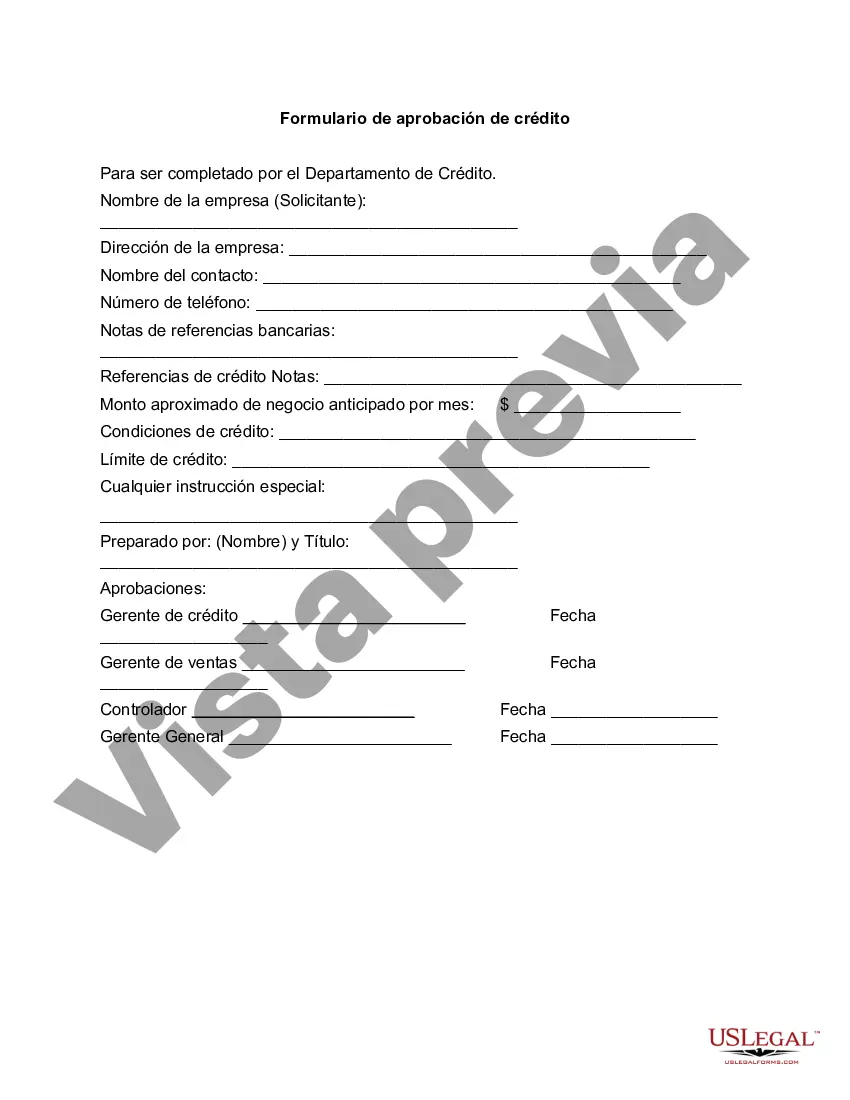

Miami-Dade Florida Credit Approval Form is a vital document used in the financial industry to assess and grant credit to individuals or businesses located in Miami-Dade County, Florida. It is designed to gather comprehensive information about the applicant's financial standing, credit history, and ability to repay the loan. The form typically includes personal details, such as full name, address, contact information, and social security number. Moreover, the Miami-Dade Florida Credit Approval Form includes sections to disclose employment status, income sources, and the length of employment. This information helps lenders evaluate the applicant's stability and assess their ability to meet repayment obligations. The form may feature questions related to the applicant's current and previous debts, allowing lenders to determine their overall creditworthiness. In addition, the Miami-Dade Florida Credit Approval Form might request information about the purpose of the loan, loan amount, and desired repayment terms. It also includes sections to authorize credit checks and consent to provide financial information to lenders and credit reporting agencies. Different types of Miami-Dade Florida Credit Approval Forms include: 1. Personal Credit Approval Form: Specifically designed for individuals seeking personal loans, this form focuses on collecting personal financial details and credit history to assess creditworthiness for personal funding needs. 2. Business Credit Approval Form: This form is tailored for business entities and entrepreneurs looking for credit to support their business operations, expansion, or investment. It gathers information about the company's financial health, including business structure, annual revenue, and outstanding debts. 3. Mortgage Credit Approval Form: As the name suggests, this form caters to individuals or businesses seeking credit for purchasing properties in Miami-Dade County. It delves into more specific details regarding the mortgage, such as property information, loan terms, and down payment options. 4. Student Credit Approval Form: Aimed at students or their parents seeking educational loans, this form focuses on student-specific financial information, including educational institution details, expected graduation date, and future income potential. It is important to note that these various types of Miami-Dade Florida Credit Approval Forms serve different purposes but share the common objective of providing reliable information to lenders for credit assessment and decision-making. By providing accurate and comprehensive details through these forms, applicants enhance their chances of obtaining credit approval and achieving their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Formulario de aprobación de crédito - Credit Approval Form

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-13284BG

Format:

Word

Instant download

Description

Credit approval is the process a business or an individual undergoes to become eligible for a loan or pay for goods and services over an extended period.

Miami-Dade Florida Credit Approval Form is a vital document used in the financial industry to assess and grant credit to individuals or businesses located in Miami-Dade County, Florida. It is designed to gather comprehensive information about the applicant's financial standing, credit history, and ability to repay the loan. The form typically includes personal details, such as full name, address, contact information, and social security number. Moreover, the Miami-Dade Florida Credit Approval Form includes sections to disclose employment status, income sources, and the length of employment. This information helps lenders evaluate the applicant's stability and assess their ability to meet repayment obligations. The form may feature questions related to the applicant's current and previous debts, allowing lenders to determine their overall creditworthiness. In addition, the Miami-Dade Florida Credit Approval Form might request information about the purpose of the loan, loan amount, and desired repayment terms. It also includes sections to authorize credit checks and consent to provide financial information to lenders and credit reporting agencies. Different types of Miami-Dade Florida Credit Approval Forms include: 1. Personal Credit Approval Form: Specifically designed for individuals seeking personal loans, this form focuses on collecting personal financial details and credit history to assess creditworthiness for personal funding needs. 2. Business Credit Approval Form: This form is tailored for business entities and entrepreneurs looking for credit to support their business operations, expansion, or investment. It gathers information about the company's financial health, including business structure, annual revenue, and outstanding debts. 3. Mortgage Credit Approval Form: As the name suggests, this form caters to individuals or businesses seeking credit for purchasing properties in Miami-Dade County. It delves into more specific details regarding the mortgage, such as property information, loan terms, and down payment options. 4. Student Credit Approval Form: Aimed at students or their parents seeking educational loans, this form focuses on student-specific financial information, including educational institution details, expected graduation date, and future income potential. It is important to note that these various types of Miami-Dade Florida Credit Approval Forms serve different purposes but share the common objective of providing reliable information to lenders for credit assessment and decision-making. By providing accurate and comprehensive details through these forms, applicants enhance their chances of obtaining credit approval and achieving their financial goals.