Alameda California Liquidation of Partnership with Sale and Proportional Distribution of Assets is a process in which a partnership based in Alameda, California comes to an end by selling its assets and dividing the proceeds among the partners in proportion to their ownership interests. This type of liquidation ensures a fair and equitable distribution of assets among all partners involved. The liquidation process begins with the identification and valuation of the partnership's assets, including any tangible and intangible assets such as real estate, equipment, inventory, intellectual property, investments, and accounts receivable. The partnership may engage the services of professional appraisers or valuers to accurately determine the worth of these assets. Once the assets have been appraised, they are typically sold either privately or through public auctions, depending on the prevailing market conditions and the nature of the assets. The partnership may choose to enlist the services of a reputable broker or auctioneer to manage the sale process and maximize the value of the assets. The sale proceeds are then used to pay off any outstanding debts or liabilities of the partnership, including loans, leases, contractual obligations, and other financial obligations. Any surplus funds remaining after settling all liabilities are considered as distribute assets and are distributed among the partners. The distribution of assets is based on the partners' ownership interests as recorded in the partnership agreement or as agreed upon by all partners during the liquidation process. This proportional distribution ensures that each partner receives a fair share of the partnership's assets, taking into account their respective contributions and entitlements. While Alameda California Liquidation of Partnership with Sale and Proportional Distribution of Assets generally follows a standard procedure, there may be variations depending on the specific terms outlined in the partnership agreement. Furthermore, the liquidation process may differ if the partnership is involved in a specialized field or holds unique assets. It is recommended that partners seek legal and financial advice from professionals experienced in partnership liquidations to ensure compliance with applicable laws and regulations, as well as to navigate any complexities specific to their partnership structure or industry. In conclusion, Alameda California Liquidation of Partnership with Sale and Proportional Distribution of Assets encompasses the sale of a partnership's assets, settlement of debts, and fair distribution of remaining funds among partners. This process ensures a smooth and transparent dissolution of the partnership, providing a framework for an orderly transition to individual partners' future endeavors.

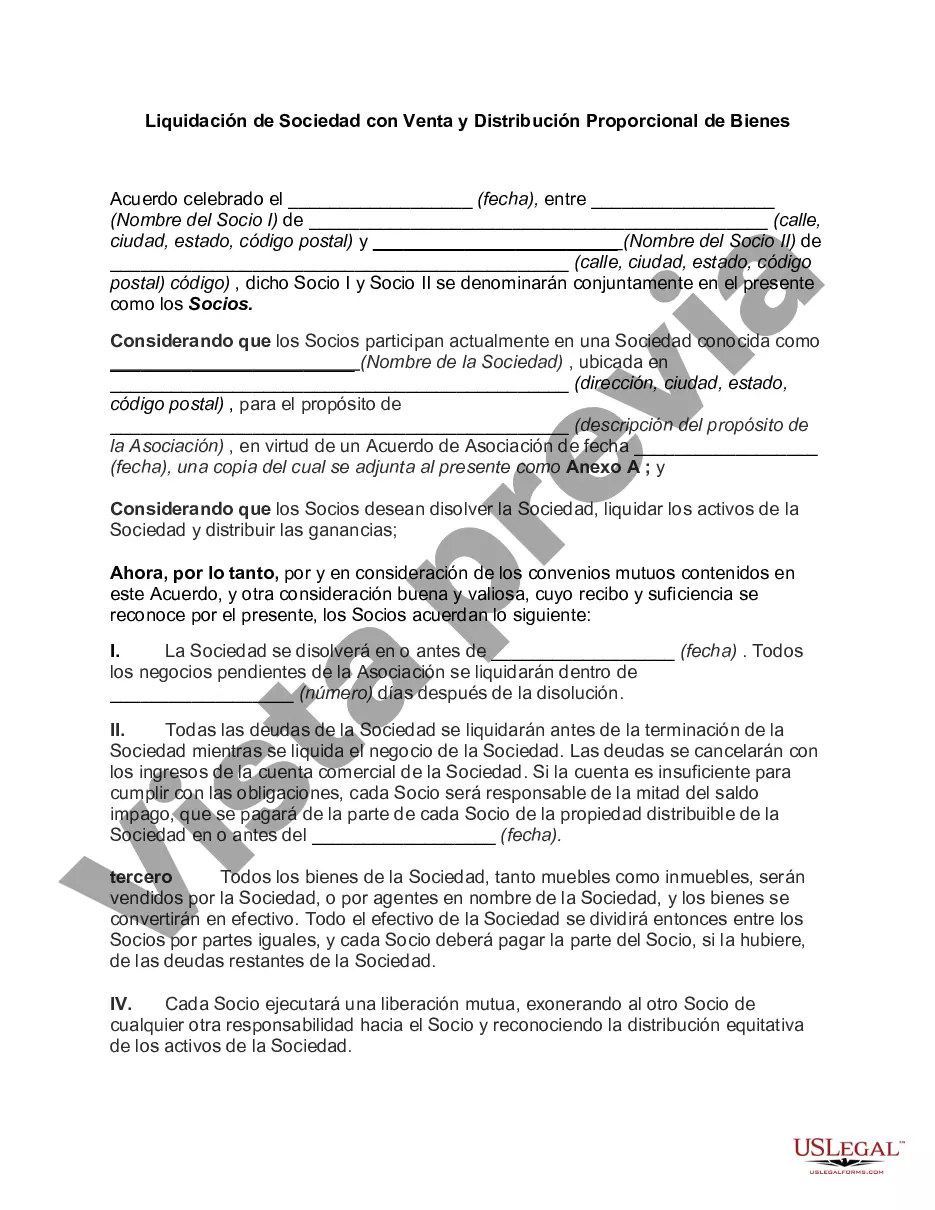

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Alameda California Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Alameda Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!