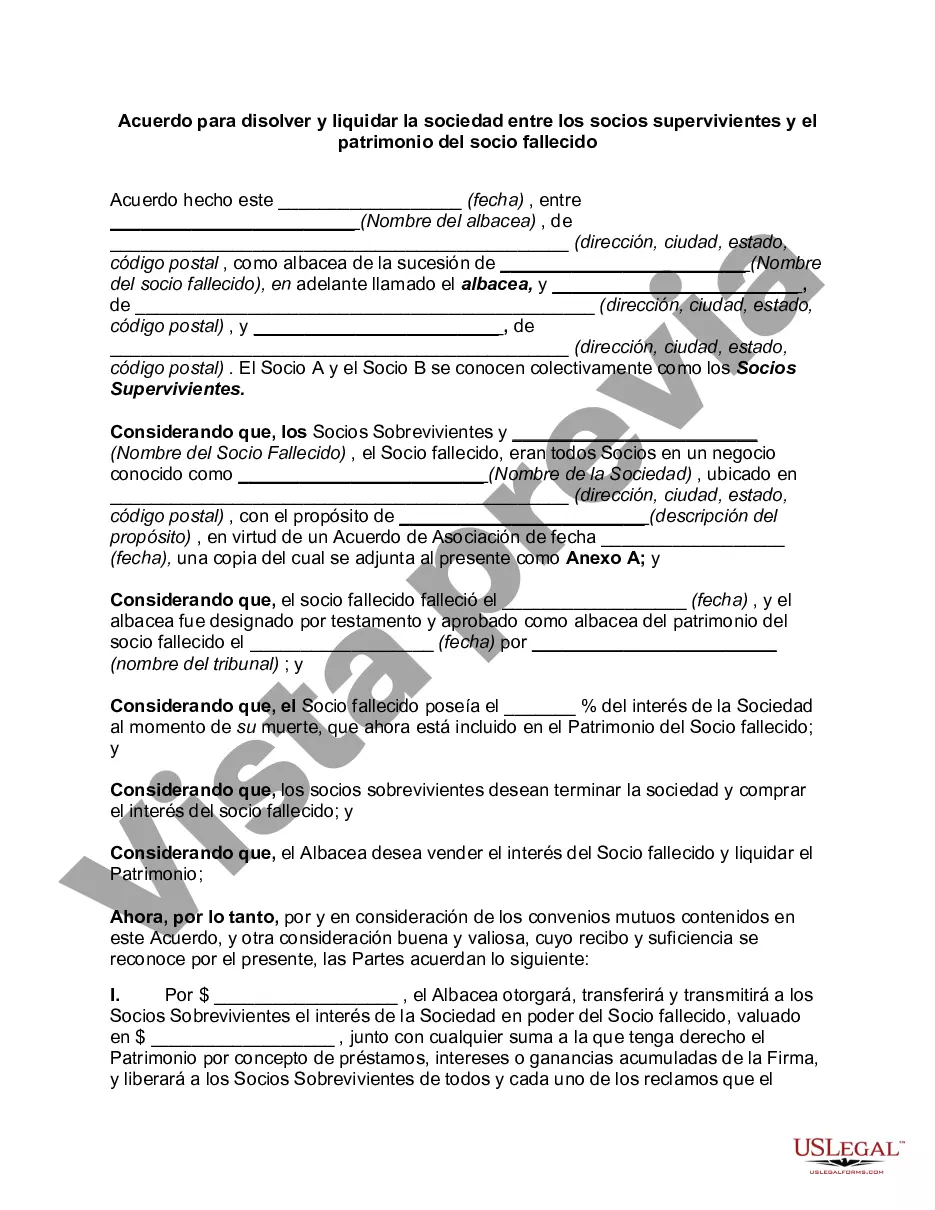

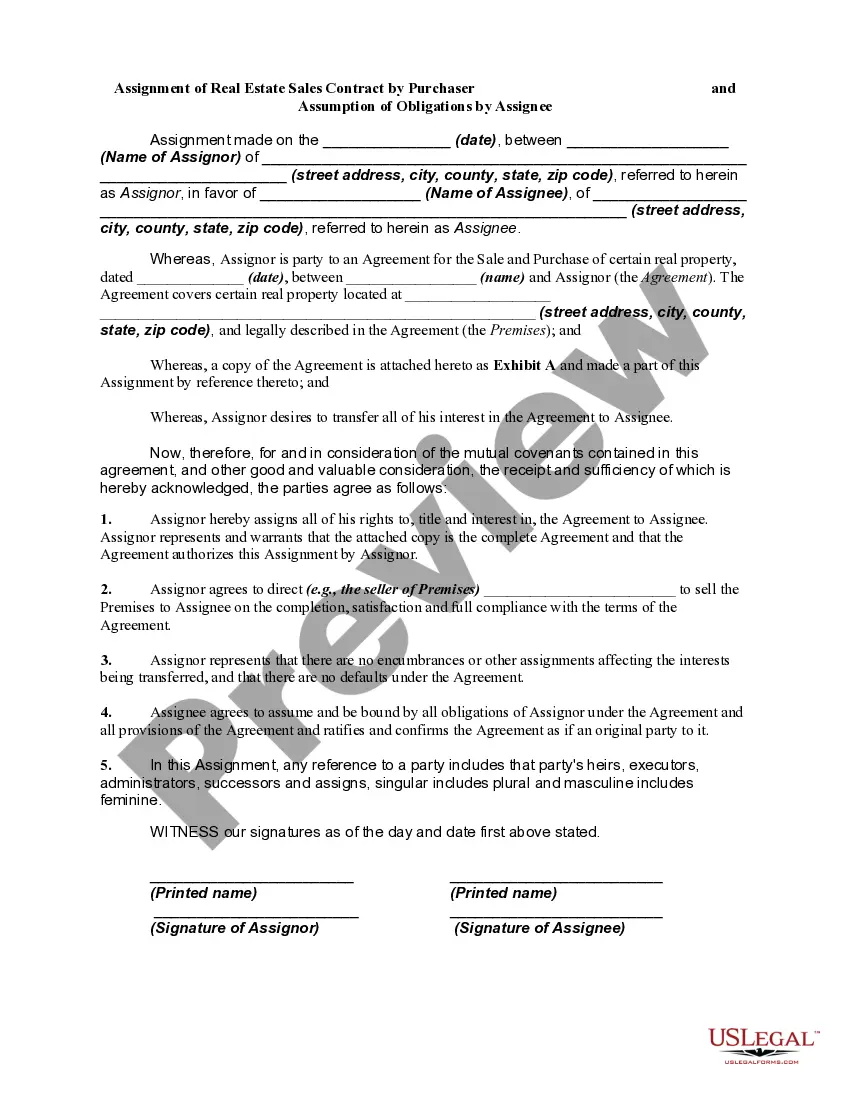

The Harris Texas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legal document that outlines the process and terms for terminating a partnership after the death of one partner. This agreement is specific to partnerships located in Harris County, Texas, and serves to guide the surviving partners and the estate of the deceased partner through the dissolution and winding-up process. Key Features of the Harris Texas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner: 1. Purpose: The agreement serves as a formal record of the intentions and responsibilities of the surviving partners and the estate of the deceased partner to dissolve the partnership. It outlines the steps that need to be taken to ensure a smooth transition while honoring the interests of all parties involved. 2. Identification of Parties: The agreement clearly identifies the surviving partners and the estate of the deceased partner. It also includes their respective roles, rights, and responsibilities in the dissolution process. 3. Dissolution Process: This section describes the required steps to dissolve the partnership, such as notifying creditors, resolving outstanding debts and obligations, liquidating partnership assets, and distributing the remaining assets in accordance with the terms of the partnership agreement or state laws. 4. Valuation and Allocation: The agreement may provide guidelines for valuing the partnership's assets and liabilities, as well as determining each partner's share of the partnership's net worth. This ensures that the distribution is fair and accurate. 5. Buyout Options: In case the surviving partners wish to continue the business, the agreement may outline buyout options for the deceased partner's estate. This may involve purchasing the partner's ownership interest or negotiating terms of compensation. 