Title: Understanding the Queens New York Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets Introduction: The Queens New York Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets is a legal agreement that outlines the process of dissolving a partnership in Queens, New York. This agreement specifically deals with the sale of partnership assets to a partner and the subsequent uneven distribution of assets among the partners. This detailed description aims to provide an in-depth understanding of this agreement and its various types. Types of Queens New York Agreements to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets: 1. Voluntary Dissolution: Under this type of agreement, partners mutually agree to dissolve the partnership and distribute assets unevenly among them. The agreement typically specifies the terms regarding the sale of assets to a partner, a formula for the disproportionate distribution of assets, and a timeline for winding up the partnership. 2. Forced Dissolution: In cases where a partner unilaterally decides to dissolve the partnership, often due to irreconcilable differences or breaches of partnership agreements, a forced dissolution agreement can be implemented. This type of agreement provides guidelines for the sale of assets to that partner and the subsequent disproportionate distribution. Key Elements of a Queens New York Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets: 1. Sale of Assets: The agreement outlines the process of selling partnership assets to a partner, including valuation methods, payment terms, and any restrictions imposed on the sale. 2. Allocation of Liabilities: Partners must decide how to allocate the partnership's debts and liabilities, ensuring fair distribution according to their respective shares or predetermined arrangements. 3. Disproportionate Distribution of Assets: This agreement highlights the unequal distribution of assets among partners, specifying the ratio or formula for determining the distribution. It may take into account various factors such as contributions, capital accounts, profits, agreed-upon percentages, or other predetermined criteria. 4. Winding Up the Partnership: The agreement sets forth the timeline and procedures for winding up the partnership, including the settlement of outstanding obligations, the closure of financial and tax matters, and the final distribution of assets. 5. Release and Waiver: To ensure a smooth transition, partners often include a release and waiver clause in the agreement, which releases each party from liability arising from the dissolution and distribution of assets. Conclusion: The Queens New York Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets provides a comprehensive framework for ending partnerships while facilitating the sale of assets and uneven distribution. The agreement protects the interests of all partners involved and ensures a fair dissolution process according to the terms agreed upon.

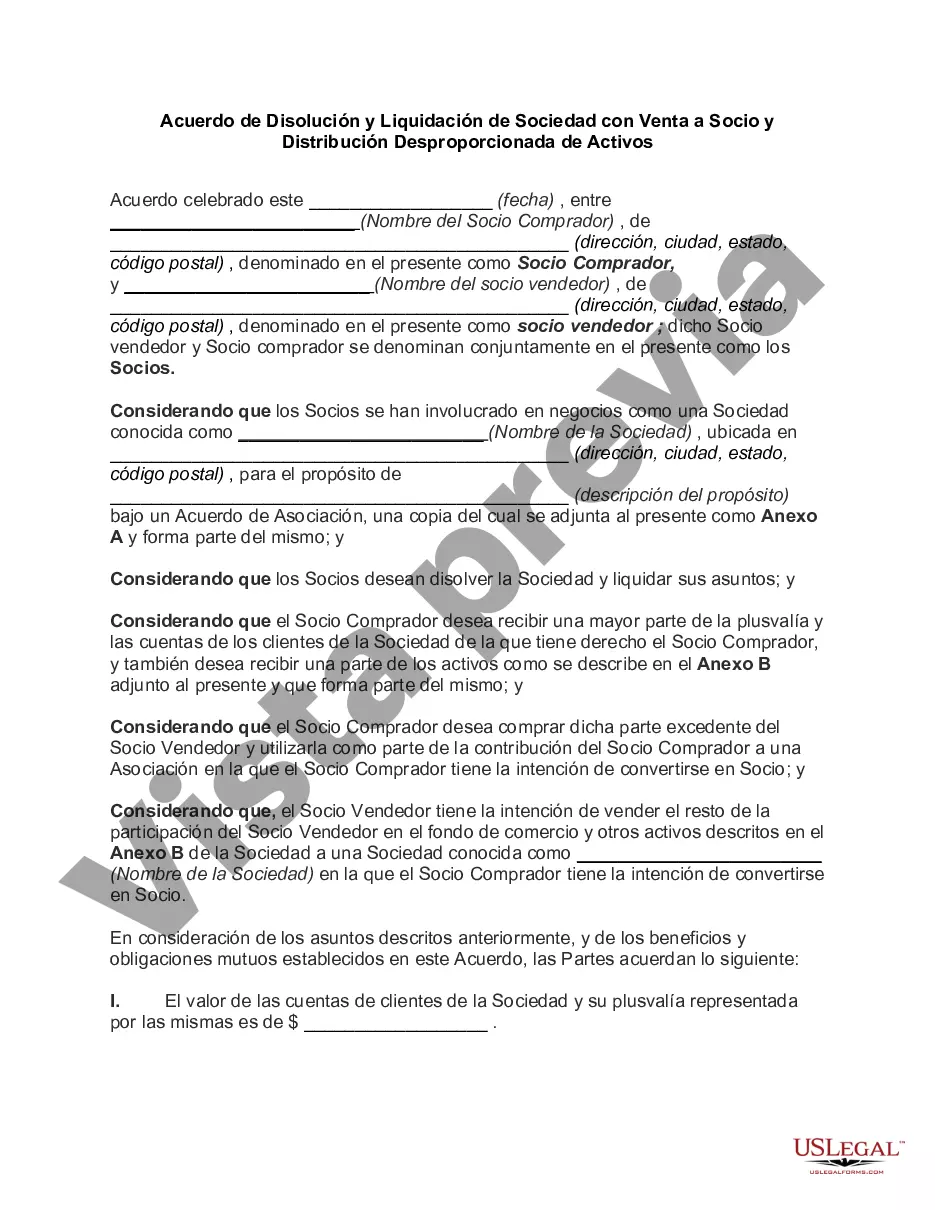

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Acuerdo de Disolución y Liquidación de Sociedad con Venta a Socio y Distribución Desproporcionada de Activos - Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Queens New York Acuerdo De Disolución Y Liquidación De Sociedad Con Venta A Socio Y Distribución Desproporcionada De Activos?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Queens Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can purchase and download Queens Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Queens Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Queens Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to cope with an exceptionally complicated situation, we advise getting a lawyer to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!