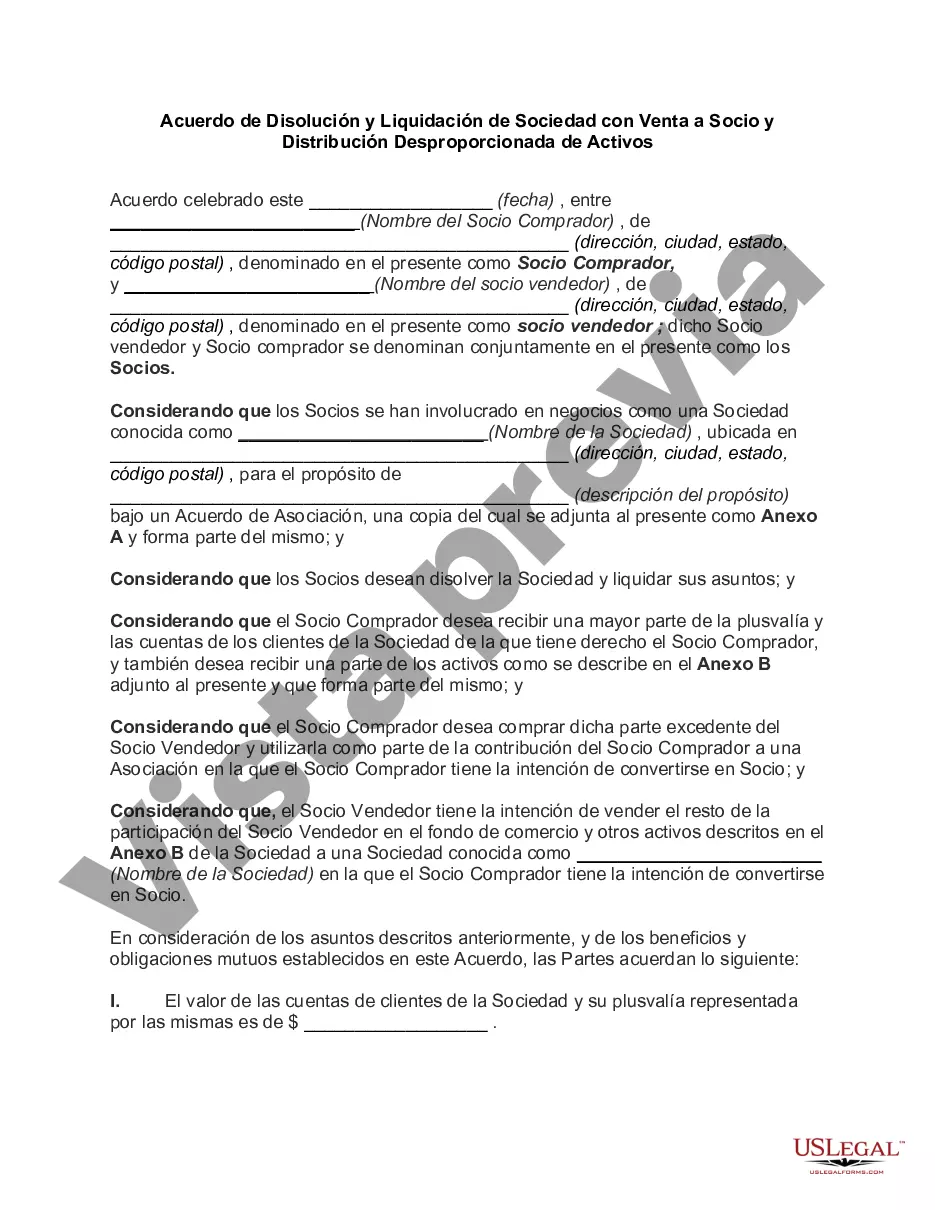

Travis Texas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets is a legal document that outlines the dissolution process of a partnership in Travis County, Texas. This agreement provides a framework for the fair distribution of assets, including the sale of partnership interests to one partner and the subsequent distribution of assets in a disproportionate manner. In certain cases, there might be variations of the Travis Texas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets. These may include: 1. Voluntary Dissolution: This type of agreement is executed when partners mutually agree to dissolve the partnership voluntarily. The assets are typically sold to one partner, usually with a disproportionate distribution of the proceeds. 2. Forced Dissolution: In cases where one partner seeks dissolution of the partnership against the wishes of other partners, the Travis Texas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets may be drawn up. Here, the sale of assets and their disproportionate distribution often occur due to legal proceedings and court decisions. 3. Retirement or Death of a Partner: When a partner retires or passes away, the partnership may choose to wind up its operations. In this scenario, the remaining partners can sell the deceased or retiring partner's interest to one individual, leading to disproportionate distribution of assets. This agreement typically covers important aspects of the dissolution and subsequent distribution, including: 1. Identification of Partners: The agreement will begin by clearly stating the names and roles of the partners involved in the partnership. 2. Dissolution Process: It will outline the specific steps to be taken in order to dissolve the partnership, which may involve the sale of assets to one partner. 3. Asset Valuation and Sale: The agreement will detail how the assets will be valued and sold, often at fair market value, and determine the terms of the sale to one partner. 4. Disproportionate Distribution: This clause of the agreement addresses the allocation of assets after the sale. It explains how the remaining assets will be distributed disproportionately among the partners based on predetermined criteria, such as capital contributions, profit-sharing percentages, or any other agreed-upon method of allocation. 5. Partnership Debts and Obligations: The agreement will specify how any outstanding debts and obligations will be settled and collected. 6. Legal Considerations: It will ensure that the parties involved comply with all relevant laws and regulations governing partnership dissolution in Travis County, Texas. It is important to consult with qualified legal professionals to draft and execute the Travis Texas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets to ensure compliance with local laws and to protect the interests of all parties involved in the partnership dissolution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Disolución y Liquidación de Sociedad con Venta a Socio y Distribución Desproporcionada de Activos - Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Travis Texas Acuerdo De Disolución Y Liquidación De Sociedad Con Venta A Socio Y Distribución Desproporcionada De Activos?

Preparing paperwork for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Travis Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Travis Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Travis Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!