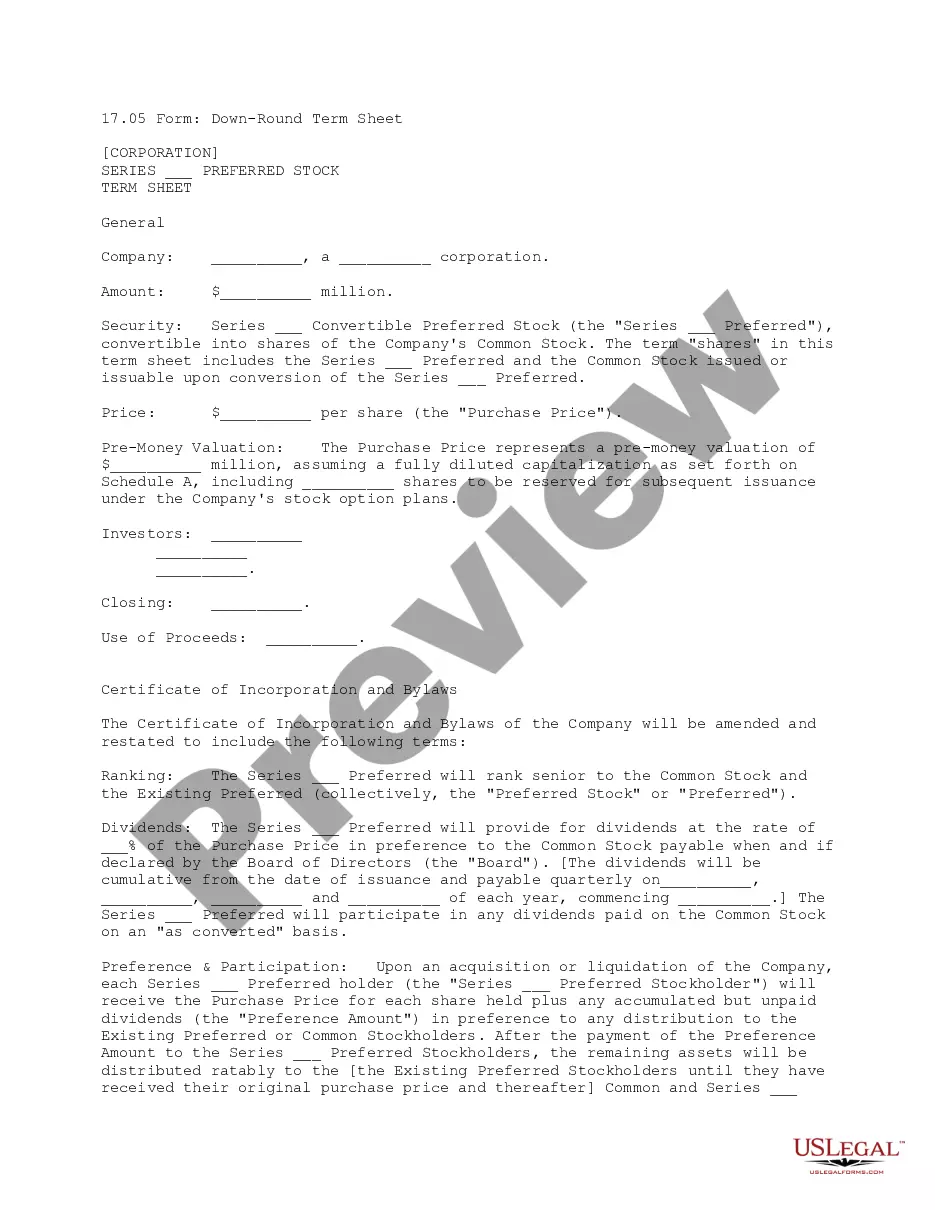

A Wayne Michigan Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor is a legally binding contract that outlines the terms and conditions for the transfer of ownership in a partnership upon the death of one partner. This agreement is particularly important in Wayne, Michigan, as it helps to ensure a smooth transition of business interests and protects the long-term stability and sustainability of the partnership. The main purpose of a Partnership Buy-Sell Agreement is to establish a fair and predetermined value for the deceased partner's share of the business. This fixed value is often determined through a mutually agreed-upon valuation method, such as using a formula based on the partnership's financial statements or by hiring an independent appraiser. By fixing the value, the agreement helps to eliminate potential disputes or disagreements over the worth of the partnership interest. Furthermore, this type of agreement also requires the estate of the deceased partner to sell their ownership interest to the surviving partner(s). The surviving partner(s) are obligated to purchase the deceased partner's share at the predetermined value outlined in the agreement, ensuring that the deceased partner's family or beneficiaries receive appropriate compensation for their stake in the business. Several variations of the Wayne Michigan Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor may exist, depending on the specific needs and circumstances of the partnership. Some of these variations may include: 1. Cross-Purchase Agreement: In this type of agreement, each partner agrees to purchase the ownership interest of the deceased partner. This means that the surviving partners individually buy the deceased partner's share. 2. Entity Redemption Agreement: In contrast to the cross-purchase agreement, this type of agreement enables the partnership itself to redeem the deceased partner's interest. This means that the partnership entity buys back the ownership interest using its own funds or by obtaining financing. 3. Hybrid Agreement: This type of agreement combines elements of both the cross-purchase and entity redemption agreements. It allows the surviving partners and the partnership entity to jointly purchase the deceased partner's ownership interest based on predetermined proportions. This can provide flexibility and accommodate different financial capabilities of the partners. In conclusion, the Wayne Michigan Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor provides a crucial framework for the transfer of ownership in a partnership upon the death of a partner. By establishing a fair value and requiring the sale to the surviving partner(s), this agreement helps to protect the interests of all parties involved and ensures the continued success and longevity of the partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de compra-venta de sociedad que fija el valor y requiere la venta por parte del patrimonio del socio fallecido al sobreviviente - Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

How to fill out Wayne Michigan Acuerdo De Compra-venta De Sociedad Que Fija El Valor Y Requiere La Venta Por Parte Del Patrimonio Del Socio Fallecido Al Sobreviviente?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Wayne Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Wayne Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Wayne Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Wayne Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!