6. Dispute Resolution: The agreement may include provisions for resolving any disagreements or disputes that may arise during the dissolution process, such as mediation or arbitration. This helps maintain a harmonious relationship between the surviving partners and the estate. Types of Harris Texas Agreements to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner: 1. General Partnership Agreement: This type of agreement is suitable for partnerships where each partner has full liability and equal control over the business's operations. The agreement helps facilitate an equitable dissolution of the partnership upon the death of a partner. 2. Limited Partnership Agreement: In a limited partnership, there are general partners who have unlimited liability and control, while limited partners have limited liability and play a passive role. The agreement for a limited partnership includes specific provisions addressing the dissolution and winding-up process, taking into account the unique considerations of limited partners. 3. Family Partnership Agreement: This agreement is designed for partnerships where the partners are family members, such as siblings, parents, or children. It takes into account familial dynamics and inheritance considerations, providing a framework for dissolving the partnership while preserving family relationships and wealth. In conclusion, the Harris Texas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a crucial legal document that guides the orderly dissolution of a partnership in Harris County, Texas. It ensures that the interests of surviving partners and the estate of the deceased partner are protected and that the winding-up process is conducted in a fair and efficient manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo para disolver y liquidar la sociedad entre los socios supervivientes y el patrimonio del socio fallecido - Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Harris Texas Acuerdo Para Disolver Y Liquidar La Sociedad Entre Los Socios Supervivientes Y El Patrimonio Del Socio Fallecido?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Harris Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the Harris Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Harris Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner:

