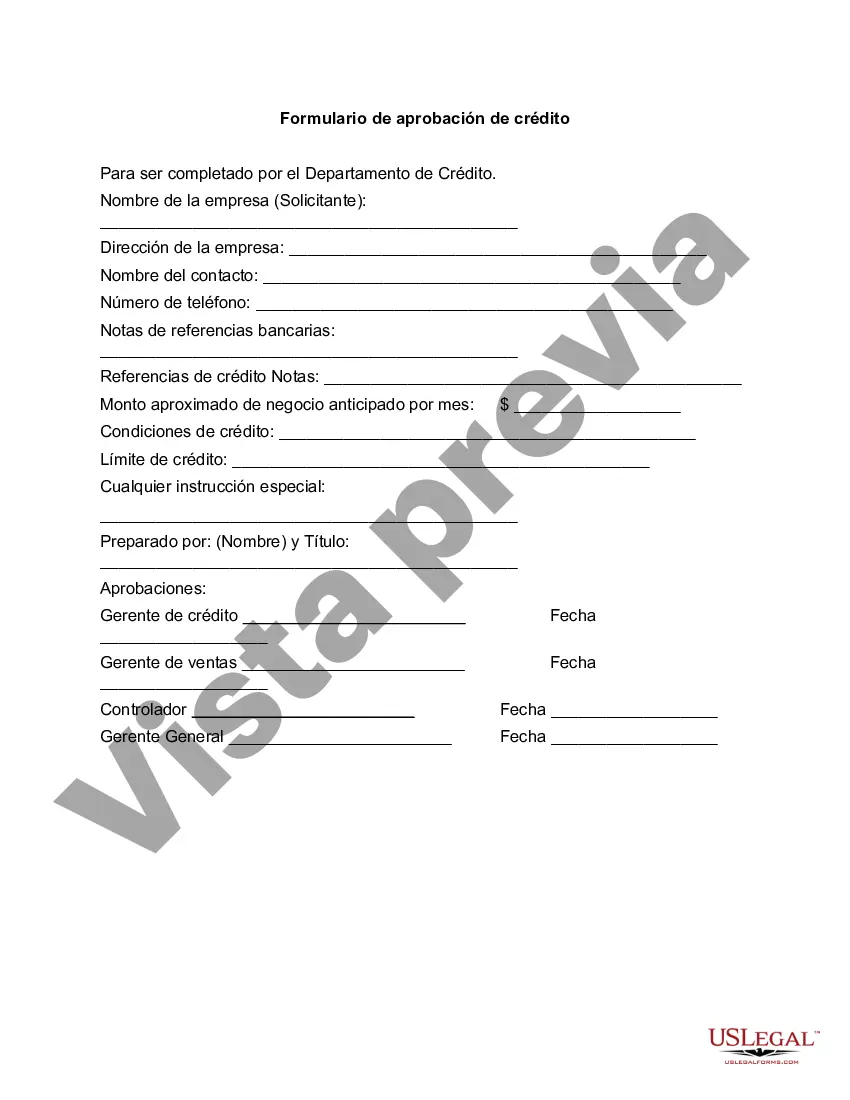

The Contra Costa California Credit Approval Form is a crucial document used by financial institutions, lenders, or credit companies based in Contra Costa County to assess the creditworthiness of individuals or businesses applying for credit. This form helps evaluate the borrower's ability to repay the loan and determines whether the credit should be approved or denied. To ensure accuracy and completeness, the Contra Costa California Credit Approval Form typically requests specific information from the applicant. The details typically include the applicant's personal information, such as name, address, contact information, and social security number. Additionally, the form may require details about the applicant's employment history, income, assets, liabilities, and previous credit history. By carefully reviewing the Contra Costa California Credit Approval Form, lenders can make informed decisions regarding credit granting. The form assists in determining if the applicant has a stable income, sufficient assets, and a good repayment track record. It allows lenders to assess the borrower's debt-to-income ratio, credit utilization ratio, and overall financial health. There could be various types of Contra Costa California Credit Approval Forms, depending on the specific needs and requirements of the lender. Some common variations include: 1. Personal Credit Approval Form: This form is used when individuals apply for personal loans, credit cards, or other forms of unsecured credit. 2. Business Credit Approval Form: Specifically designed for business entities, this form focuses on evaluating the creditworthiness of companies seeking business loans or lines of credit. 3. Auto Loan Credit Approval Form: Used by lenders specializing in auto financing, this form assesses the creditworthiness of individuals or businesses applying for vehicle loans. 4. Mortgage Credit Approval Form: This form is utilized by lenders or mortgage companies when evaluating applicants applying for home loans or mortgage refinancing. 5. Student Loan Credit Approval Form: Designed for educational financing institutes, this form helps determine the creditworthiness of students applying for educational loans. The Contra Costa California Credit Approval Form serves as a critical tool for lenders and borrowers alike. It enables lenders to make informed decisions, manage risks, and maintain responsible lending practices. Borrowers benefit from this process as well, as it ensures fair evaluations and improved access to credit based on their financial standing and repayment capabilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Contra Costa California Formulario De Aprobación De Crédito?

Draftwing forms, like Contra Costa Credit Approval Form, to take care of your legal matters is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms intended for various cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Contra Costa Credit Approval Form template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before getting Contra Costa Credit Approval Form:

- Ensure that your template is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Contra Costa Credit Approval Form isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our service and get the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!