Cuyahoga Ohio Liquidation of Partnership with Sale of Assets and Assumption of Liabilities refers to the legal process of winding up a business partnership in Cuyahoga County, Ohio, where the assets of the partnership are sold off to pay off the debts and obligations, and the liabilities are assumed by the partners. During the liquidation process, the partnership's assets, such as real estate, equipment, inventory, and intellectual property, are appraised, marketed, and sold to generate funds. The proceeds from the asset sale are then used to settle the partnership's outstanding debts, loans, and other financial obligations. In Cuyahoga County, Ohio, there are different types of liquidation that may occur, depending on the specific circumstances of the partnership: 1. Voluntary Liquidation: This type of liquidation occurs when the partners willingly decide to dissolve the partnership due to various reasons such as retirement, disagreement, or the expiration of a predetermined timeline. The partners come to an agreement on the sale of assets and assumption of liabilities in accordance with the terms outlined in the partnership agreement. 2. Involuntary Liquidation: In some cases, a partnership may undergo involuntary liquidation due to external factors like bankruptcy, a court order, or the death of a partner. In this scenario, the liquidation is typically overseen by a court-appointed trustee or administrator, who will manage the sale of assets and allocation of liabilities. 3. Court-Ordered Liquidation: When a partnership encounters legal issues or breaches certain obligations, a court may order the liquidation of the partnership as a resolution. The court-appointed trustee will ensure the fair and proper sale of assets and the assumption of liabilities. The Cuyahoga Ohio Liquidation of Partnership with Sale of Assets and Assumption of Liabilities process requires a comprehensive understanding of Ohio partnership laws, negotiation skills, and familiarity with valuation techniques. It is advisable for partners seeking to undertake this process to consult with knowledgeable business attorneys or financial advisors to ensure compliance with all legal requirements and smooth execution of the liquidation.

