King Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process that involves the dissolution and winding up of a partnership. In this process, the partnership's assets are sold to repay its debts and obligations while also transferring any remaining assets to the partners. During the King Washington Liquidation, the partnership undergoes a thorough assessment of its assets and liabilities to determine the best course of action. This process ensures that both creditors and partners are fairly treated and provided with appropriate compensation. One of the types of King Washington Liquidation of Partnership is the voluntary liquidation. In this scenario, partners collectively agree to dissolve the partnership due to various reasons such as retirement, disagreements among partners, or the completion of a specific business project. The voluntary liquidation typically requires a formal agreement among the partners and proper documentation to ensure legal compliance. Another type of King Washington Liquidation of Partnership is the involuntary liquidation. In this case, the partnership may be forced into liquidation due to legal action or bankruptcy. Creditors or other interested parties may file a petition to the court to initiate the liquidation process. The court then appoints a liquidator who oversees the sale of assets and distribution of proceeds to creditors and partners based on their rights and claims. The sale of assets is a crucial aspect of King Washington Liquidation of Partnership. During this process, the partnership's assets, which can include tangible assets like property, inventory, and equipment, as well as intangible assets like intellectual property rights, are evaluated and sold to generate funds for debt repayment. The sale can be conducted through public auctions, private negotiations, or by engaging a professional asset appraiser. Simultaneously, the assumption of liabilities takes place during the liquidation process. Partners are responsible for ensuring that all outstanding debts and obligations of the partnership are settled. This may include repayment of loans, outstanding taxes, contractual agreements, and lawsuits. The partners assume these liabilities based on their respective share in the partnership. Overall, King Washington Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a complex legal process that requires careful evaluation, negotiation, and compliance with applicable laws and regulations. The goal of this procedure is to ensure the orderly and equitable distribution of the partnership's assets and resolution of its debts, ultimately bringing the partnership to a formal end.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Liquidación de Sociedad con Venta de Activos y Asunción de Pasivos - Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out King Washington Liquidación De Sociedad Con Venta De Activos Y Asunción De Pasivos?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including King Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how you can locate and download King Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

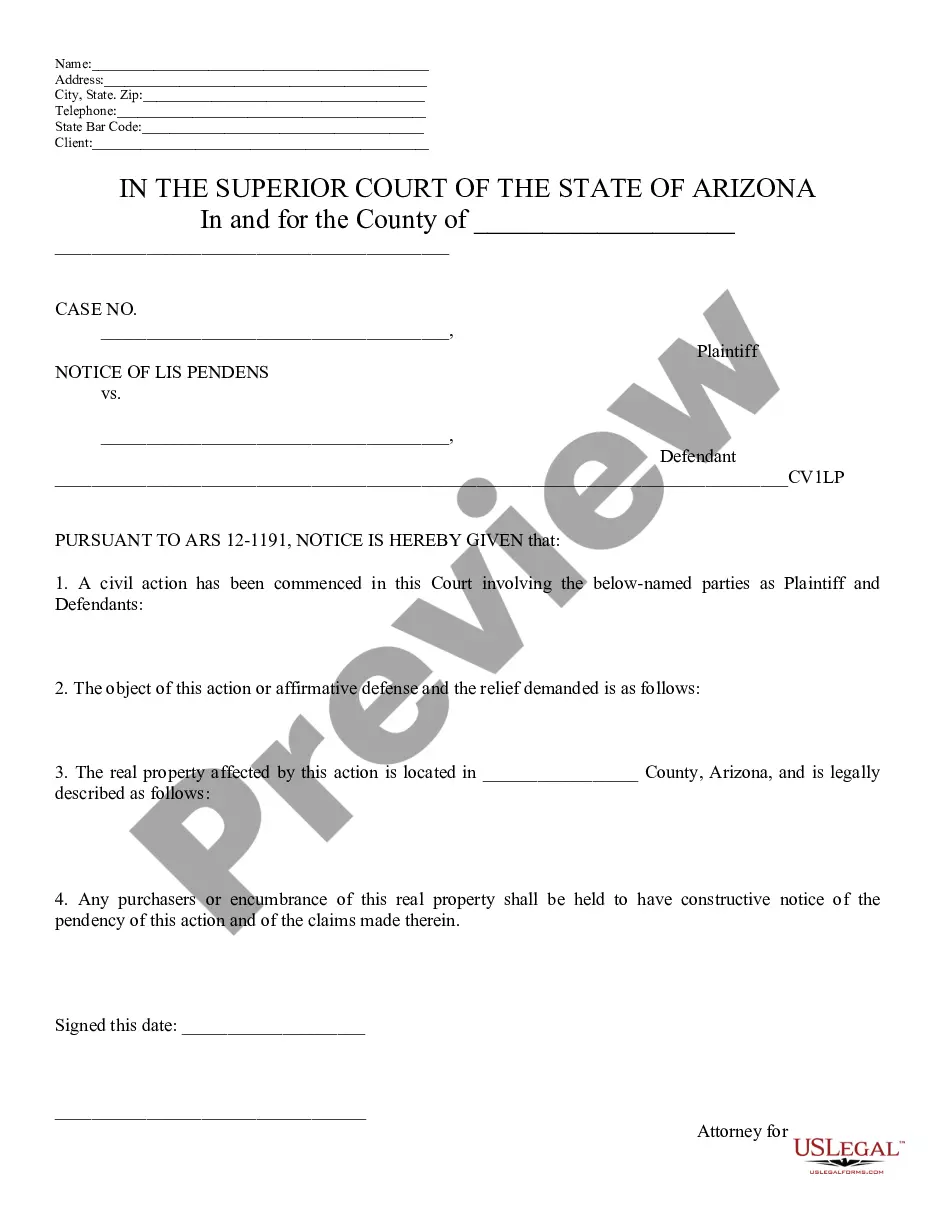

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase King Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate King Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you need to cope with an extremely challenging situation, we advise getting an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents with ease!