- Examine the content of the page you’re on.

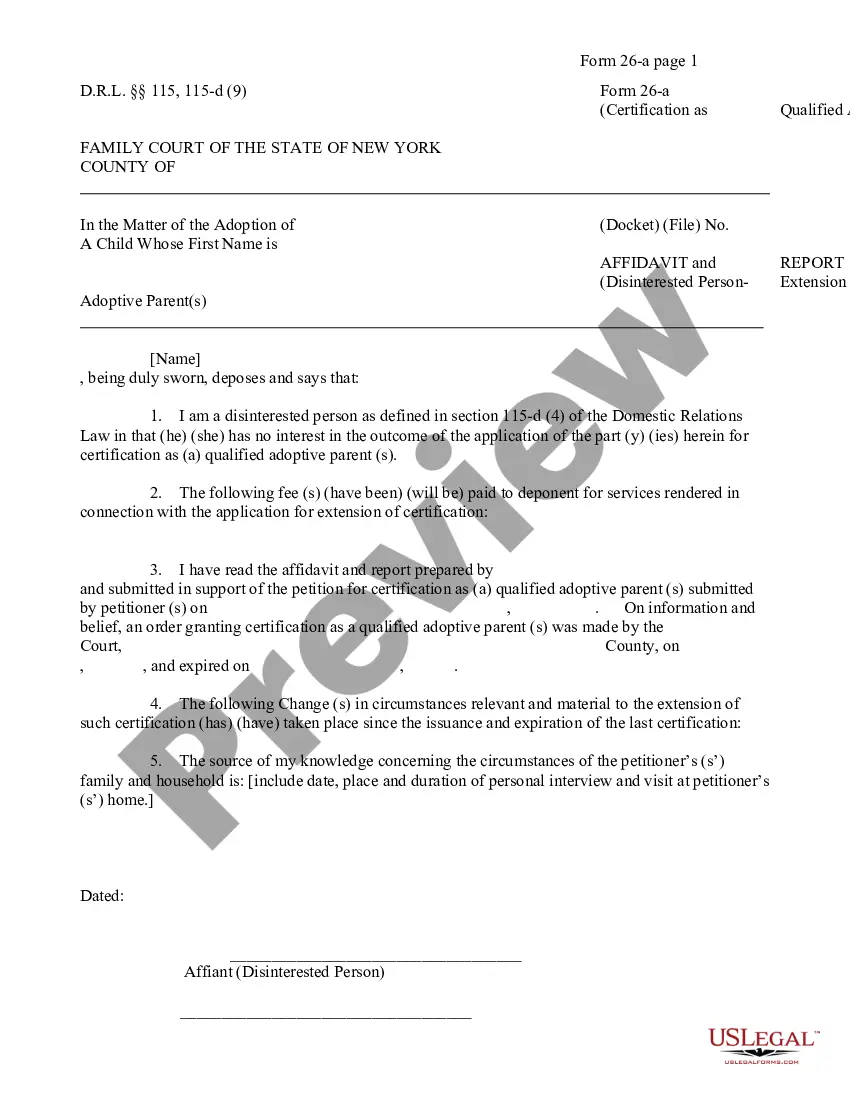

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!