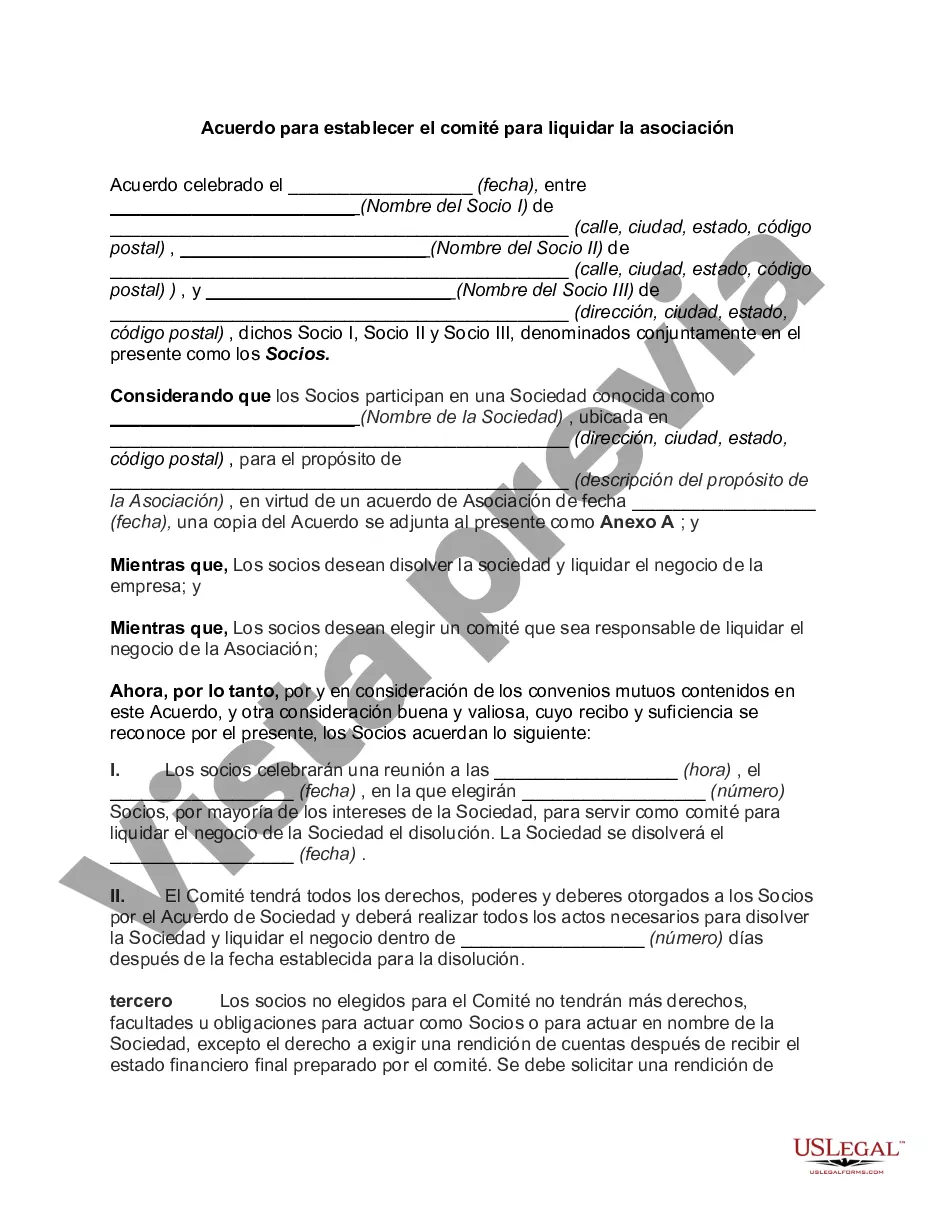

The Franklin Ohio Agreement to Establish Committee to Wind up Partnership is a legally binding document that outlines the procedures and responsibilities for ending a partnership. This agreement is typically utilized when partners decide to dissolve their partnership and require a structured approach to wind up business affairs. By establishing a committee, the agreement ensures that the dissolution process is carried out efficiently and fairly, protecting the interests of all parties involved. The agreement begins by stating the full names of the partners and their respective addresses, followed by a clear declaration of their intention to dissolve the partnership. Important dates, such as the effective date of dissolution, are also specified in the agreement. The terms and conditions discussed in the agreement vary depending on the specific needs and circumstances of the partnership. One key aspect of the Franklin Ohio Agreement to Establish Committee to Wind up Partnership is the definition of the committee's composition. The agreement specifies the number of committee members, their names, and their roles in the process. In some cases, the agreement may also outline the process for selecting committee members, either by mutual agreement or through a predetermined method. The agreement also addresses the committee's authority and powers. It discusses the scope of their decision-making abilities, including the ability to sell assets, settle debts, and distribute remaining funds among partners. Clauses regarding the restrictions on committee members' activities during the dissolution process may also be included to prevent conflicts of interest and ensure a fair winding up of the partnership. Additionally, the Franklin Ohio Agreement to Establish Committee to Wind up Partnership may include provisions related to the allocation of liabilities and obligations. It determines how debts, loans, and responsibilities will be divided among the partners or paid off using partnership assets. This ensures that all debts are settled equitably and that partners are relieved of any personal liabilities as the partnership is dissolved. It is worth noting that there may be various types or variations of the Franklin Ohio Agreement to Establish Committee to Wind up Partnership, depending on the specific requirements of the partnership or the nature of its dissolution. Some possible variations include agreements that address specific industries, partnerships with complex financial structures, or partnerships with multiple locations. In conclusion, the Franklin Ohio Agreement to Establish Committee to Wind up Partnership is a crucial legal document that provides a structured approach to dissolve a partnership. It outlines the composition, authority, and responsibilities of the committee entrusted with winding up the partnership's affairs. By adhering to this agreement, partners can efficiently and fairly divide assets, settle liabilities, and ensure a smooth transition to the next phase of their professional lives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo para establecer el comité para liquidar la asociación - Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Franklin Ohio Acuerdo Para Establecer El Comité Para Liquidar La Asociación?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Franklin Agreement to Establish Committee to Wind up Partnership, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Franklin Agreement to Establish Committee to Wind up Partnership from the My Forms tab.

For new users, it's necessary to make some more steps to get the Franklin Agreement to Establish Committee to Wind up Partnership:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!