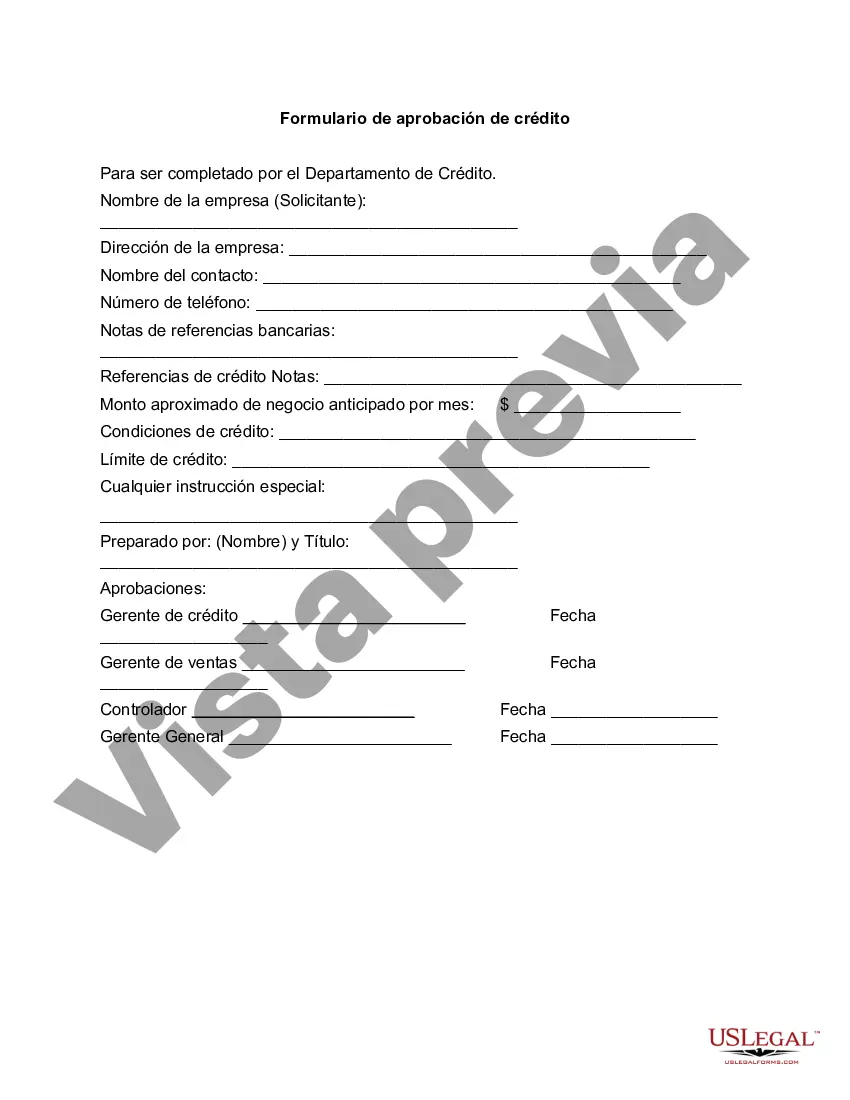

Chicago Illinois Credit Approval Form is a document designed to assess and determine the creditworthiness of individuals or businesses applying for credit within the city of Chicago, Illinois. This comprehensive form contains fields and sections that collect all necessary information for evaluating an applicant's financial standing, history, and ability to repay any borrowed funds. The Chicago Illinois Credit Approval Form aids financial institutions and lending agencies in making informed decisions when extending credit to applicants. Keywords: Chicago, Illinois, Credit Approval Form, creditworthiness, individuals, businesses, financial standing, history, ability to repay, borrowed funds, financial institutions, lending agencies. Types of Chicago Illinois Credit Approval Forms: 1. Individual Credit Approval Form: This form is specifically designed for individuals applying for credit within Chicago, Illinois. It collects information such as personal details, employment history, income sources, credit history, assets, liabilities, and other relevant financial information required to assess an individual's creditworthiness. 2. Business Credit Approval Form: This type of form is intended for businesses seeking credit in Chicago, Illinois. It includes sections to gather details about the business's structure, ownership, financial statements, balance sheets, cash flows, credit history, and other pertinent information necessary to evaluate the creditworthiness of businesses. 3. Mortgage Credit Approval Form: This form is tailored for individuals or businesses interested in obtaining a mortgage loan in Chicago, Illinois. It requires the applicant to provide detailed information about the property being financed, current mortgage rates, employment details, collateral particulars, income statements, credit report, and any other relevant information required by the lender to assess the mortgage creditworthiness. 4. Auto Loan Credit Approval Form: This form specifically serves individuals or businesses seeking credit approvals for purchasing a vehicle within Chicago, Illinois. It typically asks for details such as the desired vehicle's make, model, year, purchase price, down payment, employment history, income information, credit score, and other relevant information needed to evaluate the applicant's ability to repay the auto loan. 5. Personal Loan Credit Approval Form: Individuals in Chicago, Illinois, who are seeking personal loans can use this form to apply for credit approval. This form primarily focuses on gathering the applicant's personal and financial details, including income, expenses, credit history, employment history, and any collateral or co-signor information. Keywords: Chicago, Illinois, Credit Approval Form, individual, business, mortgage, auto loan, personal loan, creditworthiness, financial statements, employment history.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Chicago Illinois Formulario De Aprobación De Crédito?

Draftwing documents, like Chicago Credit Approval Form, to take care of your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for various scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Chicago Credit Approval Form form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Chicago Credit Approval Form:

- Ensure that your document is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Chicago Credit Approval Form isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!