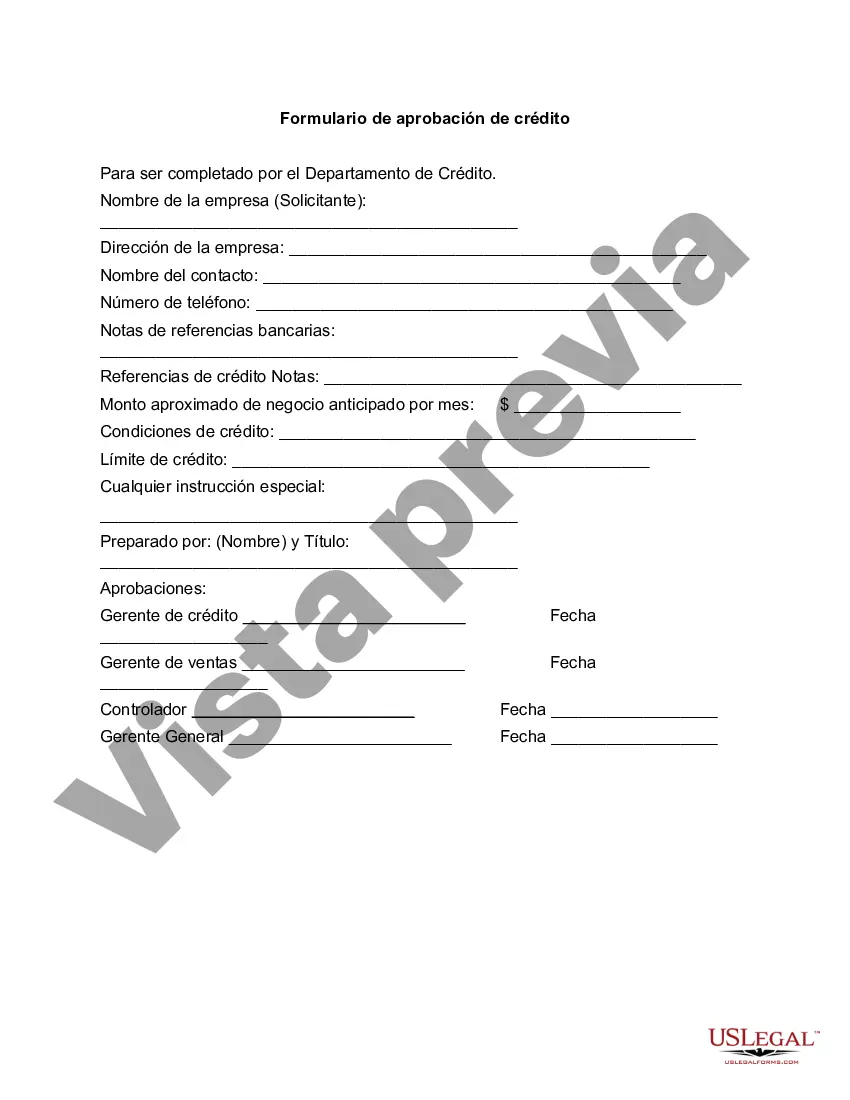

San Antonio Texas Credit Approval Form is an essential document that allows individuals or businesses to apply for credit in San Antonio, Texas. This form is specifically designed for residents of San Antonio who wish to obtain credit from various financial institutions or lenders. The Credit Approval Form captures crucial information needed by financial institutions to evaluate an applicant's creditworthiness and determine whether they qualify for the requested credit. It enables lenders to assess the applicant's financial background, employment status, income, credit history, and other relevant factors that play a role in the credit approval process. Some important details typically included in the San Antonio Texas Credit Approval Form are as follows: 1. Personal Information: The form requires the applicant to provide personal details such as their full name, address, Social Security number, contact information, date of birth, and other identification information. 2. Employment Details: Applicants are required to disclose their current employment status, including job title, name of the employer, duration of employment, and monthly income. In some cases, self-employed individuals may need to provide additional documentation to verify their income. 3. Financial Information: The form requests information regarding the applicant's banking relationships, existing debts, monthly expenses, and assets. This information helps the lender assess the applicant's overall financial situation and capability to manage additional credit obligations. 4. Credit History and References: Applicants are asked to provide details related to their credit history, including outstanding loans, credit card balances, and any issues like bankruptcy or foreclosure. Lenders may also request personal or professional references for additional verification. 5. Loan or Credit Details: The form allows applicants to specify the desired loan amount, purpose of credit, repayment terms, and other terms and conditions they may require. San Antonio Texas Credit Approval Form comes in different types, depending on the specific credit needs and institutions involved. While the fundamental structure and purpose remain the same, some forms may be tailored for specific credit types, such as auto loans, mortgage loans, personal loans, business loans, or credit cards. In conclusion, the San Antonio Texas Credit Approval Form serves as a vital tool for individuals and businesses in San Antonio to request and obtain credit from financial institutions. By providing comprehensive information about the applicant's financial background, employment status, and credit history, this form assists lenders in evaluating creditworthiness and making informed decisions regarding granting credit.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out San Antonio Texas Formulario De Aprobación De Crédito?

Do you need to quickly draft a legally-binding San Antonio Credit Approval Form or probably any other document to manage your own or business matters? You can select one of the two options: hire a professional to write a valid document for you or draft it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including San Antonio Credit Approval Form and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, carefully verify if the San Antonio Credit Approval Form is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were looking for by using the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the San Antonio Credit Approval Form template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!