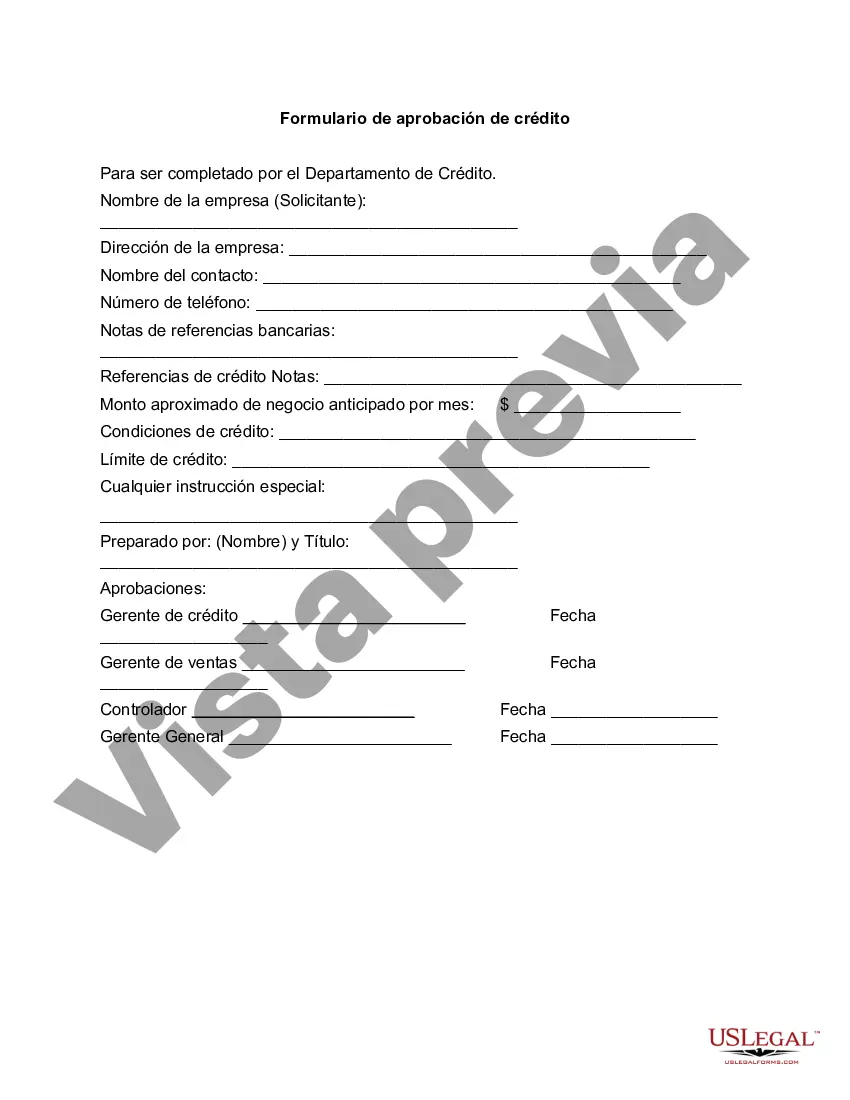

Orange California Credit Approval Form is a crucial document used by financial institutions and lenders to assess an individual's creditworthiness and determine whether they are eligible for credit. It is important to accurately complete this form as it plays a significant role in the credit approval process. The Orange California Credit Approval Form typically requires the applicant to provide personal information such as their full name, current address, social security number, contact details, and employment information. This information helps lenders verify the applicant's identity and evaluate their financial stability. Additionally, the form may ask for details regarding the type and amount of credit being applied for, such as a credit card, loan, or mortgage. The applicant may be required to provide information about any existing debts or liabilities to assess their overall creditworthiness. This includes details about outstanding loans, credit lines, or other financial obligations. Furthermore, the applicant may be asked to disclose their income information, including their employer's name, job title, and verifiable income sources. This assists in determining the applicant's ability to repay the credit being sought. Moreover, the Orange California Credit Approval Form may have sections to record the applicant's credit history. This includes information about previous loans, credit defaults, late payments, bankruptcies, or any other negative financial events that may have occurred. It is worth mentioning that different types of credit may have specific application forms tailored to their specific requirements. For instance, there might be separate credit approval forms for credit cards, auto loans, home mortgages, personal loans, or business loans in Orange California. To expedite the approval process, applicants are advised to ensure that all the relevant information is accurately provided in the Orange California Credit Approval Form. Any incomplete or incorrect information can result in delays or even rejection of the credit application. Overall, the Orange California Credit Approval Form is a crucial tool for lenders in Orange, California, to evaluate an individual's creditworthiness before extending credit. It assists them in assessing the risk associated with providing credit and enables them to make informed decisions regarding credit approval.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Orange California Formulario De Aprobación De Crédito?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Orange Credit Approval Form, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Orange Credit Approval Form from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Orange Credit Approval Form:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!