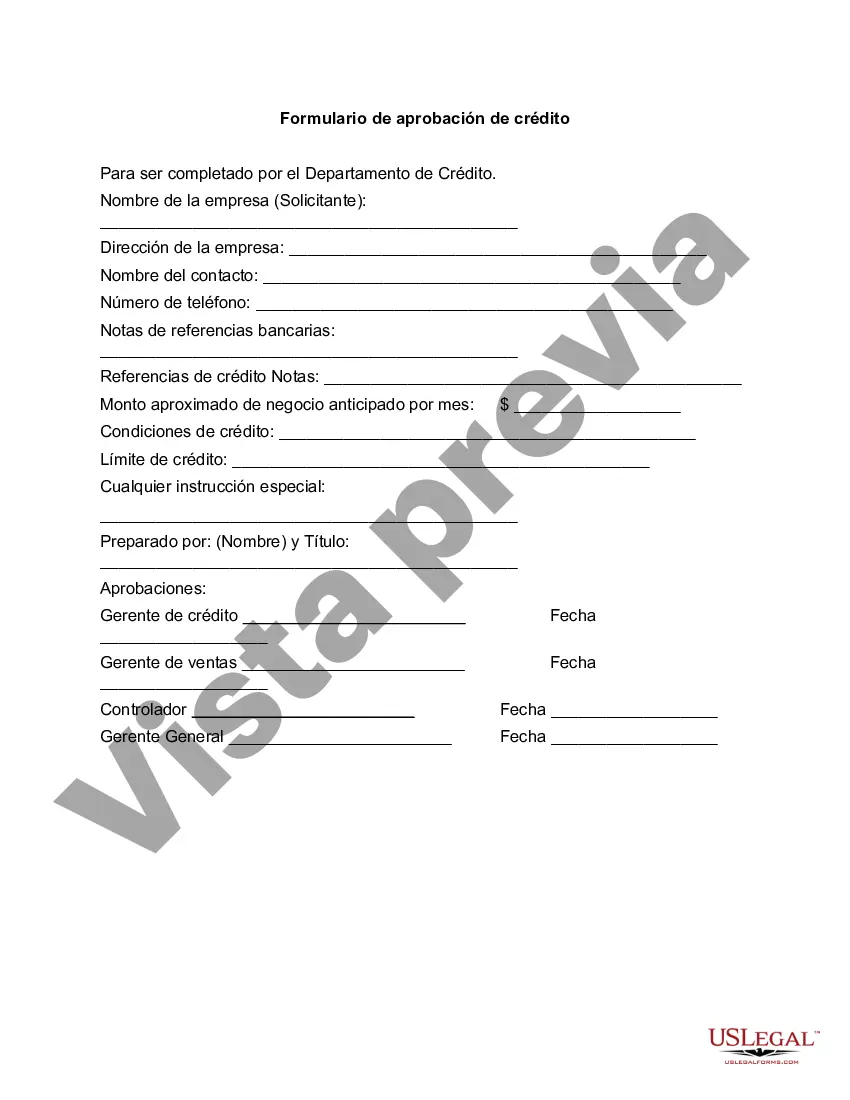

Montgomery Maryland Credit Approval Form is a document used in Montgomery County, Maryland, to assess and approve an individual's creditworthiness for various financial transactions. This form is an essential tool utilized by financial institutions, lenders, and creditors in evaluating an applicant's credit history, financial stability, and ability to repay debts. The Montgomery Maryland Credit Approval Form gathers pertinent personal and financial information to evaluate the applicant's creditworthiness thoroughly. This information typically includes the applicant's full name, contact details, social security number, employment history, current income, assets, liabilities, and existing outstanding debts. The form may also require the applicant to provide documentation such as recent pay stubs, bank statements, and tax returns to support the information provided. By reviewing the Montgomery Maryland Credit Approval Form, lenders and financial institutions can determine an applicant's eligibility for various credit products, such as loans, mortgages, credit cards, or lines of credit. They assess the applicant's financial stability, credit score, debt-to-income ratio, and past payment history to make an informed decision on granting credit approval. Different types of Montgomery Maryland Credit Approval Forms may exist based on the specific credit product or service being applied for. Some common variations include: 1. Montgomery Maryland Mortgage Credit Approval Form: Specifically designed for loan applicants seeking mortgage financing to purchase a property or refinance an existing mortgage. It requires detailed information about the property, loan amount, down payment, and current mortgage details. 2. Montgomery Maryland Auto Loan Credit Approval Form: Used when applying for an auto loan, this form focuses on the applicant's car purchase details, such as make, model, year, VIN number, and loan amount requested. 3. Montgomery Maryland Credit Card Approval Form: Aimed at individuals applying for a credit card, this form emphasizes the applicant's income, employment, and credit card preferences such as credit limit and rewards programs. 4. Montgomery Maryland Personal Loan Credit Approval Form: This form is used when applying for a personal loan for purposes such as debt consolidation, home improvement, or unexpected expenses. It requires information regarding the loan amount, purpose, and repayment terms. It is important to note that different lenders or financial institutions may have their customized versions of the Montgomery Maryland Credit Approval Form, tailored to their specific requirements and policies. Nonetheless, the core purpose remains the same — to assess an individual's creditworthiness and determine their eligibility for credit products and services based on accurate and comprehensive financial information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Montgomery Maryland Formulario De Aprobación De Crédito?

Draftwing paperwork, like Montgomery Credit Approval Form, to manage your legal matters is a challenging and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for different cases and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Montgomery Credit Approval Form form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Montgomery Credit Approval Form:

- Ensure that your form is specific to your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Montgomery Credit Approval Form isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our website and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!