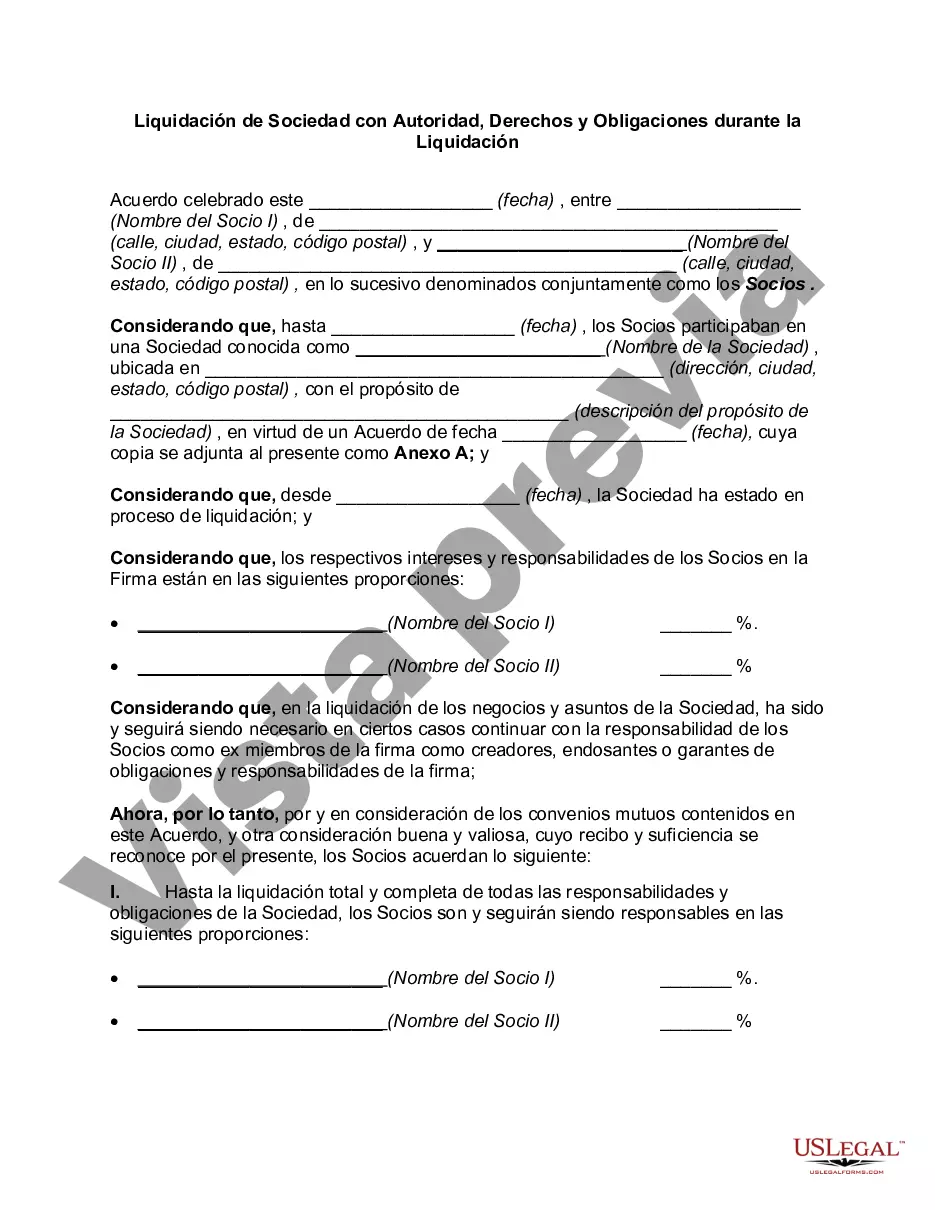

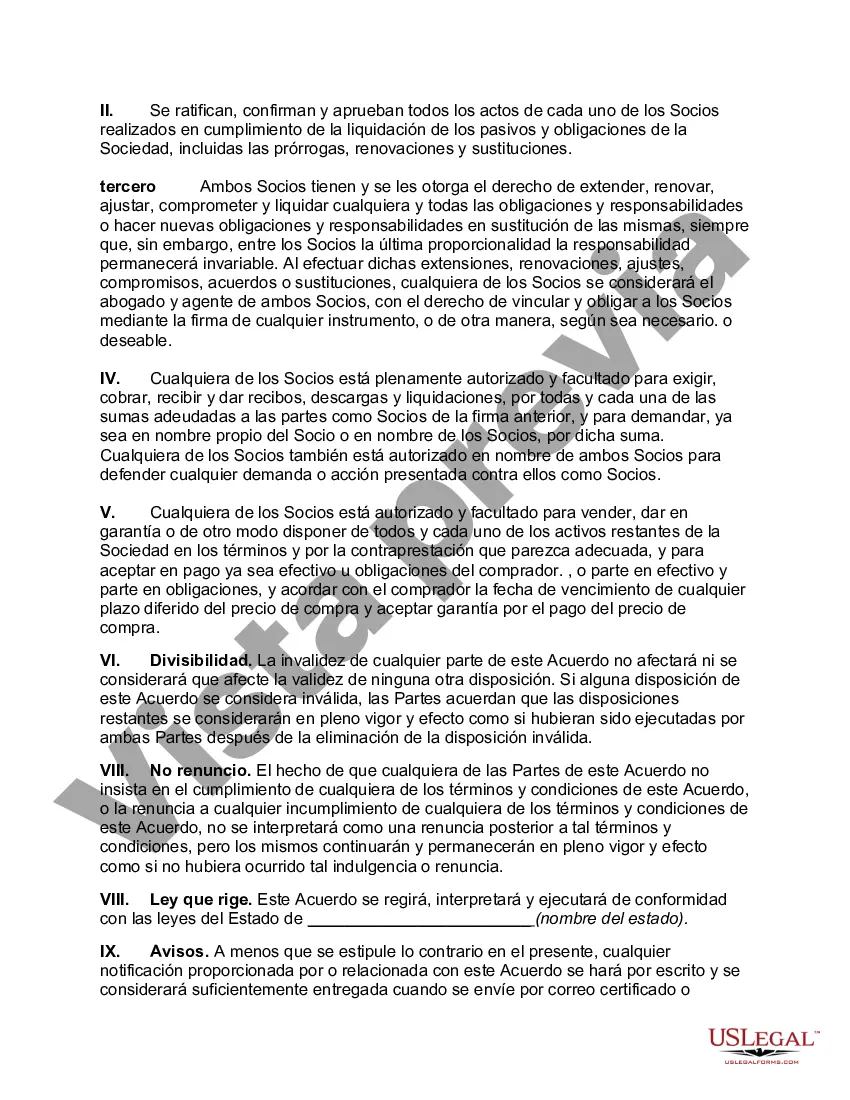

Dallas, Texas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation In Dallas, Texas, the liquidation of a partnership involves the dissolution and winding up of a partnership's affairs. It is important for partners to understand the authority, rights, and obligations that come into play during this process. Let's delve into the details of Dallas Texas Liquidation of Partnership with relevant keywords. 1. Liquidation Process: The liquidation process in Dallas, Texas, involves several key steps. First, the partners must agree to dissolve the partnership, which can be done by mutual consent or through a court order. Once the dissolution is confirmed, the partnership's assets are collected and sold off to pay off liabilities, with any remaining proceeds distributed among the partners. 2. Authority in Liquidation: During the liquidation process, partners are granted specific authority to undertake certain tasks. This includes the power to sell partnership assets, pay off creditors, enforce rights against debtors, and settle claims and obligations. However, partners must work together and act in the best interests of the partnership and its creditors. 3. Rights of Partners: Partners have certain rights during the liquidation process. One crucial right is the right to participate in the winding up of the partnership's affairs, which includes the right to access and review the partnership's financial records. Partners also have the right to be paid any amounts owed to them from the partnership's assets after satisfying liabilities. 4. Obligations during Liquidation: Partners have various obligations to fulfill during the liquidation phase. These obligations include diligently collecting and liquidating the partnership's assets, giving notice to creditors and other interested parties regarding the dissolution, and appropriately distributing the proceeds to creditors and partners based on their legal priorities. Types of Liquidation of Partnership