Contra Costa California: Liquidation of Partnership with Authority, Rights, and Obligations during Liquidation is a process wherein a partnership is terminated, its assets are sold, and the proceeds are distributed to its partners. In Contra Costa County, California, the liquidation of a partnership is governed by specific rules and regulations that outline the authority, rights, and obligations of all parties involved during this crucial phase. Types of Contra Costa California Liquidation of Partnership: 1. Voluntary Liquidation: This occurs when partners agree to dissolve the partnership voluntarily. In such cases, the partnership's assets are sold, and the proceeds are divided among the partners according to their ownership interests. 2. Involuntary Liquidation: This type of liquidation is initiated by the court in response to specific circumstances, such as partner misconduct, insolvency, or a breach of partnership agreements. The court-appointed receiver oversees the liquidation process to ensure fair distribution of assets. Authority, Rights, and Obligations during Contra Costa California Liquidation: 1. Authority: The partnership agreement typically designates one or more partners with the authority to manage the liquidation process. These partners, known as liquidators, are responsible for selling the partnership's assets, settling its debts and liabilities, and distributing remaining assets to the partners. 2. Rights and Obligations of Partners: During the liquidation, partners have several rights and obligations, including: — Right to Share in the Proceeds: Each partner has the right to a share of the partnership's remaining assets after the payment of debts and liabilities. The distribution is usually based on the partners' ownership interests as outlined in the partnership agreement. — Right to Access Information: Partners have the right to access relevant financial records, documents, and statements related to the liquidation. This allows them to verify the accuracy of the liquidators' actions and decisions. — Obligation to Cooperate: Partners are obligated to cooperate with the liquidators by providing necessary information, assisting in the sale of assets, and ensuring a smooth liquidation process. — Obligation to Settle Debts and Liabilities: Partners are required to help settle the partnership's debts and liabilities using the proceeds from asset sales. This includes paying creditors and fulfilling any outstanding obligations. — Right to Consent: In certain cases, partners may need to provide consent for specific actions during the liquidation process, as outlined by the partnership agreement or applicable laws. Navigating the liquidation process in Contra Costa County, California, requires a thorough understanding of the partnership's rights, obligations, and legal framework. It is strongly recommended consulting with legal professionals experienced in partnership liquidation to ensure compliance and the fair distribution of assets.

