Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets refers to a legal agreement made in Philadelphia, Pennsylvania, which outlines the process of dissolving a partnership and distributing the partnership's assets in an unequal manner to a specific partner. This type of agreement is typically used when partners have different ownership interests or contributions to the partnership and want to divide the assets accordingly upon dissolution. The Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets can take two main forms: 1. Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Partial Sale to Partner and Disproportionate Distribution of Assets: In this scenario, the partnership dissolves, and one partner agrees to purchase a portion of the partnership's assets based on a predetermined valuation. The assets are then distributed disproportionately among the remaining partners, taking into account their respective ownership interests and contribution levels. 2. Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Full Sale to Partner and Disproportionate Distribution of Assets: This variant involves the complete sale of the partnership's assets to one partner, who assumes full ownership of the business and is solely responsible for the remaining liabilities. The proceeds from the sale are then disproportionately distributed among the other partners based on their respective ownership percentages or other agreed-upon criteria. The Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets is a comprehensive legal document that typically includes various provisions such as: 1. Dissolution Process: Outlining the steps and procedures to be followed to dissolve the partnership, including notifications to creditors and other relevant parties. 2. Asset Valuation: Determining the fair market value of the partnership assets or the portion to be sold to the specific partner. 3. Purchase Agreement: Defining the terms and conditions of the sale of assets to the partner, including purchase price, payment terms, and any warranties or representations. 4. Disproportionate Distribution: Stating how the assets will be distributed among the remaining partners, taking into account their respective ownership interests, contribution levels, or any other agreed-upon factors. 5. Release and Indemnification: Releasing the selling partner from any liability associated with the partnership assets transferred to another partner and indemnifying them against any potential claims. 6. Governing Law and Jurisdiction: Specifying that the agreement is governed by the laws of Pennsylvania and any disputes shall be resolved through Philadelphia courts. It is crucial to seek legal advice when drafting a Philadelphia Pennsylvania Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets to ensure compliance with local laws and to protect the rights and interests of all involved parties.

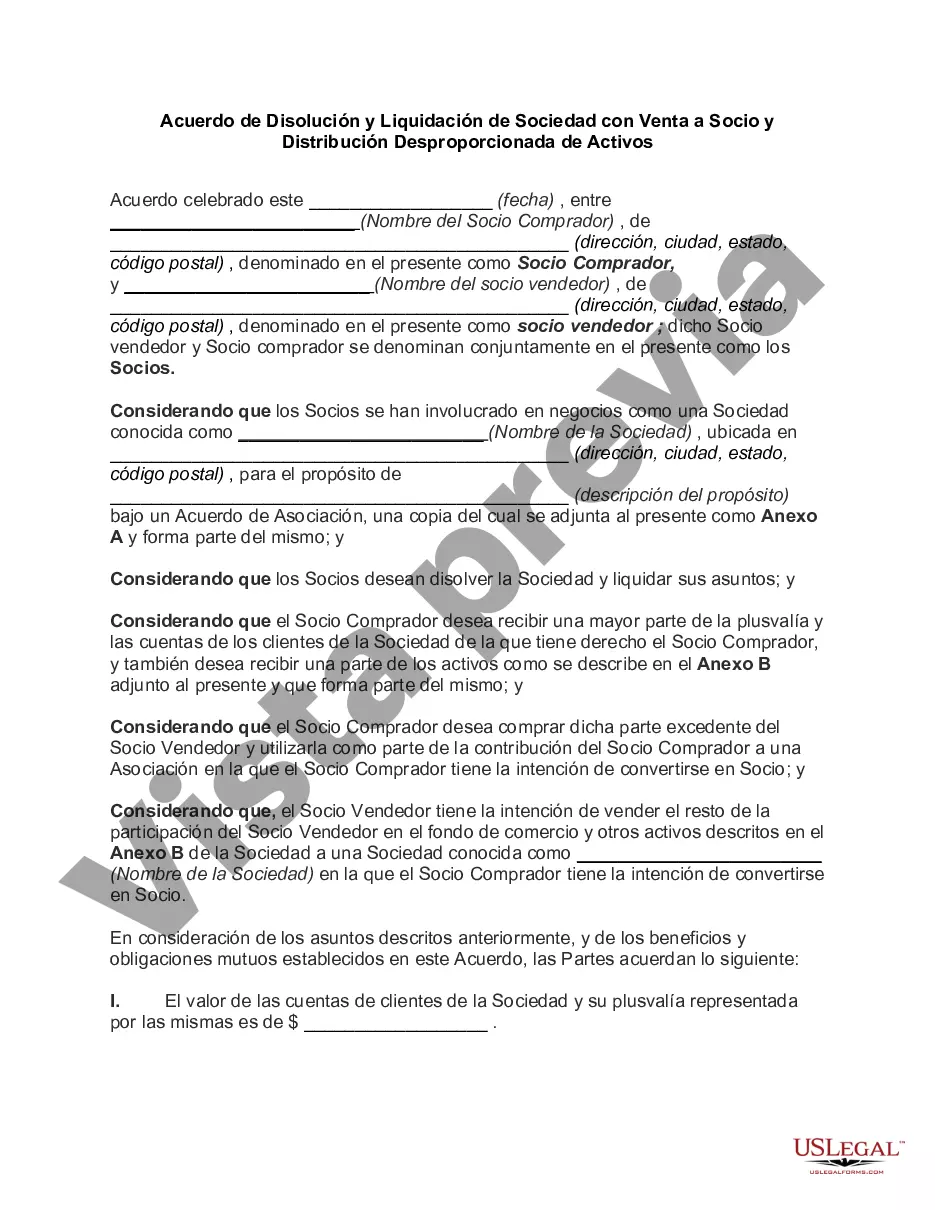

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Acuerdo de Disolución y Liquidación de Sociedad con Venta a Socio y Distribución Desproporcionada de Activos - Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Philadelphia Pennsylvania Acuerdo De Disolución Y Liquidación De Sociedad Con Venta A Socio Y Distribución Desproporcionada De Activos?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Philadelphia Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks associated with document completion simple.

Here's how to find and download Philadelphia Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the similar document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Philadelphia Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Philadelphia Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally challenging case, we recommend using the services of a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!