Nassau New York Credit Approval Form is a crucial document used by financial institutions and other credit lenders in Nassau County, New York. This form is designed to obtain detailed information from individuals or businesses seeking credit approval for various purposes such as loans, mortgages, credit card applications, leases, and other financial transactions. The Nassau New York Credit Approval Form typically consists of several sections requiring the applicant to provide comprehensive personal and financial details. The form starts with basic identification information, including the applicant's name, address, contact information, social security number, and date of birth. The next section delves into employment details, requiring the applicant to provide their current and previous employment history, job title, employer's name and address, and income details. This information helps lenders evaluate the applicant's stability, ability to repay the credit, and assess whether they meet the lender's risk criteria. The Nassau New York Credit Approval Form also includes sections to provide a detailed overview of the applicant's financial circumstances. This includes disclosing existing debts and obligations, such as loans, mortgages, credit card balances, and any other outstanding liabilities. The form may also require the applicant to disclose their assets, including bank accounts, investments, properties, and other valuable possessions. Moreover, the form may include a credit history section, where applicants are expected to provide details about any previous credit history, delinquent accounts, bankruptcies, foreclosures, or any other negative financial events. This section assists lenders in assessing an applicant's creditworthiness and helps them make informed decisions regarding credit approval. It is important to note that there might be different types of Nassau New York Credit Approval Forms tailored for specific credit purposes. For instance, there may be specific forms designed for mortgage applications, automobile financing, business loans, student loans, and credit card applications. Each type of form may have slight variations in the required information, depending on the specific credit product. In summary, the Nassau New York Credit Approval Form is a vital document used by financial institutions in Nassau County, New York, to assess creditworthiness and make informed decisions regarding credit approvals. This comprehensive form encompasses personal, financial, and credit history details to evaluate an applicant's ability to repay credit obligations. Different variations of this form exist depending on the specific credit purpose, such as mortgage applications, business loans, or credit cards.

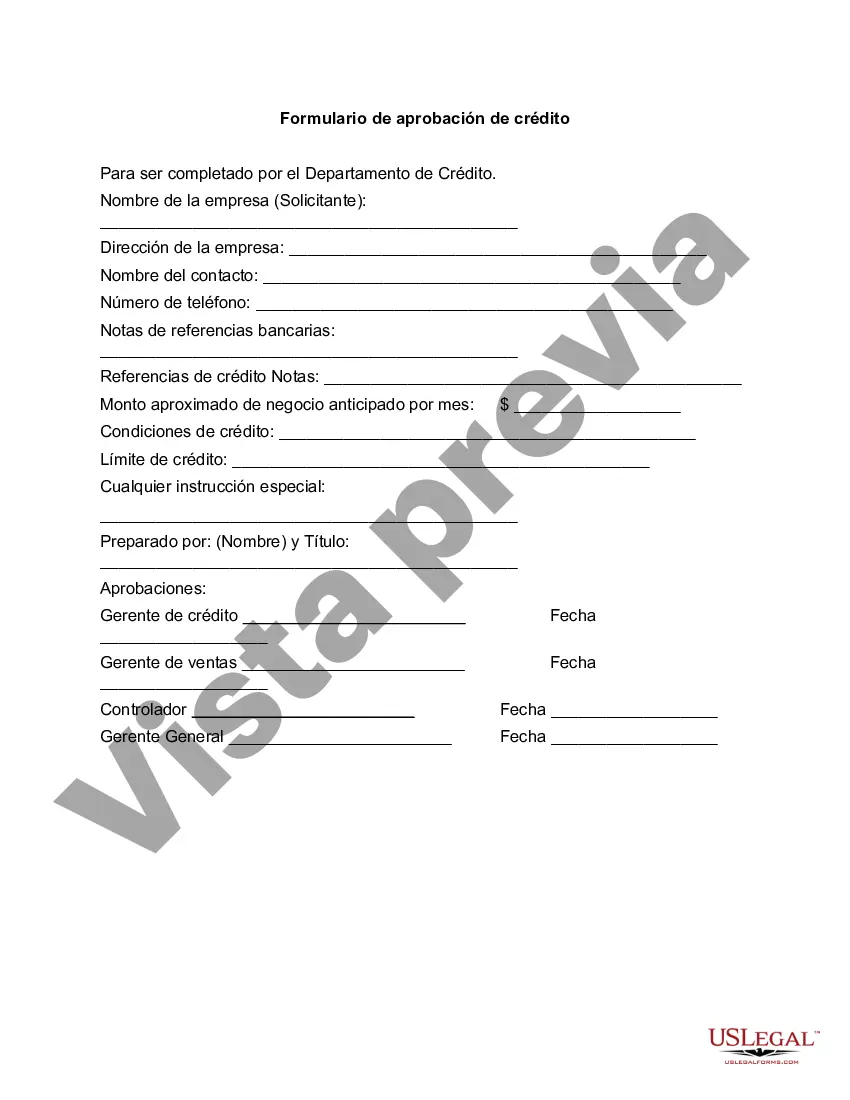

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Nassau New York Formulario De Aprobación De Crédito?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Nassau Credit Approval Form meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Nassau Credit Approval Form, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Nassau Credit Approval Form:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Nassau Credit Approval Form.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!