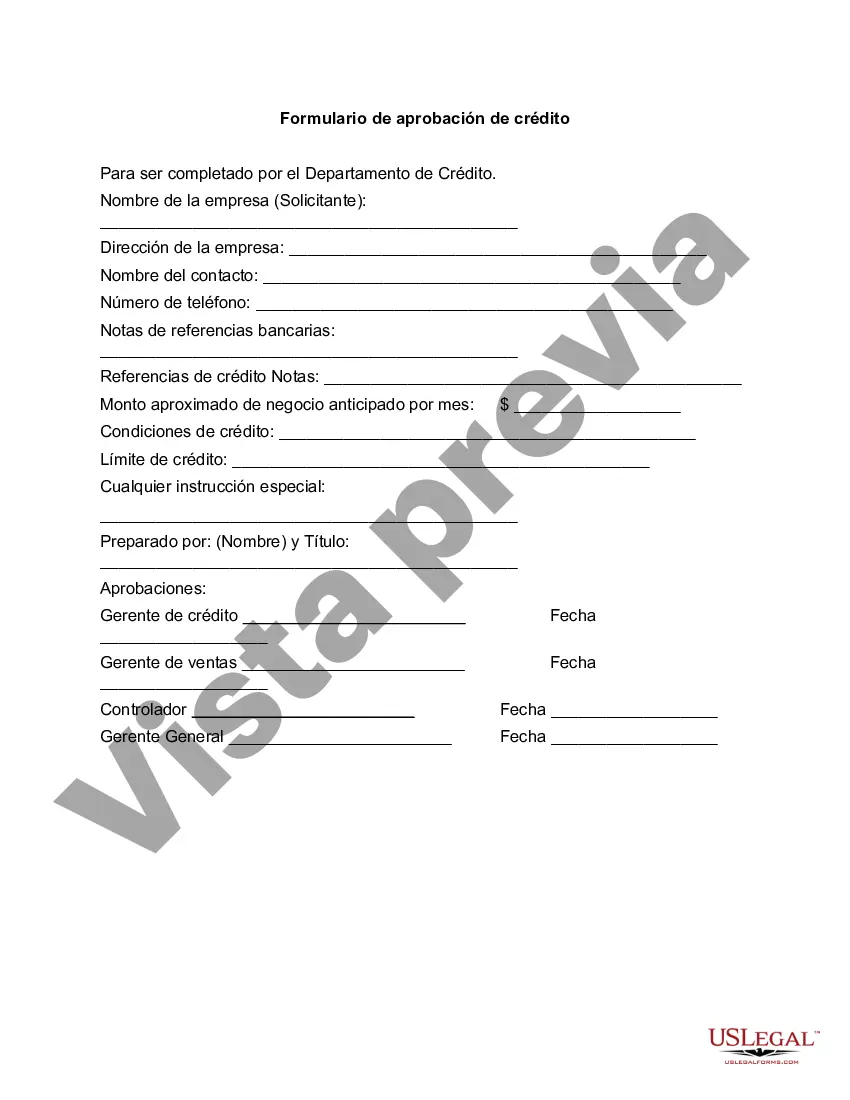

The Bexar Texas Credit Approval Form is a document utilized by financial institutions or lenders in Bexar County, Texas, to assess the creditworthiness of an individual or business applying for credit. It captures essential information about the applicant in order to evaluate their eligibility for potential credit offerings. The form typically requires the following details: applicant's full name, contact information, residential address, social security number (SSN), date of birth, employment status, current employer information, income details, and information about any existing debts or financial obligations. Lenders use the Bexar Texas Credit Approval Form to verify an applicant's credit history, employment stability, and capacity to repay the requested credit, allowing them to make an informed lending decision. This form is essential for lenders to minimize risks associated with granting credit and determine suitable interest rates, loan terms, or credit limits. It is important to note that there might be different types of Bexar Texas Credit Approval Forms, customized to different types of credit applications. For instance, there may be specific forms designed for: 1. Bexar Texas Personal Credit Approval: This form is used by individuals seeking personal credit such as personal loans, credit cards, or lines of credit. 2. Bexar Texas Business Credit Approval: Specifically designed for businesses applying for business loans or lines of credit. This form often requests additional information like business structure, years in operation, tax identification number, financial statements, and bank statements. 3. Bexar Texas Mortgage Credit Approval: Used when applying for a mortgage loan, this form collects information related to the property being financed, purchase price, down payment amount, and other specific details necessary for mortgage approval. These examples indicate that the Bexar Texas Credit Approval Form caters to various credit types, enabling lenders to assess creditworthiness accurately. By carefully analyzing the information provided on the form, lenders can evaluate the applicant's financial stability, credit history, and capacity to manage credit, allowing them to make informed decisions regarding credit approvals and terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Bexar Texas Formulario De Aprobación De Crédito?

If you need to get a reliable legal form supplier to find the Bexar Credit Approval Form, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Bexar Credit Approval Form, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Bexar Credit Approval Form template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Bexar Credit Approval Form - all from the comfort of your sofa.

Join US Legal Forms now!