Middlesex Massachusetts Liquidation of Partnership with Authority, Rights and Obligations during Liquidation The Middlesex Massachusetts Liquidation of Partnership refers to the process of winding down and closing a partnership in the Middlesex County of Massachusetts. During this legal procedure, partners dissolve their partnership and distribute their assets, settling any remaining debts and obligations. Let's explore the key elements related to the liquidation process, including authority, rights, and obligations. Authority in Middlesex Massachusetts Liquidation of Partnership: 1. Dissolution: The first step in the liquidation process is the dissolution of the partnership, which marks the end of the partnership's existence. This can be initiated voluntarily by the partners' agreement or involuntarily due to certain events, such as expiration of the partnership term or the death of a partner. 2. Partnership Agreement: The partnership agreement, also known as the articles of partnership, outlines the rights, responsibilities, and procedures to be followed during the liquidation process. It may also provide specific instructions regarding the partners' authority in making decisions during this phase. Rights in Middlesex Massachusetts Liquidation of Partnership: 1. Distribution of Assets: Once the partnership is dissolved, the partners have the right to distribute the partnership's assets. This distribution is often based on the partners' initial contributions, although the partnership agreement may provide alternative allocation methods. 2. Right of Inspection: Partners have the right to inspect and review all partnership records, including financial statements, contracts, and any other relevant documents regarding the liquidation process. This facilitates transparency and ensures that all partners are informed. Obligations in Middlesex Massachusetts Liquidation of Partnership: 1. Creditors' Claims: Partners must settle all outstanding debts and liabilities owed by the partnership, including loans, accounts payable, and obligations to third parties. Creditors typically have the right to file claims against the partnership's assets, and partners must ensure they are duly addressed during the liquidation process. 2. Tax Obligations: Partners are responsible for fulfilling any tax obligations associated with the liquidation. This includes reporting partnership income and gains, as well as complying with relevant tax laws and regulations. Different types of Middlesex Massachusetts Liquidation of Partnership: 1. Voluntary Liquidation: Partners willingly agree to dissolve the partnership and initiate the liquidation process according to the terms outlined in the partnership agreement. 2. Involuntary Liquidation: The partnership is dissolved due to events beyond the partners' control, such as bankruptcy or the death of a partner. In conclusion, the Middlesex Massachusetts Liquidation of Partnership involves the winding down of a partnership and the distribution of its assets. Partners have specific authority, rights, and obligations during this process, and it can be carried out through voluntary or involuntary means. It is essential for partners to understand their roles and responsibilities, as well as consult with legal professionals to ensure compliance with the applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Liquidación de Sociedad con Autoridad, Derechos y Obligaciones durante la Liquidación - Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Middlesex Massachusetts Liquidación De Sociedad Con Autoridad, Derechos Y Obligaciones Durante La Liquidación?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Middlesex Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the latest version of the Middlesex Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Liquidation of Partnership with Authority, Rights and Obligations during Liquidation:

- Look through the page and verify there is a sample for your region.

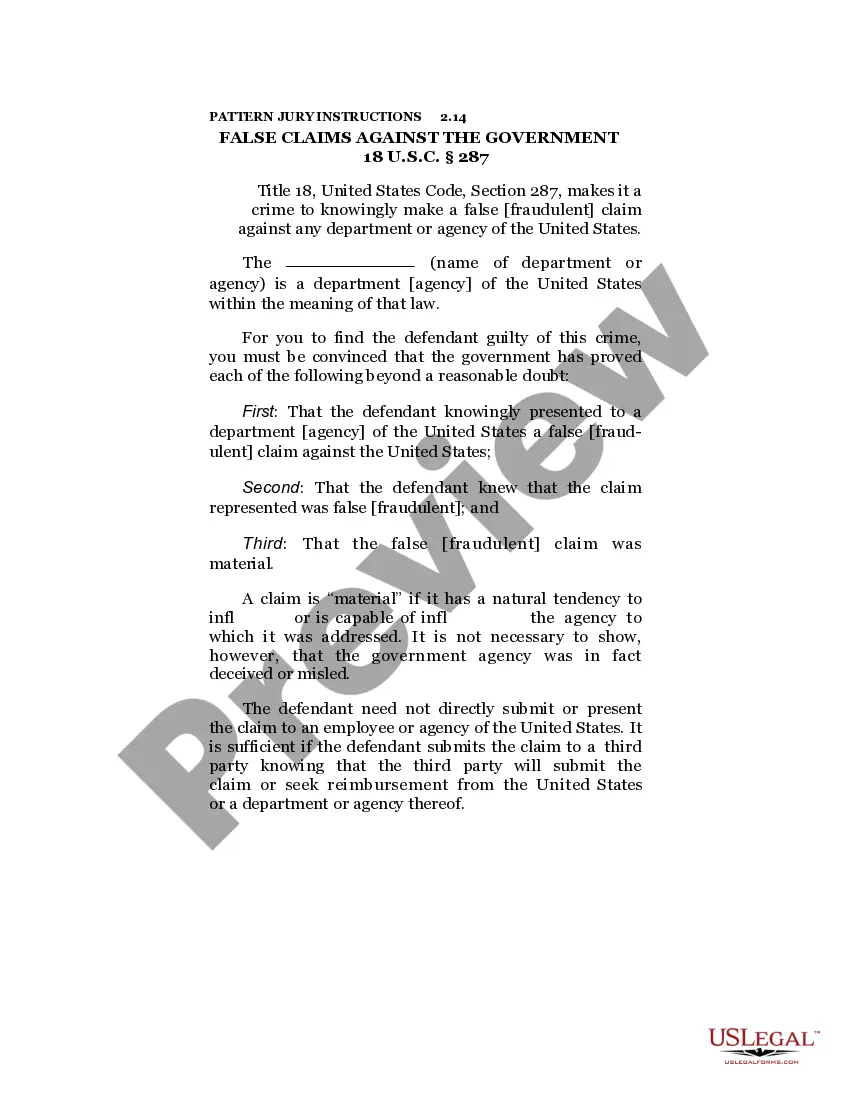

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Middlesex Liquidation of Partnership with Authority, Rights and Obligations during Liquidation and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!