in Dallas, Texas: 1. Voluntary Liquidation: Voluntary liquidation occurs when partners agree to dissolve the partnership willingly. This could be due to various reasons such as the partnership accomplishing its objectives or facing insurmountable challenges. In such cases, partners work together to conduct the liquidation process. 2. Involuntary Liquidation: Involuntary liquidation occurs when a court orders the dissolution of the partnership due to legal reasons or non-compliance with partnership agreements or relevant laws. This process typically involves the appointment of a liquidator or receiver to oversee the liquidation proceedings. 3. Receiver Liquidation: Receiver liquidation takes place when a court-appointed receiver is assigned to oversee the liquidation process because partnership disputes or fraudulent activities have arisen. The receiver acts independently to ensure the partnership's assets are appropriately sold and distributed to creditors and partners. In conclusion, the Dallas Texas Liquidation of Partnership with Authority, Rights, and Obligations during Liquidation involves partners collaborating to dissolve the partnership and liquidate its assets to settle obligations and distribute residual proceeds. Understanding the different types of liquidation, such as voluntary, involuntary, and receiver liquidation, can help partners navigate the process effectively while fulfilling their authority, rights, and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Liquidación de Sociedad con Autoridad, Derechos y Obligaciones durante la Liquidación - Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Dallas Texas Liquidación De Sociedad Con Autoridad, Derechos Y Obligaciones Durante La Liquidación?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life situation, locating a Dallas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Dallas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Dallas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Dallas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!