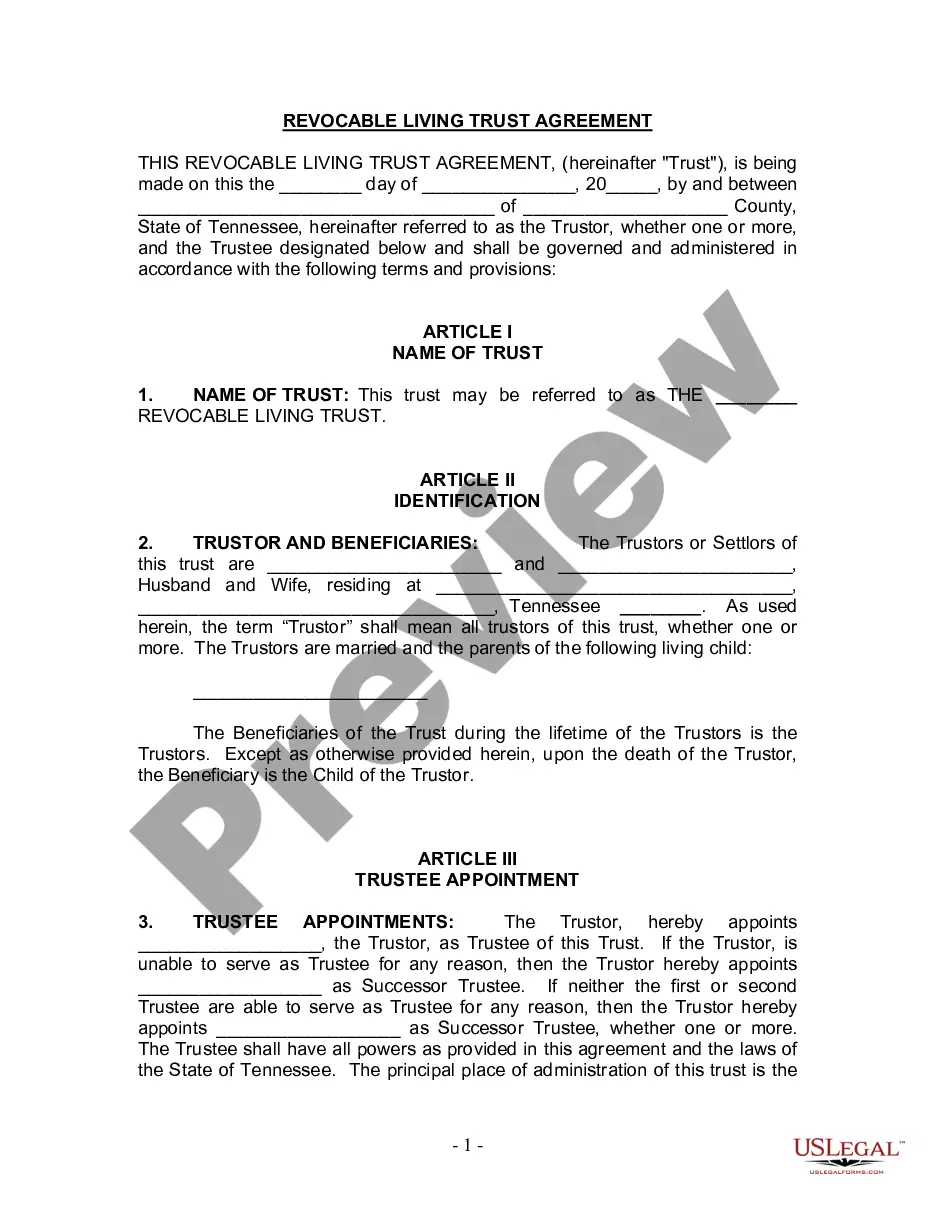

The Nassau New York Agreement to Establish Committee to Wind up Partnership refers to a legal arrangement made in Nassau, New York, for the purpose of winding up a partnership. This agreement outlines the roles and responsibilities of the committee members involved in the process of dissolving a partnership and distributing its assets. The agreement aims to ensure a fair and systematic approach to the dissolution of the partnership, benefiting all parties involved. It provides a framework within which the committee operates, ensuring transparency, accountability, and efficiency throughout the partnership wind-up process. The Nassau New York Agreement to Establish Committee to Wind up Partnership is designed to address various aspects related to partnership dissolution. It covers topics such as asset valuation, debt settlement, distribution of profits and losses, contractual obligations, and decision-making procedures. Different types or variations of the Nassau New York Agreement to Establish Committee to Wind up Partnership may exist based on specific circumstances or requirements. Some examples include: 1. Dissolution of a Limited Partnership: This type of agreement specifically applies to the wind-up process of a limited partnership, where there are general and limited partners involved. It outlines the responsibilities and rights of each partner category during the dissolution process. 2. Partnership Wind-up for Tax Purposes: In some cases, partnerships may decide to wind up to optimize tax benefits or comply with changing tax regulations. This type of agreement would focus on tax planning and considerations during the dissolution process. 3. Voluntary Dissolution and Liquidation: This type of agreement applies when partners decide to dissolve the partnership voluntarily, typically due to retirement, incompatibility, or a desire to pursue different business ventures. It outlines the steps and procedures for winding up the partnership's affairs and distributing its assets. 4. Court-Ordered Dissolution: In situations where partners have disputes, legal conflicts, or breaches of partnership agreements, a court may order the dissolution of the partnership. In such cases, the Nassau New York Agreement to Establish Committee to Wind up Partnership would provide guidelines on how the committee should operate under the supervision of the court. Overall, the Nassau New York Agreement to Establish Committee to Wind up Partnership offers a comprehensive structure for the dissolution process, enabling the involved parties to address all relevant aspects and reach a fair and equitable resolution. It serves as a crucial legal document to ensure a smooth and efficient wind-up of a partnership in Nassau, New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo para establecer el comité para liquidar la asociación - Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Nassau New York Acuerdo Para Establecer El Comité Para Liquidar La Asociación?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Nassau Agreement to Establish Committee to Wind up Partnership without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Nassau Agreement to Establish Committee to Wind up Partnership by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Nassau Agreement to Establish Committee to Wind up Partnership:

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!