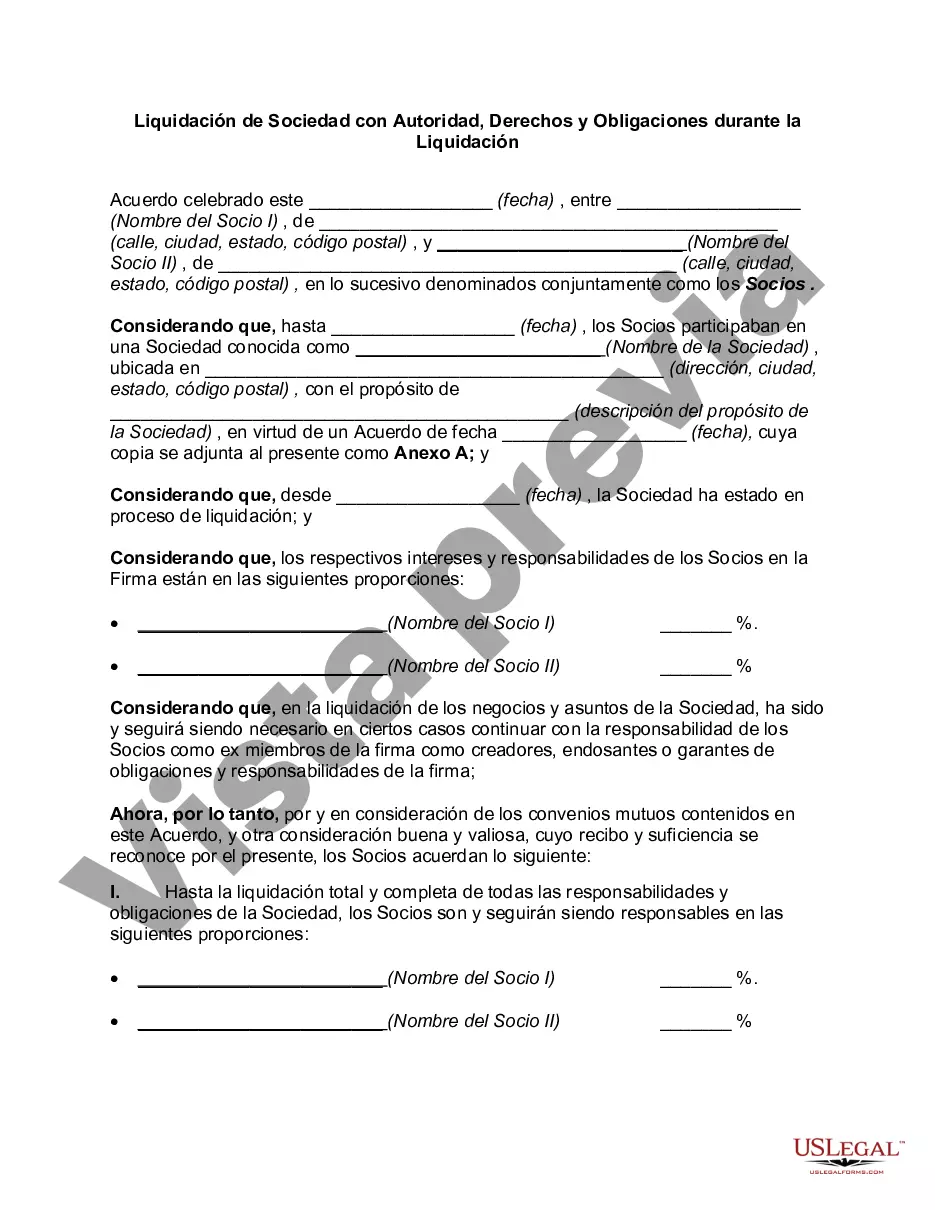

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Liquidación de Sociedad con Autoridad, Derechos y Obligaciones durante la Liquidación - Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Contra Costa California Liquidación De Sociedad Con Autoridad, Derechos Y Obligaciones Durante La Liquidación?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Contra Costa Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Contra Costa Liquidation of Partnership with Authority, Rights and Obligations during Liquidation will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Contra Costa Liquidation of Partnership with Authority, Rights and Obligations during Liquidation:

- Ensure you have opened the right page with your local form.

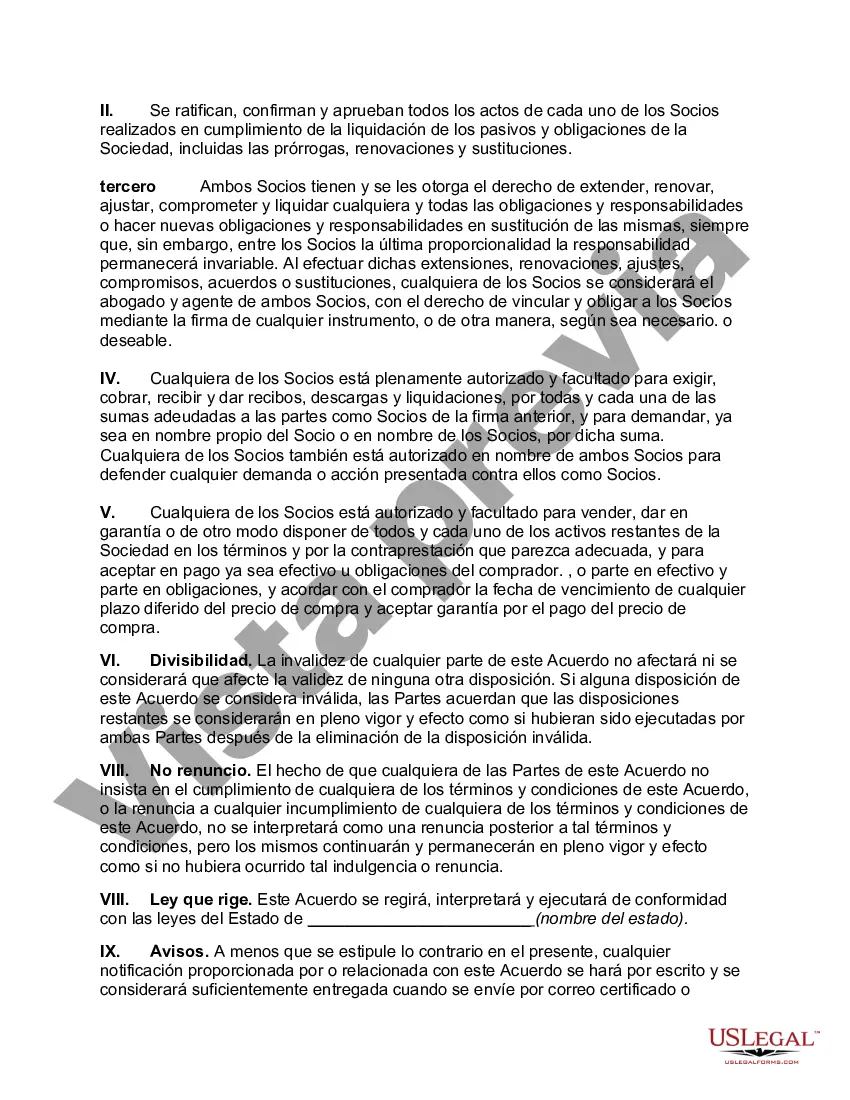

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Contra Costa Liquidation of Partnership with Authority, Rights and Obligations during Liquidation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!