When a partnership in Phoenix, Arizona reaches its end, the partners must go through a liquidation process to dissolve the business and distribute its assets. This process, known as the liquidation of partnership with sale and proportional distribution of assets, ensures a fair distribution among the partners in accordance with their ownership interests. Here, we delve into the details of this procedure, highlighting its steps, legal considerations, and potential types of Phoenix Arizona liquidation of partnership. The liquidation of a partnership in Phoenix, Arizona involves several essential steps. Firstly, the partners must agree to dissolve the business and initiate the liquidation process. This decision is typically based on various factors, such as retirement, partnership disputes, or an agreement to pursue other ventures individually. Once the partners unanimously agree to dissolve the partnership, the liquidation process can begin. During the liquidation process, the partnership's assets are identified, evaluated, and sold. These assets may include physical property, inventory, equipment, patents, trademarks, and any other tangible or intangible assets owned by the partnership. The proceeds from the sale of these assets will be used to pay off any outstanding debts and liabilities of the partnership. After settling debts and liabilities, the remaining funds will be distributed to the partners in proportion to their ownership interests or as specified in the partnership agreement. This proportional distribution ensures that each partner receives a fair share of the partnership's assets, reflecting their contribution and stake in the business. While the liquidation process generally follows these steps, there are different types of liquidation methods that can be employed in Phoenix, Arizona. These include voluntary liquidation, involuntary liquidation, and court-ordered liquidation. Voluntary liquidation occurs when the partners make a mutual agreement to dissolve the partnership and undergo the liquidation process. This method is often preferred as it allows the partners to maintain control over the process and decisions made regarding asset distribution. Involuntary liquidation, on the other hand, is initiated by external parties such as creditors or the court due to partnership disputes, insolvency, or failure to meet legal obligations. In such cases, the court may appoint a trustee or liquidator to oversee the liquidation process and ensure fair asset distribution. Court-ordered liquidation arises when a partner petitions the court to dissolve the partnership and distribute the assets. This may occur in situations where one partner wants to exit the business but faces resistance or disagreement. Regardless of the method used, Phoenix Arizona liquidation of partnership with sale and proportional distribution of assets involves meticulous accounting, thorough evaluation of assets, and compliance with legal requirements. Seeking guidance from legal professionals and accountants familiar with partnership laws in Phoenix, Arizona is crucial to ensure a smooth and legally sound liquidation process.

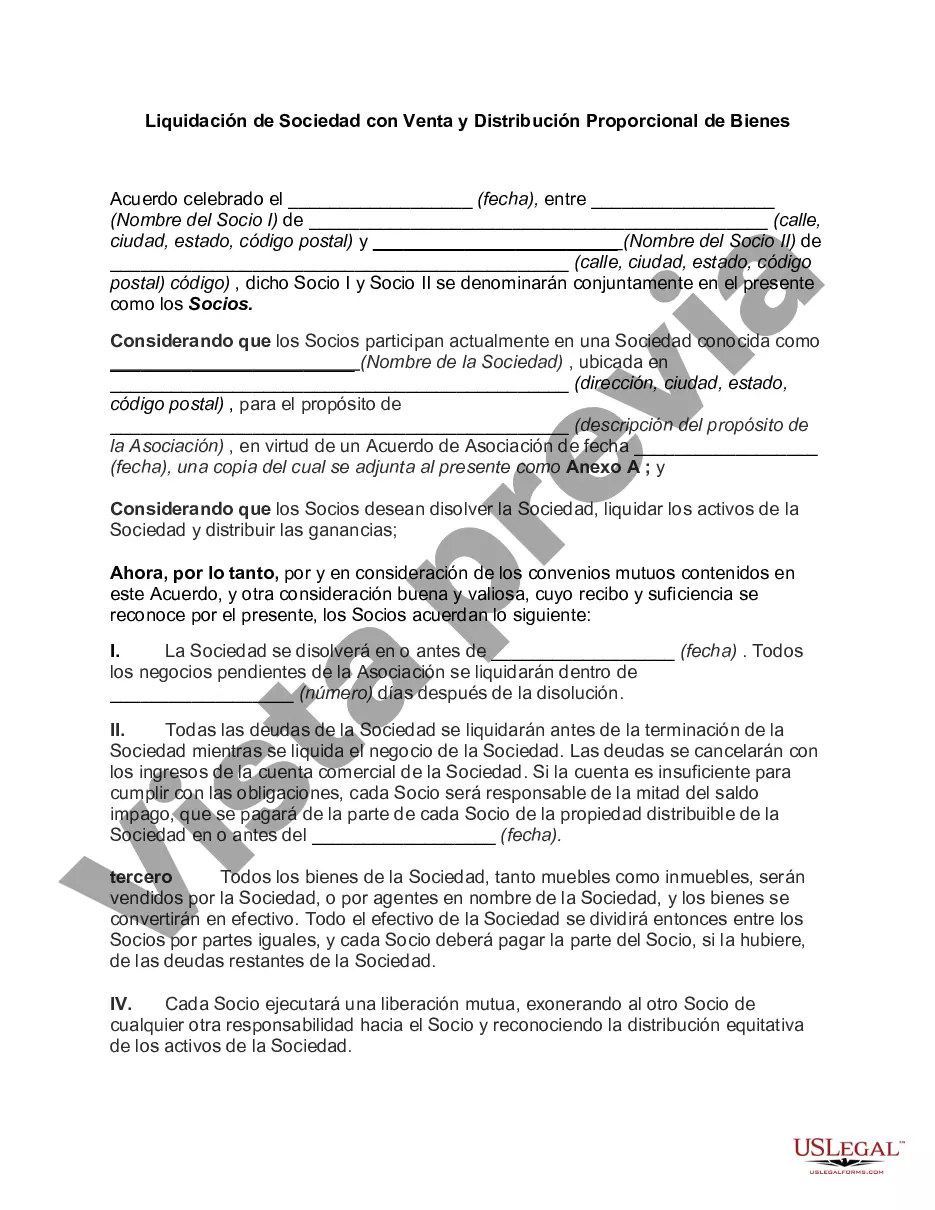

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Phoenix Arizona Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

Do you need to quickly create a legally-binding Phoenix Liquidation of Partnership with Sale and Proportional Distribution of Assets or maybe any other form to manage your own or business affairs? You can select one of the two options: contact a legal advisor to draft a legal document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Phoenix Liquidation of Partnership with Sale and Proportional Distribution of Assets and form packages. We provide templates for an array of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Phoenix Liquidation of Partnership with Sale and Proportional Distribution of Assets is tailored to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Phoenix Liquidation of Partnership with Sale and Proportional Distribution of Assets template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!