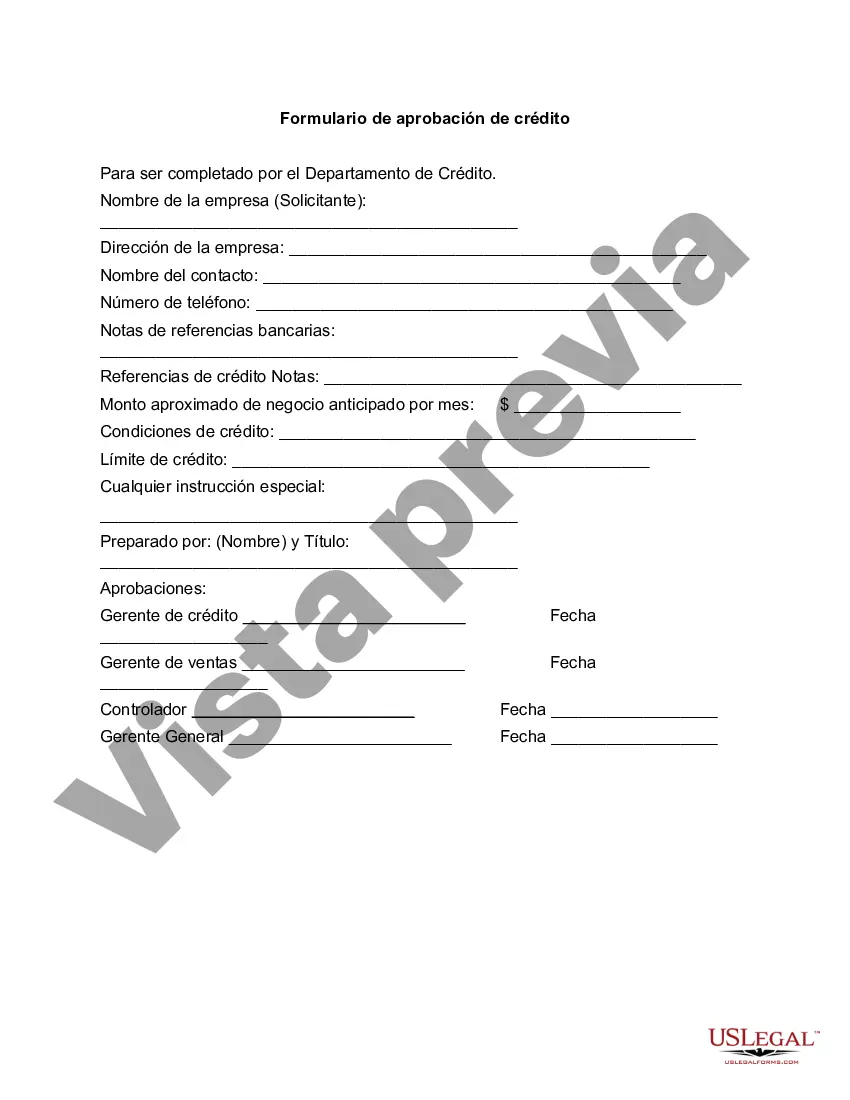

Santa Clara California Credit Approval Form is a crucial document used to assess and approve credit requests in Santa Clara, California. This form plays a vital role in determining an individual or organization's creditworthiness and evaluating their ability to repay borrowed funds. The Santa Clara California Credit Approval Form typically consists of several important sections designed to gather relevant information. It starts with the applicant's personal details such as name, contact information, social security number, and residential address. This information helps in verifying the applicant's identity and establishing a line of communication. Next, the form requires details about the applicant's employment status, including their employer's name, position, and length of employment. This section is crucial as it helps evaluate the stability of the applicant's income source and their capacity to meet payment obligations. The form then asks for information about the requested credit amount, purpose of credit, and desired repayment terms. These details enable the credit institution to assess the purpose of the loan and determine if it aligns with the applicant's financial capabilities. Furthermore, the Santa Clara California Credit Approval Form delves into the applicant's financial history, seeking information about their income, assets, liabilities, and existing debts. This section helps determine the applicant's overall financial health, debt-to-income ratio, and their ability to manage additional credit. Additionally, the form may require the applicant to provide information on references who can vouch for their creditworthiness. These references may include individuals who have a good understanding of the applicant's financial responsibility and can provide insights into their character. It is important to note that the Santa Clara California Credit Approval Form may have different variations or types depending on the specific financial institution or organization implementing it. For example, there may be specific forms for personal credit approvals, business credit approvals, auto loan approvals, or mortgage approvals. These variations cater to different types of credit requests, each with its own set of criteria and evaluation processes. In conclusion, the Santa Clara California Credit Approval Form is a comprehensive document used to assess creditworthiness in Santa Clara, California. It gathers essential information about the applicant's personal details, employment status, financial history, and references. By providing a clear understanding of the applicant's financial health, this form helps credit institutions in making informed decisions regarding credit approval.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Santa Clara California Formulario De Aprobación De Crédito?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Santa Clara Credit Approval Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how you can find and download Santa Clara Credit Approval Form.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar document templates or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Santa Clara Credit Approval Form.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Santa Clara Credit Approval Form, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely complicated case, we recommend using the services of an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!