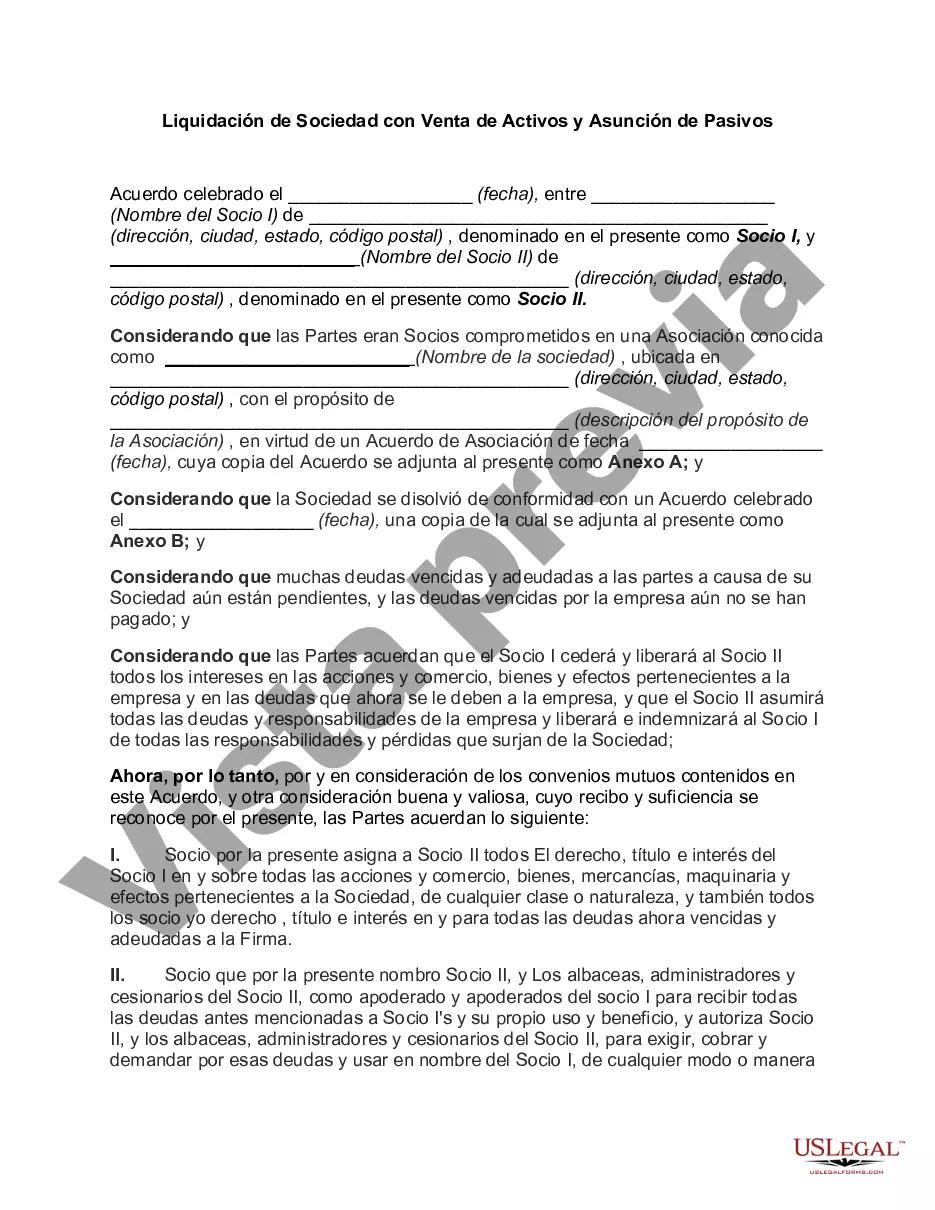

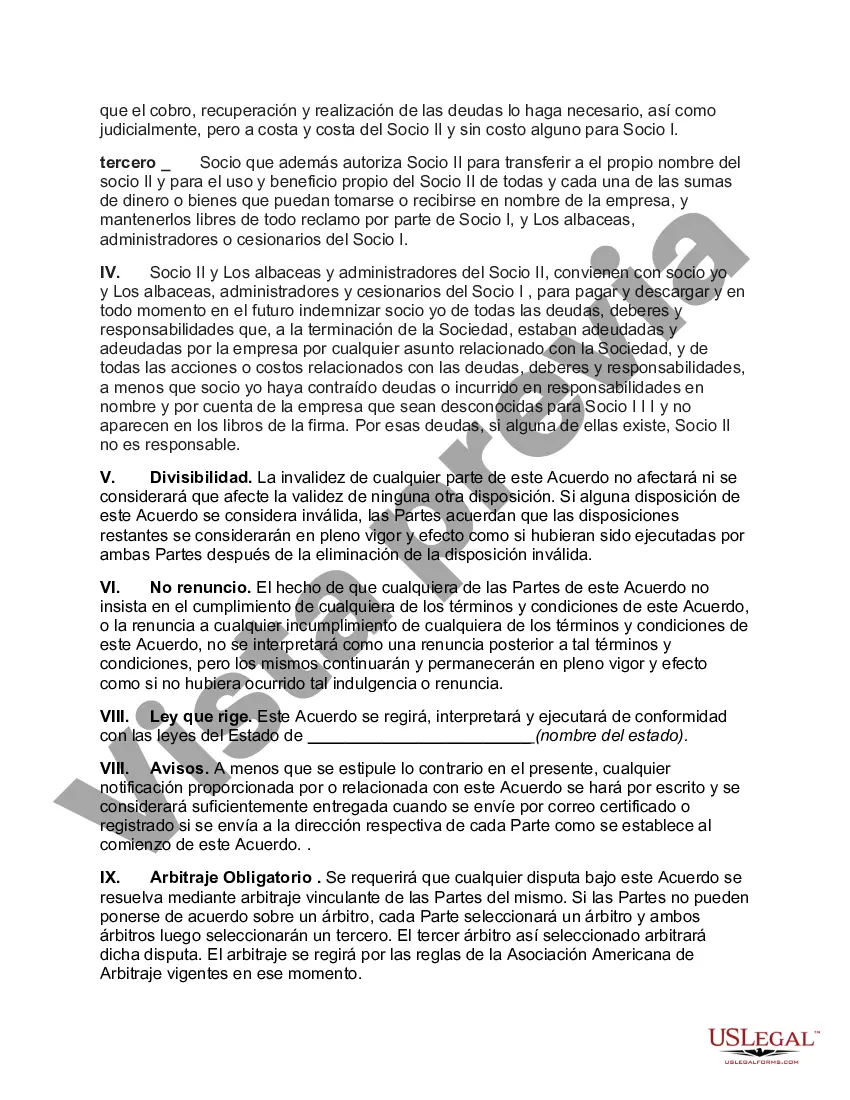

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Liquidación de Sociedad con Venta de Activos y Asunción de Pasivos - Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Cuyahoga Ohio Liquidación De Sociedad Con Venta De Activos Y Asunción De Pasivos?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the latest version of the Cuyahoga Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Liquidation of Partnership with Sale of Assets and Assumption of Liabilities:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Cuyahoga Liquidation of Partnership with Sale of Assets and Assumption of Liabilities and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!