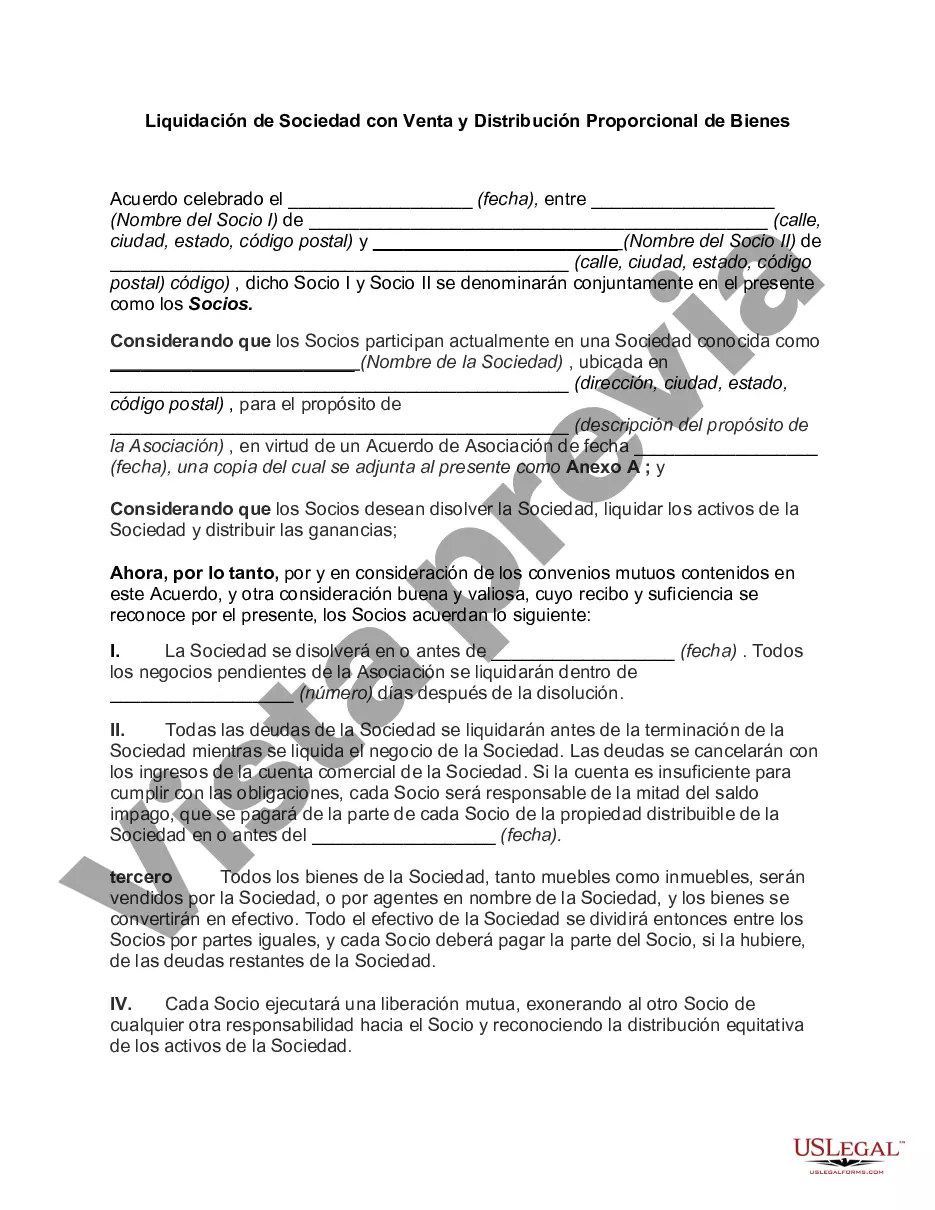

San Jose, California is a bustling city located in the heart of Silicon Valley. Known for its thriving tech industry, diverse cultural attractions, and stunning natural landscapes, San Jose is a sought-after destination for business and leisure. When it comes to liquidation of partnerships in San Jose, California, there are various types, including liquidation with sale and proportional distribution of assets. This process typically occurs when a partnership dissolves or when partners decide to liquidate their interests and divide the assets among themselves. Liquidation of partnership with sale and proportional distribution of assets involves the selling of partnership assets to convert them into cash, which is then proportionally divided among the partners according to their ownership interests. This process ensures that the partners receive their fair share of the partnership's assets during the dissolution. During the liquidation process, an inventory of the partnership's assets is made, including real estate, equipment, inventory, and any other valuable holdings. These assets are then appraised to determine their value, either by internal evaluation or by hiring professional appraisers. Once the assets are sold, the proceeds are distributed among the partners according to their agreed-upon profit-sharing ratios or ownership stakes outlined in the partnership agreement. The liquidation must follow the guidelines set forth in the partnership agreement or state law to ensure a fair and legal distribution. In some cases, partners may opt for a voluntary liquidation, where it is a mutual decision to dissolve the partnership and distribute the assets. However, there are also instances where a partnership may be forced into involuntary liquidation due to financial difficulties or legal issues. It's important to note that the liquidation process can be complex and time-consuming. Partners need to take into account various factors, such as outstanding debts, liabilities, and tax obligations. Seeking legal advice from a qualified attorney specializing in business and partnership law is recommended to navigate through this process successfully. San Jose, California offers a plethora of resources and professionals who can assist with the liquidation of partnerships and the proportional distribution of assets. Legal firms, accounting firms, and business consultants in the city can provide expert guidance and assistance throughout the entire process. In conclusion, San Jose, California provides a conducive environment for liquidation of partnerships with sale and proportional distribution of assets. Partners embarking on this process should be well-informed, seek professional guidance, and ensure compliance with the partnership agreement and applicable laws to achieve a fair and equitable outcome.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out San Jose California Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the San Jose Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the San Jose Liquidation of Partnership with Sale and Proportional Distribution of Assets will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the San Jose Liquidation of Partnership with Sale and Proportional Distribution of Assets:

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Jose Liquidation of Partnership with Sale and Proportional Distribution of Assets on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!