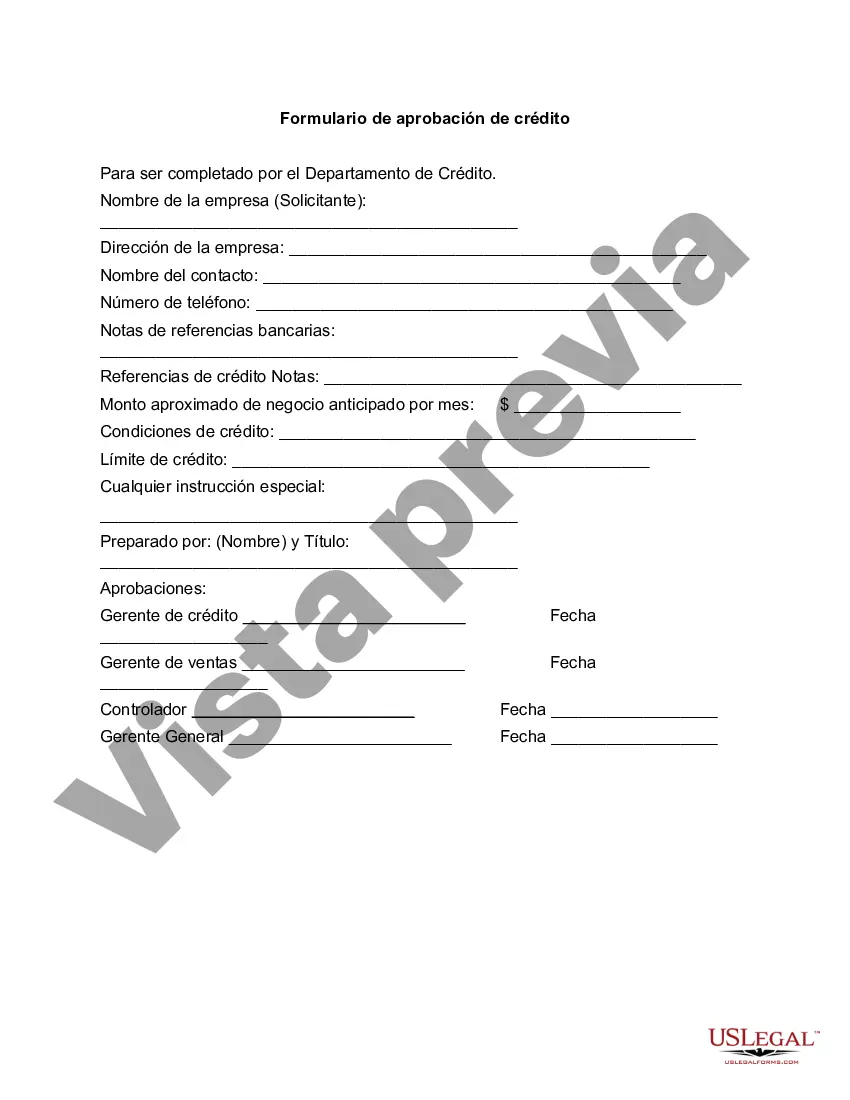

Palm Beach Florida Credit Approval Form is a crucial document required by financial institutions and lenders to evaluate an individual's creditworthiness and decide whether to approve their credit application or not. This form is designed to collect and assess various personal and financial information, aiding the lender in making informed decisions regarding lending and loan terms. Key elements commonly found in a Palm Beach Florida Credit Approval Form include: 1. Personal Information: This section requires the applicant to provide their full name, contact details, date of birth, social security number, and current address. These details are essential for identification purposes and ensuring accurate credit reporting. 2. Employment Details: Here, the applicant provides information about their current employer, job title, duration of employment, and salary. Lenders analyze this section to evaluate stable employment and income sources, which are vital factors in credit approval. 3. Financial Information: This section focuses on the applicant's financial health. It typically includes details about existing loans, credit cards, mortgages, and any other outstanding debts. Additionally, applicants may be required to disclose information about their assets, such as real estate holdings, investments, or owned vehicles. 4. Credit History: In this section, applicants are required to disclose their credit history. This includes providing details about previous loans, credit cards, and payment history. Lenders assess this information to evaluate repayment patterns, defaults, and any potential credit risks. 5. Consent and Authorization: The Palm Beach Florida Credit Approval Form typically contains a section where the applicant provides consent allowing the lender to access and review their credit reports from major credit bureaus. This consent empowers lenders with the ability to obtain accurate credit information. Different types of Palm Beach Florida Credit Approval Forms may exist, varying based on the specific financial institution or lending organization. These forms can be tailored to meet the requirements of different types of credit applications, such as auto loans, mortgages, personal loans, or credit cards. Overall, the Palm Beach Florida Credit Approval Form is a crucial tool for lenders to assess an individual's creditworthiness and make informed decisions regarding credit approvals. By carefully analyzing the provided information, lenders can ascertain the applicant's ability to repay debts and tailor appropriate loan terms based on their financial capacity and credit history.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Palm Beach Florida Formulario De Aprobación De Crédito?

Draftwing documents, like Palm Beach Credit Approval Form, to take care of your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for different scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Palm Beach Credit Approval Form form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Palm Beach Credit Approval Form:

- Ensure that your document is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Palm Beach Credit Approval Form isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start using our website and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!