Title: Understanding the Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner Introduction: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legal document that outlines the process and terms for concluding a partnership after the death of one of the partners. This agreement is crucial in ensuring a smooth and fair transition of partnership assets and responsibilities. In Maricopa, Arizona, several types of agreement exist to cater to different partnership scenarios. Let's delve into the details. 1. General Overview: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legally binding contract that sets out the dissolution and winding-up process of a partnership upon the death of a partner. This agreement ensures that the surviving partners and the estate of the deceased partner have clear guidelines for distributing partnership assets, resolving outstanding debts, and terminating the partnership's existence. 2. Terms and Provisions: — Identification of Parties: The agreement should clearly identify the surviving partners and the estate of the deceased partner, along with their respective roles and responsibilities throughout the dissolution process. — Dissolution Date: The agreement specifies the effective date of dissolution, marking the complete termination of the partnership. — Asset Distribution: Details the division and distribution of partnership assets among the surviving partners and any entitlements or claims to be allocated to the estate of the deceased partner. — Debts and Liabilities: Outlines the responsibility for settling any outstanding debts, loans, or obligations that were incurred during the partnership's existence. — Notification of Creditors: Allows for proper notification of partnership dissolution to creditors and provides a mechanism for handling any outstanding claims or disputes. — Tax Considerations: Addresses tax-related matters, such as filing final partnership tax returns and distributing profits or losses to the appropriate entities. — Governing Law: Specifies that the agreement shall be governed and interpreted under the laws of Maricopa, Arizona. Types of Maricopa Arizona Agreements to Dissolve and Wind up Partnership: 1. Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate — Simple Dissolution: An agreement applicable when the partnership ends upon the death of a partner and there are no complex assets or other partners involved. 2. Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate — Complex Dissolution: Suitable for situations where the partnership involves intricate assets, multiple surviving partners, or additional legal considerations. 3. Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate — Buyout Option: Designed when either the surviving partners or the estate of the deceased partner have expressed interest in buying out the other party's share of the partnership. 4. Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate — Continuation Agreement: If the surviving partners wish to continue the partnership's business operations after the death of a partner, this agreement provides guidelines for such a scenario. Conclusion: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a critical legal document ensuring a fair and efficient process for dissolving a partnership following the death of a partner. With various types of agreements available, partners can select one that matches their specific circumstances. Seeking legal advice is strongly recommended drafting an agreement that adheres to all relevant laws and ensures a smooth partnership dissolution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo para disolver y liquidar la sociedad entre los socios supervivientes y el patrimonio del socio fallecido - Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

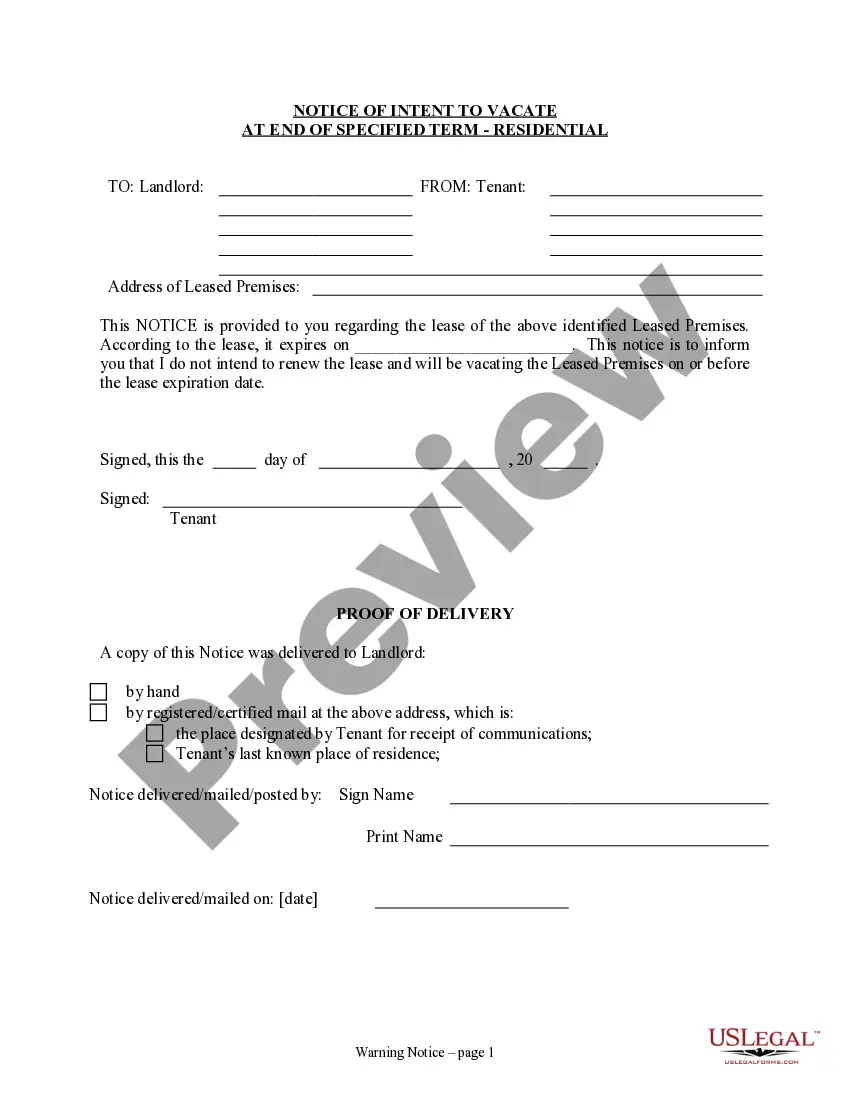

Description

How to fill out Maricopa Arizona Acuerdo Para Disolver Y Liquidar La Sociedad Entre Los Socios Supervivientes Y El Patrimonio Del Socio Fallecido?

Preparing paperwork for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Maricopa Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Maricopa Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!