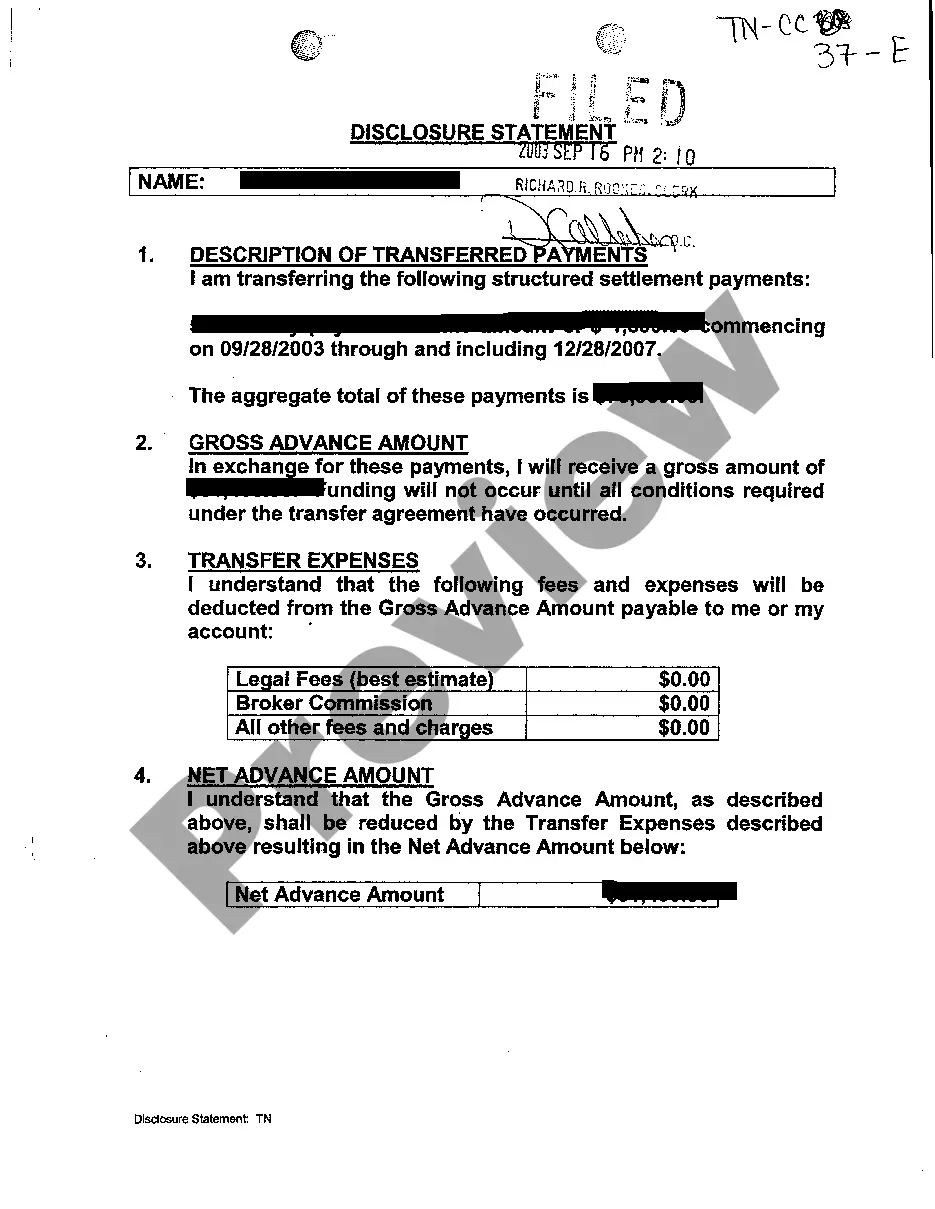

Alameda California Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a legal document specifically tailored for partnerships operating in Alameda, California. This agreement outlines the process and terms involved in dissolving a partnership and settling any outstanding liabilities or obligations. The main objective is to bring a formal end to the partnership's operations and distribute the partnership's assets among the partners. When drafting an Alameda California Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, it is crucial to include specific clauses that meet the particular needs and circumstances of the partnership. Here are some crucial elements and possible variations that may exist: 1. Dissolution Clause: This section defines the partners' intention to dissolve the partnership and provides a clear starting point outlining the steps for winding up the partnership's affairs. 2. Winding Up Process: Clarifies the procedure to follow during the winding up process, such as collecting accounts receivable, paying off outstanding debts, liquidating assets, and any necessary transfer of responsibilities. 3. Distribution of Assets and Liabilities: Clearly specifies how the partnership's assets and liabilities will be distributed among the partners. This could include cash, real estate, intellectual property, accounts, or other valuable items belonging to the partnership. 4. Settlement Agreement: Outlines the terms and conditions for resolving any outstanding disputes or obligations between partners or related to the partnership itself, such as pending contracts or litigation matters. 5. Lump Sum Payment: Determines whether the settlement will be made as a one-time lump sum payment to the partners or if alternative options, such as installment payments or non-monetary compensation, are available. 6. Tax Implications: This section addresses the possible tax consequences resulting from the dissolution and distribution of partnership assets, providing appropriate disclaimers and advising the partners to seek professional tax advice. It is worth noting that the specific name or variations of Alameda California Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment may differ depending on the partnership's unique circumstances, the nature of the business, and the preferences of the partners involved. However, the fundamental purpose of this agreement remains consistent — to outline the dissolution process and provide a clear framework for settling the partnership's affairs, including the distribution of assets and resolution of any outstanding matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo para disolver y liquidar sociedad con liquidación y pago de suma global - Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Alameda California Acuerdo Para Disolver Y Liquidar Sociedad Con Liquidación Y Pago De Suma Global?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your county, including the Alameda Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Alameda Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Alameda Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Alameda Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!