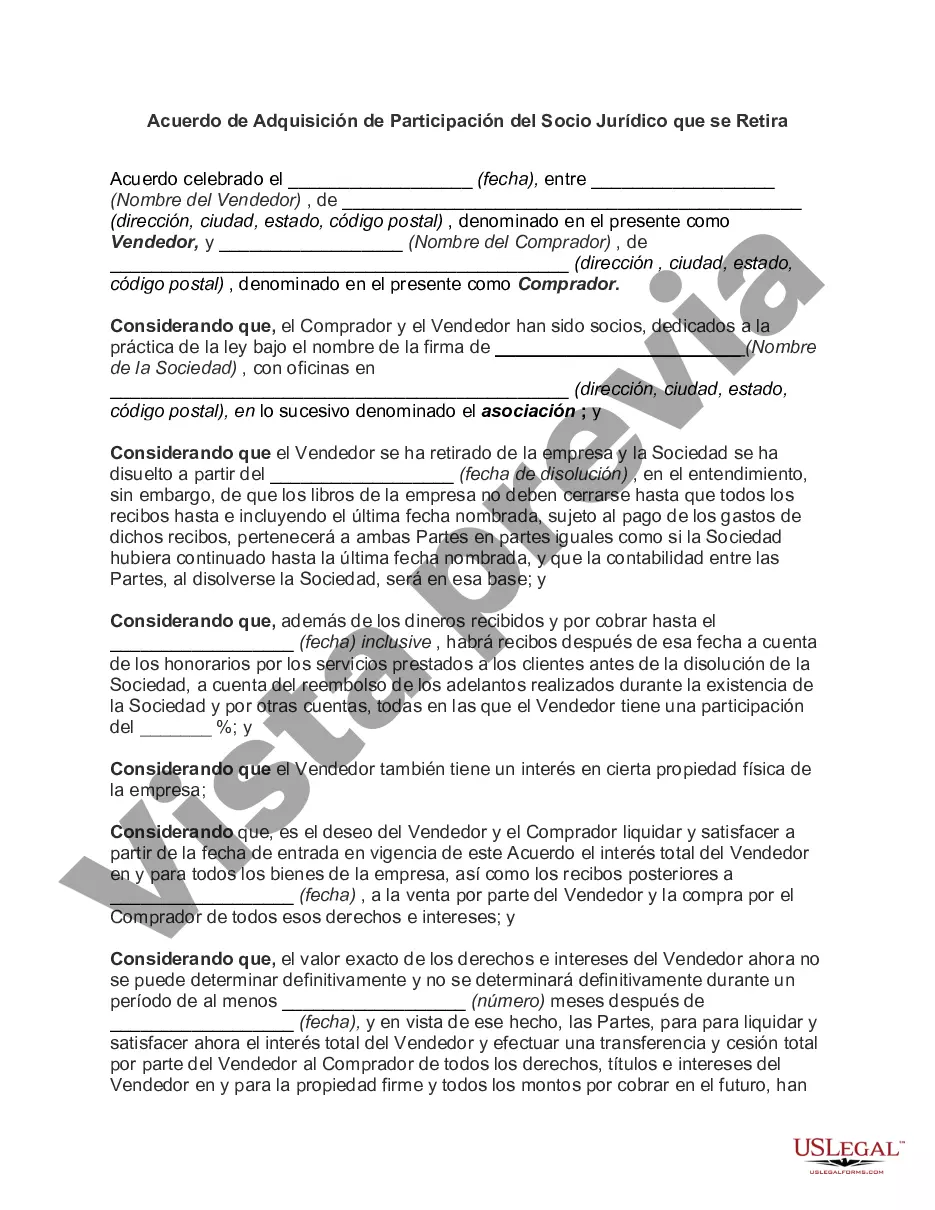

Chicago Illinois Agreement Acquiring Share of Retiring Law Partner is a legal arrangement entered into by law firms in Chicago, Illinois, to acquire the share of a retiring law partner in the firm. This agreement outlines the terms and conditions under which the retiring partner's interest in the firm will be acquired by the remaining partners or the firm itself. The purpose of this agreement is to provide a smooth transition of ownership and financial interests when a law partner decides to retire. It ensures a fair and well-structured process for both the retiring partner and the remaining partners, safeguarding the rights and obligations of all parties involved. Key provisions that are typically addressed in the Chicago Illinois Agreement Acquiring Share of Retiring Law Partner include: 1. Purchase Price: This clause defines the method of valuing the retiring partner's share and specifies the purchase price that the remaining partners or the firm will pay to acquire the interest. The valuation can be based on various factors such as profits, book value, or a predetermined formula. 2. Payment Terms: This section outlines the terms of payment for the purchase price, which may include a lump-sum payment, installment payments, or a combination of both. The agreement may also specify the timeline for completing the payment. 3. Retiring Partner's Duties: The agreement may include provisions related to the retiring partner's duties during the transition period. This could involve assisting with client transfers, cooperating in the valuation process, and providing necessary documents and information to facilitate a smooth transition. 4. Treatment of Clients: The agreement may specify the handling of the retiring partner's client base. It may include provisions regarding client retention, client transfers to other partners, or compensation for client goodwill. 5. Non-Compete Clause: To protect the interests of the remaining partners or the firm, the agreement may include a non-compete clause that restricts the retiring partner from practicing law in the same geographic area for a specified period after retirement. 6. Confidentiality and Non-Disclosure: This section ensures that all confidential information and trade secrets pertaining to the law firm are protected and prohibits the retiring partner from disclosing or using such information for their advantage post-retirement. Different types of Chicago Illinois Agreement Acquiring Share of Retiring Law Partner may exist based on variations in the clauses, terms, and conditions tailored to the specific needs and circumstances of each law firm. Some agreements may have more detailed provisions related to profit-sharing, governance issues, non-solicitation clauses, or the use of the partner's name after retirement. In conclusion, the Chicago Illinois Agreement Acquiring Share of Retiring Law Partner is a significant legal document that governs the process of acquiring the share of a retiring law partner. It aims to ensure a fair and well-structured transition by addressing various key provisions related to valuation, payment terms, client handling, non-compete clauses, and confidentiality.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de Adquisición de Participación del Socio Jurídico que se Retira - Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Chicago Illinois Acuerdo De Adquisición De Participación Del Socio Jurídico Que Se Retira?

Preparing documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Chicago Agreement Acquiring Share of Retiring Law Partner without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Chicago Agreement Acquiring Share of Retiring Law Partner on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Chicago Agreement Acquiring Share of Retiring Law Partner:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!