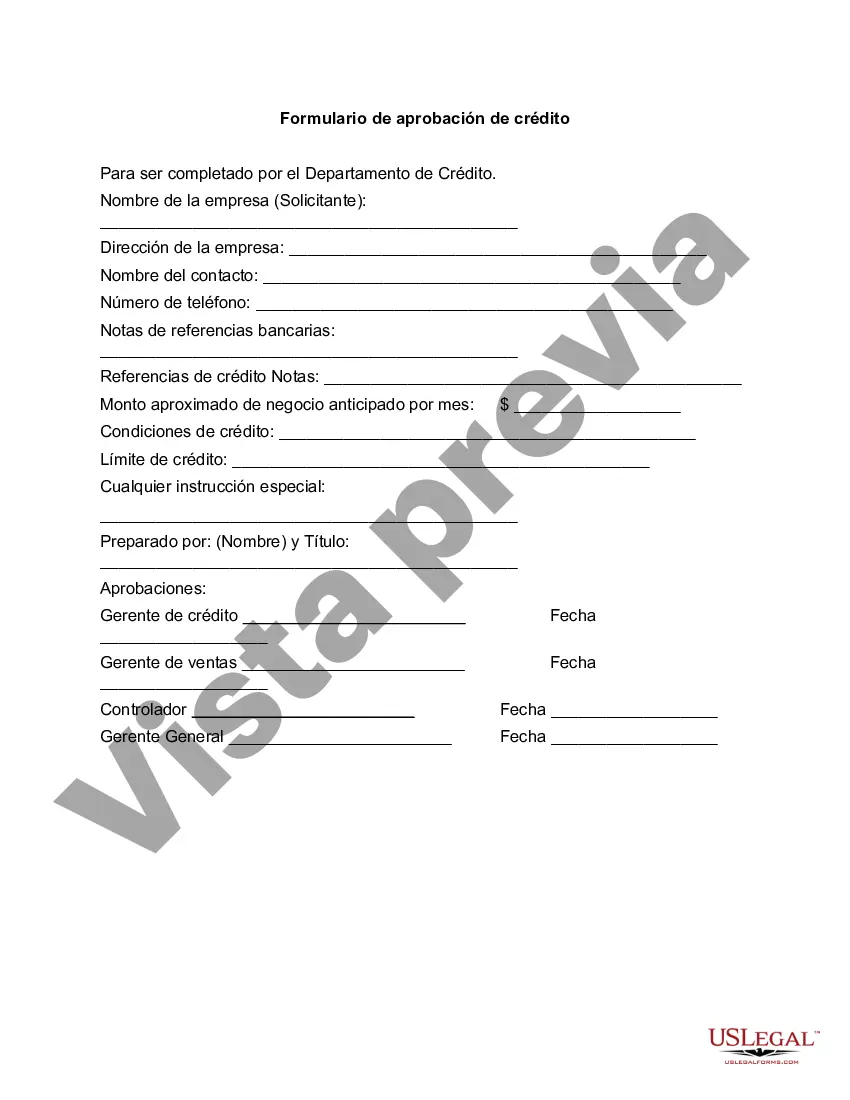

The Phoenix Arizona Credit Approval Form is a financial document used to assess and determine creditworthiness for individuals or businesses seeking credit facilities in Phoenix, Arizona. This form plays a crucial role in the loan application process, serving as a comprehensive evaluation tool for lenders and financial institutions. It gathers essential information about the applicant's financial background, credit history, and current financial situation. The form requires to be detailed personal or business information, such as full name, contact details, social security number, and employer details. Additionally, it requests information about income sources, current debts, monthly expenses, and assets owned by the applicant. This detailed data enables lenders to determine the applicant's ability to manage loan repayments and assess their credit risk. Moreover, the Phoenix Arizona Credit Approval Form includes a section to disclose the desired loan type, amount needed, and purpose. This helps lenders in tailoring suitable loan options based on the applicant's requirements and financial capability. Lenders also analyze credit score, outstanding debts, and payment history to ascertain if the applicant qualifies for the requested credit. There are different types of Phoenix Arizona Credit Approval Forms tailored to specific credit needs. Some popular variations include: 1. Personal Credit Approval Form: Specifically designed for individuals applying for personal loans, such as mortgage loans, auto loans, or personal lines of credit. 2. Business Credit Approval Form: Catering exclusively to businesses, this form is utilized for obtaining credit facilities required for business expansion, working capital, or equipment financing. 3. Credit Card Approval Form: Geared towards individuals or businesses seeking credit cards, this form collects information essential for credit card evaluation and approval. 4. Home Equity Credit Approval Form: This form is utilized by homeowners interested in obtaining a home equity line of credit (HELOT) or a home equity loan, which allows them to leverage the equity built in their property. 5. Student Loan Approval Form: Designed for students pursuing higher education, this form gathers information related to academic performance, financial aid, and the requested loan amount to facilitate student loan approval. Applicants are advised to complete the Phoenix Arizona Credit Approval Form accurately and provide all necessary documentation required by the lender. Prompt submission of the form expedites the credit assessment process, enabling lenders to make informed decisions on loan approvals efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Phoenix Arizona Formulario De Aprobación De Crédito?

