Title: Understanding the Maricopa Arizona Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners Introduction: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is a legal document that outlines the process of terminating a partnership and dividing assets among partners in Maricopa, Arizona. This comprehensive agreement provides partners with a clear framework for the dissolution procedure and fair distribution of assets. Let's delve deeper into this crucial legal document and explore its different types and key components. 1. General Overview: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is designed to address the dissolution of a partnership and the division of its assets in Maricopa, Arizona. This agreement helps partners dissolve their business systematically while ensuring all assets and obligations are resolved fairly. 2. Key Components of the Agreement: a) Identification of Partners: This section specifies the names and roles of all partners involved in the partnership. It details their respective contributions, shares, and responsibilities. b) Dissolution Date: The agreement clearly states the effective date of dissolution, marking the official end of the partnership. c) Dissolution Procedure: This section outlines the steps and procedures that partners must follow during the dissolution process. It may cover aspects such as notifying clients, settling financial obligations, and obtaining necessary permits or licenses. d) Division of Assets: The agreement establishes a mechanism for fair allocation and distribution of partnership assets. It defines how assets, including property, cash, investments, and intellectual property, will be divided among the partners. Possible methods may include pro rata distribution or an agreed-upon valuation process. e) Liability and Debts: The agreement specifies how existing liabilities, debts, and obligations will be accounted for and settled after dissolution. It ensures a fair allocation of any outstanding debts or obligations among the partners. f) Tax Obligations: Partners must adhere to relevant tax laws and regulations when dissolving a partnership. This section may include provisions related to the filing of final tax returns, the distribution of tax refunds or liabilities, or any potential tax consequences arising from the dissolution. 3. Types of Maricopa Arizona Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners: a) Voluntary Dissolution Agreement: This type of agreement is entered into by partners when they mutually decide to dissolve their partnership. It is a proactive approach that facilitates a harmonious dissolution process. b) Dissolution Agreement with Dispute Resolution: This variant includes additional provisions for resolving conflicts or disputes that may arise during the dissolution process. It aims to outline dispute resolution methods such as mediation or arbitration, ensuring a smoother dissolution for all parties involved. c) Dissolution Agreement with Sell-Off: Occasionally, partners may decide to sell off partnership assets instead of dividing them among themselves. This type of agreement outlines the procedure for selling assets, settling liabilities, and distributing the remaining proceeds among partners. Conclusion: The Maricopa Arizona Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is a vital legal document that ensures a fair and orderly dissolution process for partnerships in Maricopa, Arizona. The document covers various aspects, including the division of assets, liabilities, tax obligations, and more, thereby providing a comprehensive framework for partners to smoothly terminate their partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de Disolución y Liquidación de Sociedad con División de Bienes entre Socios - Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

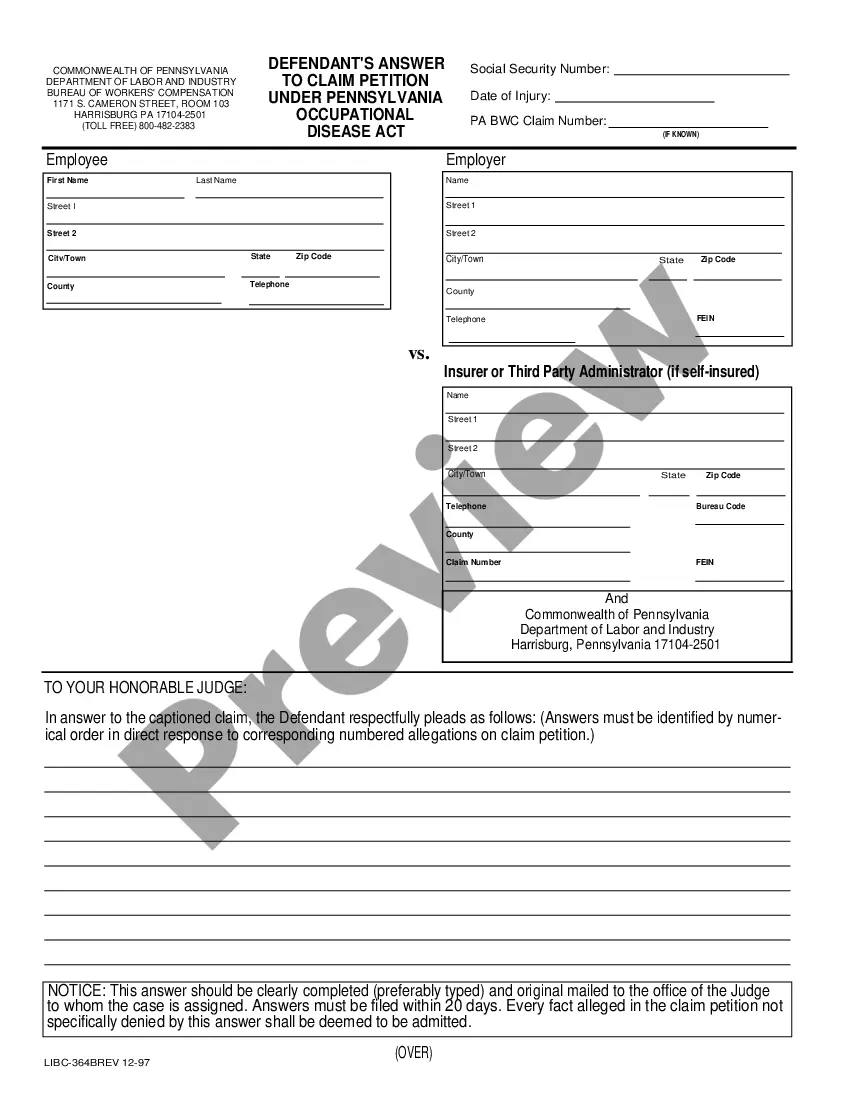

Description

How to fill out Maricopa Arizona Acuerdo De Disolución Y Liquidación De Sociedad Con División De Bienes Entre Socios?

Drafting documents for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Maricopa Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Maricopa Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!