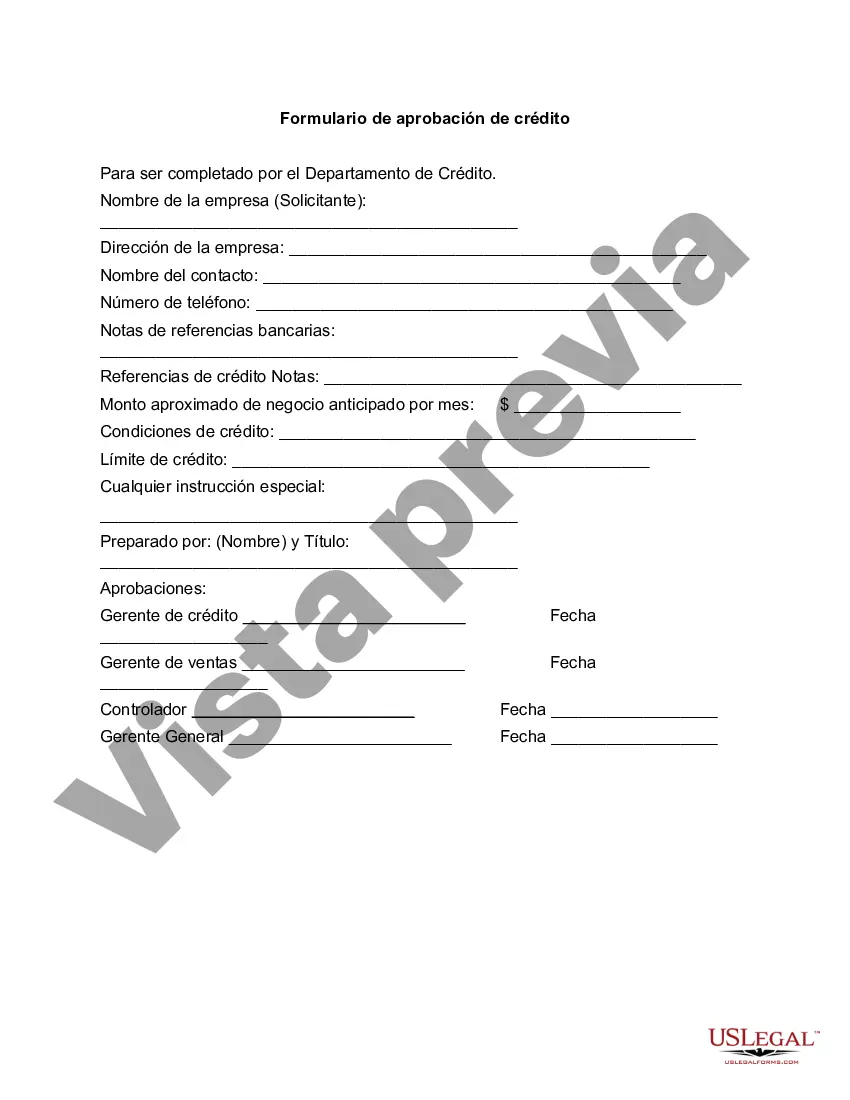

The Clark Nevada Credit Approval Form is a document commonly used by financial institutions, such as banks or credit unions, to assess the creditworthiness of individuals or businesses seeking to obtain credit. This form serves as a comprehensive evaluation tool that helps lenders make informed decisions regarding whether to approve a credit application. The Clark Nevada Credit Approval Form prominently displays sections for personal and business details, including the applicant's name, address, contact information, Social Security number or Employer Identification Number (EIN), as well as employment or business information. These sections enable the lender to verify the applicant's identity and evaluate their financial stability. In addition, the Clark Nevada Credit Approval Form requires detailed information about the applicant's financial history and current financial status. This includes sections for disclosing the applicant's current sources of income, such as employment or business revenue, as well as any outstanding debts, loans, or credit obligations. It further requires the applicant to provide bank statements, tax returns, and other relevant financial documentation to support their application and facilitate the credit assessment process. Various types of the Clark Nevada Credit Approval Form may exist, catering to different types of credit applications. For example, there may be specific forms for individuals applying for personal loans, mortgages, or credit cards. Additionally, separate forms may be available for businesses seeking commercial loans, lines of credit, or equipment financing. These variations in the Clark Nevada Credit Approval Forms account for the different requirements and risks associated with each type of credit. The specific form used will depend on the purpose and nature of the credit application, ensuring that the information gathered is relevant and tailored to meet the needs of both the applicant and the lender. Overall, the Clark Nevada Credit Approval Form is a crucial document used by financial institutions to make informed decisions regarding credit applications. It offers a standardized and meticulous evaluation process that considers the applicant's personal and financial information, providing lenders with the necessary insights to assess creditworthiness and mitigate potential risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Clark Nevada Formulario De Aprobación De Crédito?

Are you looking to quickly draft a legally-binding Clark Credit Approval Form or probably any other form to manage your own or business matters? You can select one of the two options: contact a professional to write a legal document for you or create it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific form templates, including Clark Credit Approval Form and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the Clark Credit Approval Form is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the document isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Clark Credit Approval Form template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!