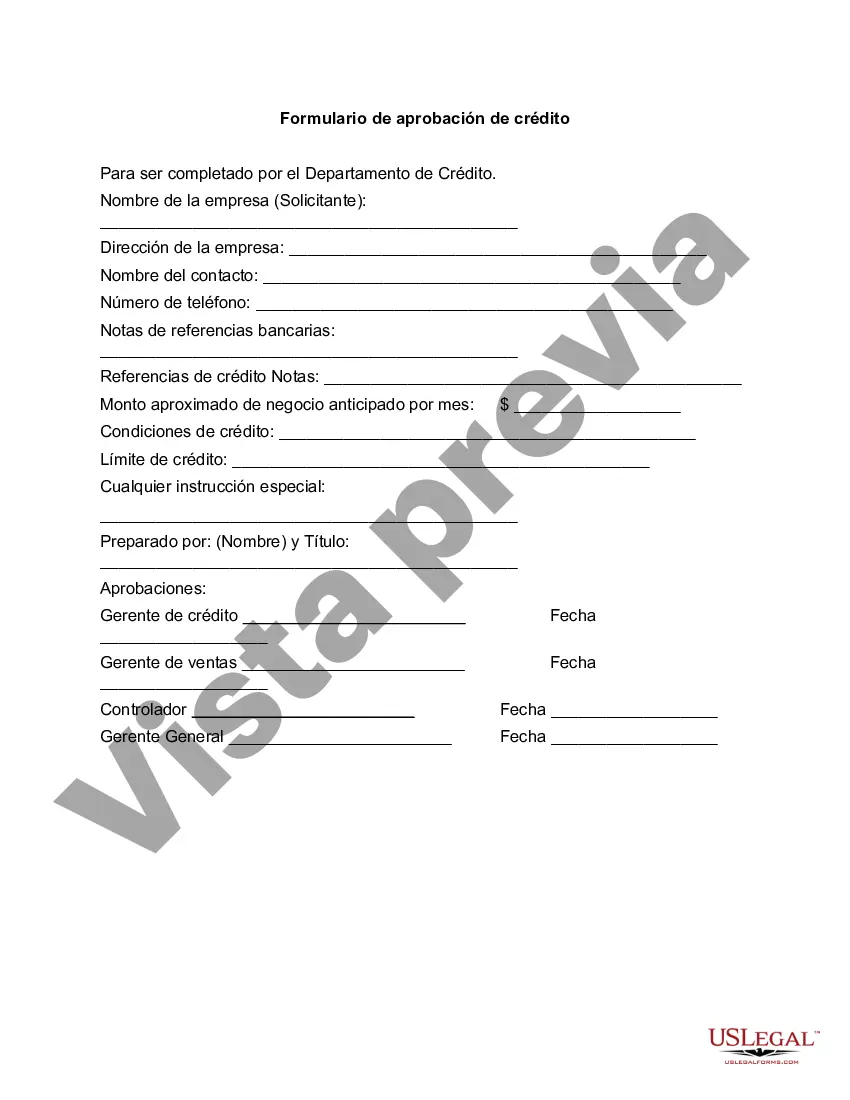

Fairfax Virginia Credit Approval Form is a vital document used to assess an individual's creditworthiness and approve credit in Fairfax, Virginia. This form plays a crucial role in determining if an individual or business should be granted credit by lenders or financial institutions. By filling out this form accurately and completely, applicants provide necessary information for lenders to evaluate their creditworthiness. The Fairfax Virginia Credit Approval Form commonly includes the following sections: 1. Personal Information: This section requires applicants to provide their full name, residential address, contact details, social security number, and driver's license information. Personal information is crucial for lenders to verify the identity of the applicant. 2. Employment Details: This section requests information relating to the applicant's current and previous employment history, including the name and address of the employer, job title, length of employment, and monthly income. Lenders consider this information to determine the applicant's ability to repay the credit. 3. Financial Information: Applicants are required to disclose their banking details, such as the name of the bank, account number, and type of account. Additionally, they may need to mention any outstanding loans, mortgages, credit card debt, or other financial obligations. 4. Credit History: This section asks applicants to state their credit history, including any previous bankruptcies, foreclosures, or delinquencies. This information helps lenders evaluate the applicant's creditworthiness and assess the potential risk of extending credit to them. 5. References: Applicants might be asked to provide personal and professional references, including their names, addresses, and contact details. References may be contacted by lenders to gather additional information about the applicant's financial responsibility. Different types of Fairfax Virginia Credit Approval Forms may vary based on the purpose or the institution that requests it. Some common variations include: 1. Personal Credit Approval Form: This form is typically used for individuals who are seeking personal loans, credit cards, or financing options. 2. Business Credit Approval Form: It caters to businesses and entrepreneurs who require credit or financing for their operations. This form may require additional information specific to the business, such as tax identification numbers, company financial statements, and projected revenue. 3. Mortgage Credit Approval Form: Specific to homebuyers, this type of form focuses on evaluating the creditworthiness of individuals seeking a mortgage or home loan. 4. Auto Loan Credit Approval Form: Used for individuals looking to finance the purchase of a car or other vehicles, this form assesses the creditworthiness of the applicant specifically for auto loan purposes. In conclusion, the Fairfax Virginia Credit Approval Form is a comprehensive document that collects essential information to assess an individual's creditworthiness in Fairfax. By providing accurate and complete information, applicants increase their chances of obtaining credit from lenders or financial institutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Fairfax Virginia Formulario De Aprobación De Crédito?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Fairfax Credit Approval Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any activities associated with document execution simple.

Here's how you can locate and download Fairfax Credit Approval Form.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar forms or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Fairfax Credit Approval Form.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Fairfax Credit Approval Form, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to deal with an extremely complicated case, we recommend using the services of an attorney to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!