Chicago, Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets refers to the process of dissolving a partnership in Chicago, Illinois, and dividing the assets among the partners. This procedure is necessary when a partnership ceases to operate or when the partners decide to end their business relationship. During the liquidation process, the partnership's assets, including cash, investments, equipment, real estate, and any remaining inventory, are sold. The proceeds from these sales are then used to settle the partnership's debts and liabilities. After all debts have been cleared, any remaining funds or assets are distributed proportionally among the partners according to their ownership interests. There are different types of liquidation of partnership with sale and proportional distribution of assets that may occur in Chicago, Illinois: 1. Voluntary Liquidation: This occurs when partners voluntarily agree to terminate the partnership and distribute the assets among themselves. It may be due to retirement, disagreement, or the desire to pursue different business ventures. 2. Involuntary Liquidation: In some cases, a partnership may be forced to liquidate. This can happen when a partner becomes bankrupt, a court issues an order to dissolve the partnership, or if the partnership violates legal obligations. 3. Dissolution by Court Order: If there is a dispute among the partners, or they are unable to agree on the terms of liquidation, a court may intervene and order the dissolution and sale of assets. The court will ensure a fair and equitable distribution of assets among the partners. 4. Dissolution through Merger or Acquisition: Sometimes, a partnership may dissolve due to a merger or acquisition with another company. In such cases, the partnership's assets are sold or transferred to the acquiring company, and the partners may become shareholders or receive compensation based on the terms of the merger or acquisition agreement. The liquidation of partnership in Chicago, Illinois requires careful planning and coordination to ensure a smooth and fair distribution of assets. Partners should consult with legal and financial advisors who specialize in partnership dissolution to navigate the complex legal and tax implications involved in the process.

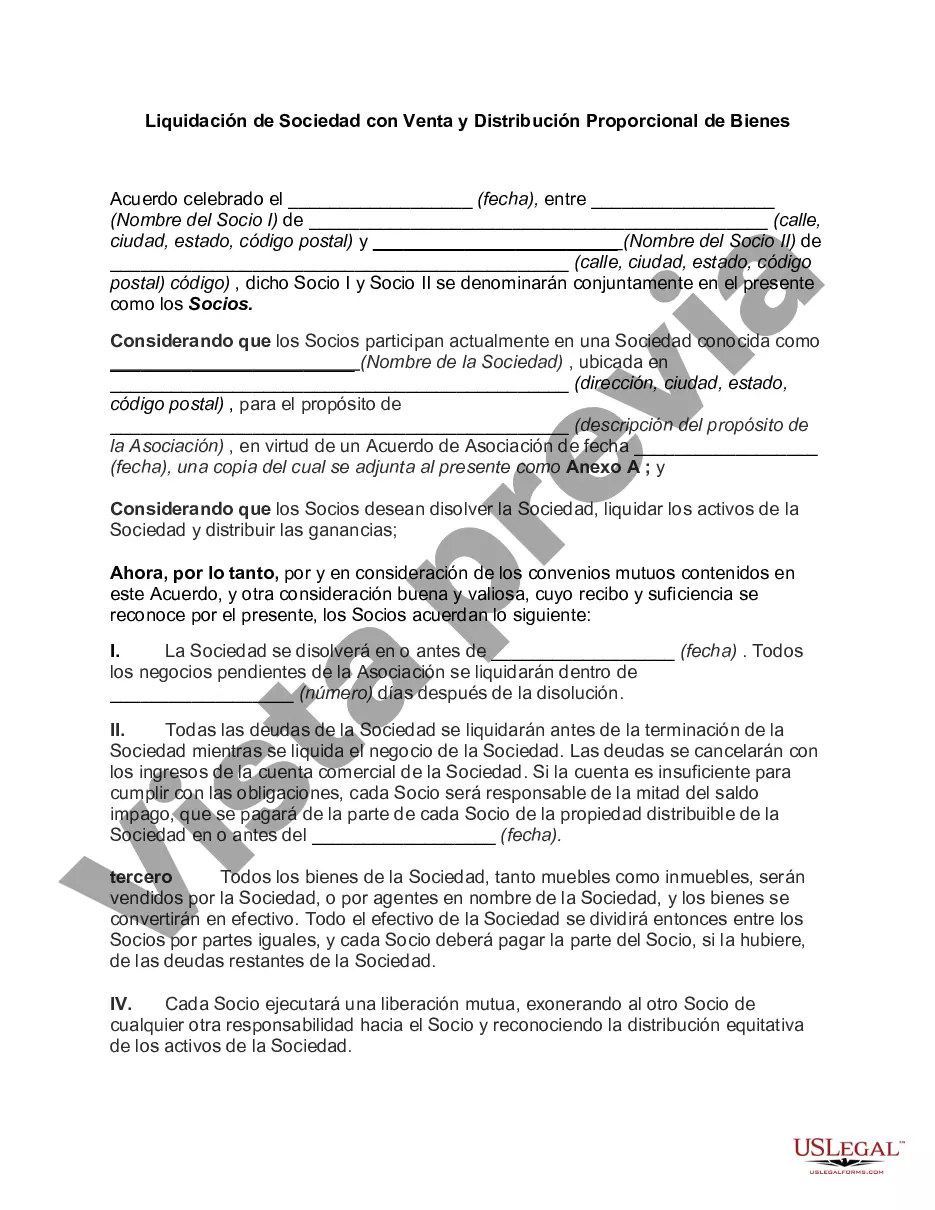

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Chicago Illinois Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a Chicago Liquidation of Partnership with Sale and Proportional Distribution of Assets meeting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Apart from the Chicago Liquidation of Partnership with Sale and Proportional Distribution of Assets, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Chicago Liquidation of Partnership with Sale and Proportional Distribution of Assets:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Chicago Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!