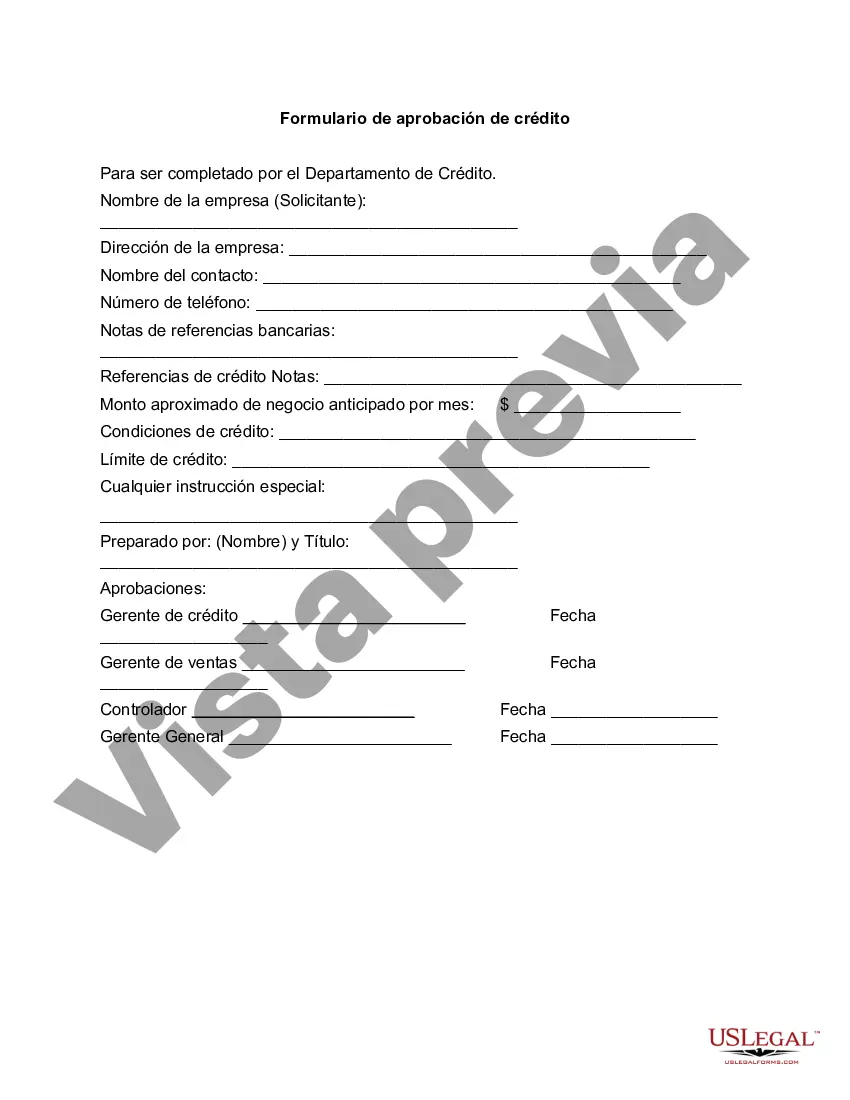

San Jose California Credit Approval Form is a crucial document used in the financial industry to assess and approve credit requests in San Jose, California. This form allows lending institutions, such as banks or credit unions, to evaluate an individual's creditworthiness before granting a loan or credit facility. This detailed description will shed light on the purpose, types, and importance of the San Jose California Credit Approval Form, along with essential keywords that are relevant to each aspect. 1. Purpose: The primary purpose of the San Jose California Credit Approval Form is to gather essential information about an applicant's financial background, credit history, and current financial situation. This data helps to evaluate institutions determine whether the applicant is a suitable candidate for a loan or credit. Keywords: credit approval, financial background, credit history, suitable candidate, loan, credit. 2. Types: There are various types of San Jose California Credit Approval Forms catering to distinct credit requirements and entities. Some common types include: a. Personal Credit Approval Form: This form is designed for individuals seeking personal loans or credit, such as mortgages, personal lines of credit, or auto loans. Keywords: personal credit, personal loans, mortgages, auto loans. b. Business Credit Approval Form: This form caters to businesses in San Jose, California, seeking credit or loans for their operations, expansion, or investment purposes. Keywords: business credit, credit for businesses, commercial loans, investment credit. c. Student Credit Approval Form: This type of credit approval form targets students who require financial support for their education, such as student loans. Keywords: student credit, student loans, education financing. d. Credit Card Approval Form: This form is specifically designed for individuals applying for credit cards, allowing for the evaluation of their creditworthiness and the determination of credit limits. Keywords: credit card, credit limit, creditworthiness. 3. Importance: The San Jose California Credit Approval Form holds significant importance for both the lending institution and the loan applicant. For lending institutions, it serves as a vital tool to assess risk, make informed decisions, and adhere to regulatory requirements. For loan applicants, it offers an opportunity to provide comprehensive information about their financial background, ensuring fair evaluation and potentially increasing the chances of credit approval. Keywords: risk assessment, informed decisions, regulatory requirements, comprehensive information, credit approval. In conclusion, the San Jose California Credit Approval Form plays a crucial role in the credit evaluation process for individuals, businesses, students, and credit card applicants. Understanding the purpose, types, and importance of these forms is essential for both parties involved, allowing for smoother credit transactions and informed decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out San Jose California Formulario De Aprobación De Crédito?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like San Jose Credit Approval Form is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the San Jose Credit Approval Form. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Credit Approval Form in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!