Title: Understanding the Alameda California Basic Law Partnership Agreement: Types and Key Components Introduction: The Alameda California Basic Law Partnership Agreement serves as a legal framework that outlines the rights, responsibilities, and obligations of partners in a business partnership based in Alameda, California. This comprehensive document provides clarity on various aspects like profit sharing, decision-making procedures, partner contributions, and dissolution processes. In this article, we will explore the different types of Alameda California Basic Law Partnership Agreements and shed light on their key components using relevant keywords. Types of Alameda California Basic Law Partnership Agreement: 1. General Partnership Agreement: In a general partnership agreement, all partners share equal rights and responsibilities. This agreement allows partners to participate in the management and decision-making process, contribute capital, and share profits and losses based on the agreed-upon ratios. 2. Limited Partnership Agreement: A limited partnership agreement consists of two types of partners: general partners and limited partners. General partners are actively involved in the day-to-day operations and decision-making, while limited partners are passive investors who contribute capital but have limited liability. The profit sharing and management responsibilities are typically defined by the agreement. 3. Limited Liability Partnership Agreement: A limited liability partnership (LLP) agreement offers partners protection against personal liability for the misconduct or negligence of other partners. This agreement is often preferred by professionals like lawyers, accountants, and doctors who operate as partnerships. Laps combine the advantages of a traditional partnership with the liability protection of a corporation. Key Components of Alameda California Basic Law Partnership Agreement: 1. Name and Purpose: Clearly state the name and purpose of the partnership, defining the business activities it will engage in. 2. Contributed Capital: Specify the capital contributed by each partner, determining the ownership and profit distribution ratios. Outline the procedure for capital contributions and the consequences of an unequal contribution. 3. Profit and Loss Sharing: Describe how profits and losses will be distributed among the partners. This section may include provisions for variations in sharing ratios, distribution schedules, and guidelines for handling deficits. 4. Decision-Making Process: Establish guidelines for decision-making, including voting rights and procedures, quorum requirements, and roles and responsibilities of partners in managing the partnership's affairs. 5. Management Responsibilities: Outline each partner's responsibilities, such as operational functions, financial management duties, and obligations to maintain accurate records and timely reporting. 6. Partnership Members: List the names and contact information of all partners forming the partnership. Include provisions for the admission of new partners and any process for partner withdrawal or termination. 7. Dissolution and Termination: Specify the circumstances under which the partnership may be dissolved, including methods of dispute resolution and mechanisms for handling partnership assets and liabilities. Conclusion: The Alameda California Basic Law Partnership Agreement is essential for establishing a clear understanding between partners, ensuring smooth business operations, and outlining the rights and responsibilities of each member. By considering the different types of agreements and incorporating the key components discussed above, partners can establish a strong legal foundation to govern their partnership effectively in Alameda, California.

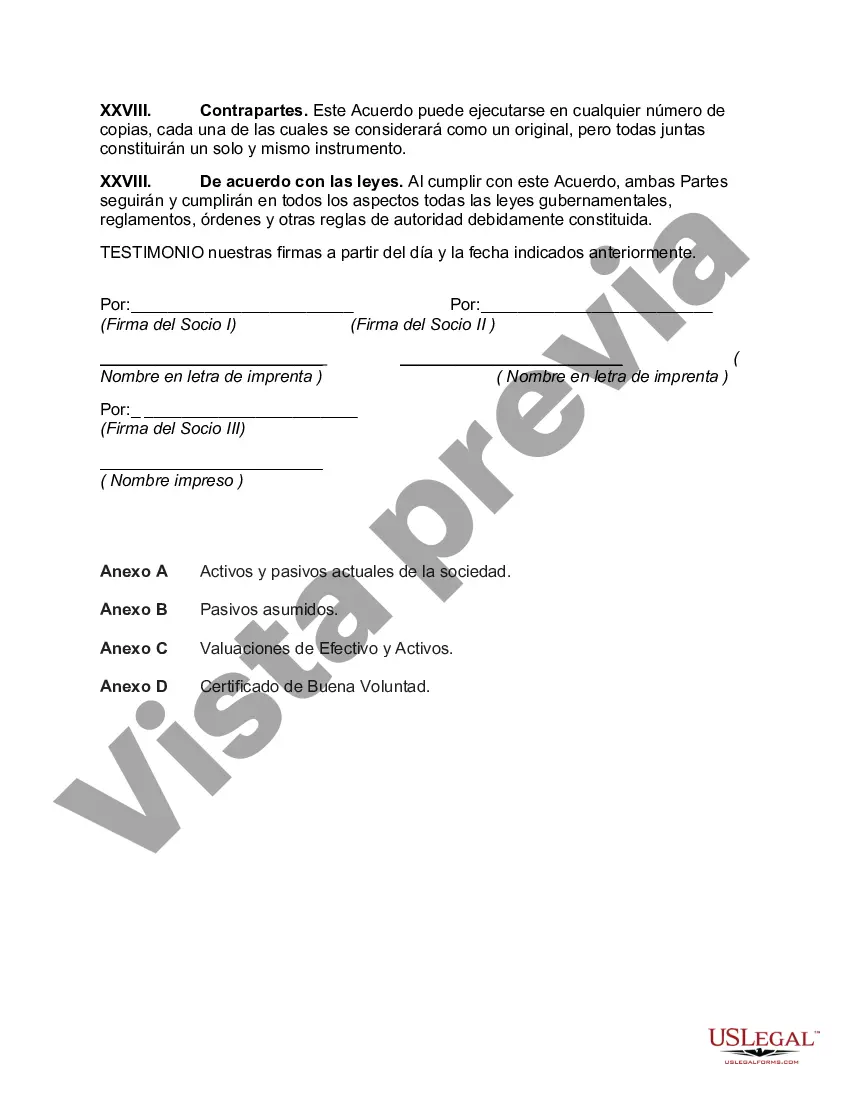

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo de Sociedad de Ley Básica - Basic Law Partnership Agreement

Description

How to fill out Alameda California Acuerdo De Sociedad De Ley Básica?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Alameda Basic Law Partnership Agreement, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the latest version of the Alameda Basic Law Partnership Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Alameda Basic Law Partnership Agreement:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Alameda Basic Law Partnership Agreement and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!