Creating documents, like Phoenix Credit Approval Form, to take care of your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for different cases and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Phoenix Credit Approval Form form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Phoenix Credit Approval Form:

- Ensure that your form is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Phoenix Credit Approval Form isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

El monto del beneficio Numero de personas en su hogar1$2502$4593$6584$8355 more rows

El monto del beneficio Numero de personas en su hogar1$2502$4593$6584$8355 more rows

La manera mas facil de solicitar beneficios es en linea por medio de Health-e-Arizona Plus. Tambien puede comenzar el proceso de solicitud por telefono al llamar al 1-855-432-7587.

Estos beneficios se distribuiran a partir del 10 de septiembre de 2022. Los ninos en edad escolar elegibles recibiran los beneficios del P-EBT de verano de 2022 a fines de octubre de 2022.

¿Como funciona? Haga una solicitud. Un representante de su condado se pondra en contacto con usted dentro de una semana o dos para programar una entrevista de elegibilidad. Obtenga dinero. Si se aprueba la solicitud, recibira una tarjeta EBT para alimentos dentro de 10 dias. Compre alimentos.

Ingreso Mensual Maximo Permisible Numero de Personas En Su HogarIngreso Bruto Mensual MaximoIngreso Bruto Mensual Maximo (60 anos de edad y mayor o discapacitado)1$ 1,771$ 2,1472$ 2,396$ 2,9033$ 3,020$ 3,6604$ 3,644$ 4,4177 more rows

El Programa de Asistencia de Emergencia para el Alquiler (ERAP, por sus siglas en ingles) ahora ofrece asistencia para pagar al renta y los servicios publicos a los inquilinos elegibles de Arizona afectados por la pandemia de COVID-19.

Ayuda con asistencia en efectivo: La asistencia en efectivo es una subvencion en efectivo dos veces al mes que los beneficiarios pueden usar para satisfacer sus necesidades basicas.

Interesting Questions

More info

Credit Cards, Mobile Phone Numbers and Banking You can request a credit card, order money orders and other personal financial aid items from the Cashier's Office of the Office of Student Financial Support and Financial Services. The Cashier's Office accepts Visa, MasterCard, Discover credit cards and personal checks. If you prefer, you may pay cash to the Student Financial Aid Office via the FAFSA Form or the Cashier's Mail Service and the student will have to complete the Student Financial Aid Form. If you are currently enrolled in Missouri, the Financial Aid Office also accepts checks and money orders over the counter. You can find the Student Financial Aid office at: Mizzou's Student Financial Aid Office. 200 N. Main Street Columbia, MO 64 Monday, Tuesday, Wednesday and Thursday from 9a.m. to 4 p.m. Saturday 11 a.m. to 4 p.m.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.