Montgomery, Maryland is known for its vibrant business community, with numerous partnerships established over the years. However, sometimes partnerships may face challenges or reach a point where liquidation becomes necessary. In such cases, the Montgomery Maryland Liquidation of Partnership with Sale and Proportional Distribution of Assets process comes into play. Liquidating a partnership involves closing down the partnership's operations, selling its assets, settling debts, and distributing remaining assets among the partners. This process is typically initiated when the partnership can no longer viably continue its operations or when the partners decide to dissolve their business relationship. During the Montgomery Maryland Liquidation of Partnership, the first step is to assess the partnership's assets and liabilities. This includes taking inventory, appraising assets, reviewing outstanding debts, and determining any legal obligations or contracts that need to be fulfilled. Once the assets and liabilities are identified, the partnership enters into the sale phase. The partnership's assets, such as property, inventory, equipment, and intellectual property, may be sold either as a whole or individually to interested buyers. The sale proceeds are then used to settle any outstanding debts, including loans, taxes, and other financial obligations. After settling the debts, the remaining assets are proportionally distributed among the partners based on their ownership interests. The distribution is typically carried out according to the terms outlined in the partnership agreement. If the partnership agreement does not provide specific guidelines for asset distribution, state laws will govern the process. It is important to note that there can be different types of Montgomery Maryland Liquidation of Partnership with Sale and Proportional Distribution of Assets, depending on the circumstances. One type may involve a voluntary liquidation where partners mutually agree to dissolve the partnership and distribute assets. Another could be an involuntary liquidation, which could occur due to a court order or bankruptcy proceedings. Additionally, there may be variations in the liquidation process depending on whether the partnership is a general partnership, limited partnership, limited liability partnership, or another form of business entity. Each entity type may have specific legal requirements and procedures to follow during the liquidation process. Overall, the Montgomery Maryland Liquidation of Partnership with Sale and Proportional Distribution of Assets is a comprehensive process that involves assessing assets, selling them, settling debts, and distributing remaining assets among partners. It is crucial for partners to consult with legal and financial professionals to ensure compliance with applicable laws and to maximize the value of the partnership's assets.

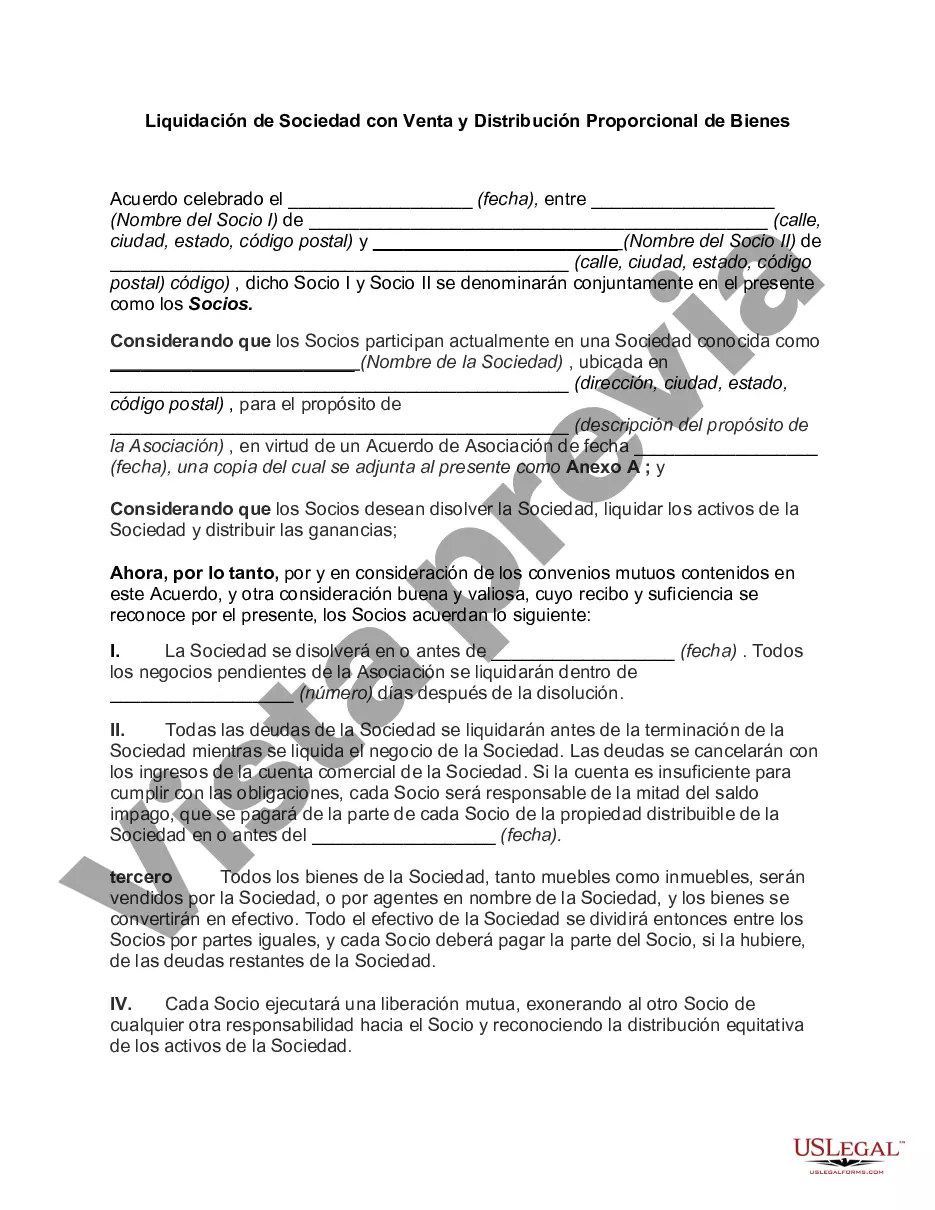

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Montgomery Maryland Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Montgomery Liquidation of Partnership with Sale and Proportional Distribution of Assets, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any tasks related to document completion simple.

Here's how you can purchase and download Montgomery Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Montgomery Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Montgomery Liquidation of Partnership with Sale and Proportional Distribution of Assets, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to cope with an extremely complicated case, we recommend using the services of a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!