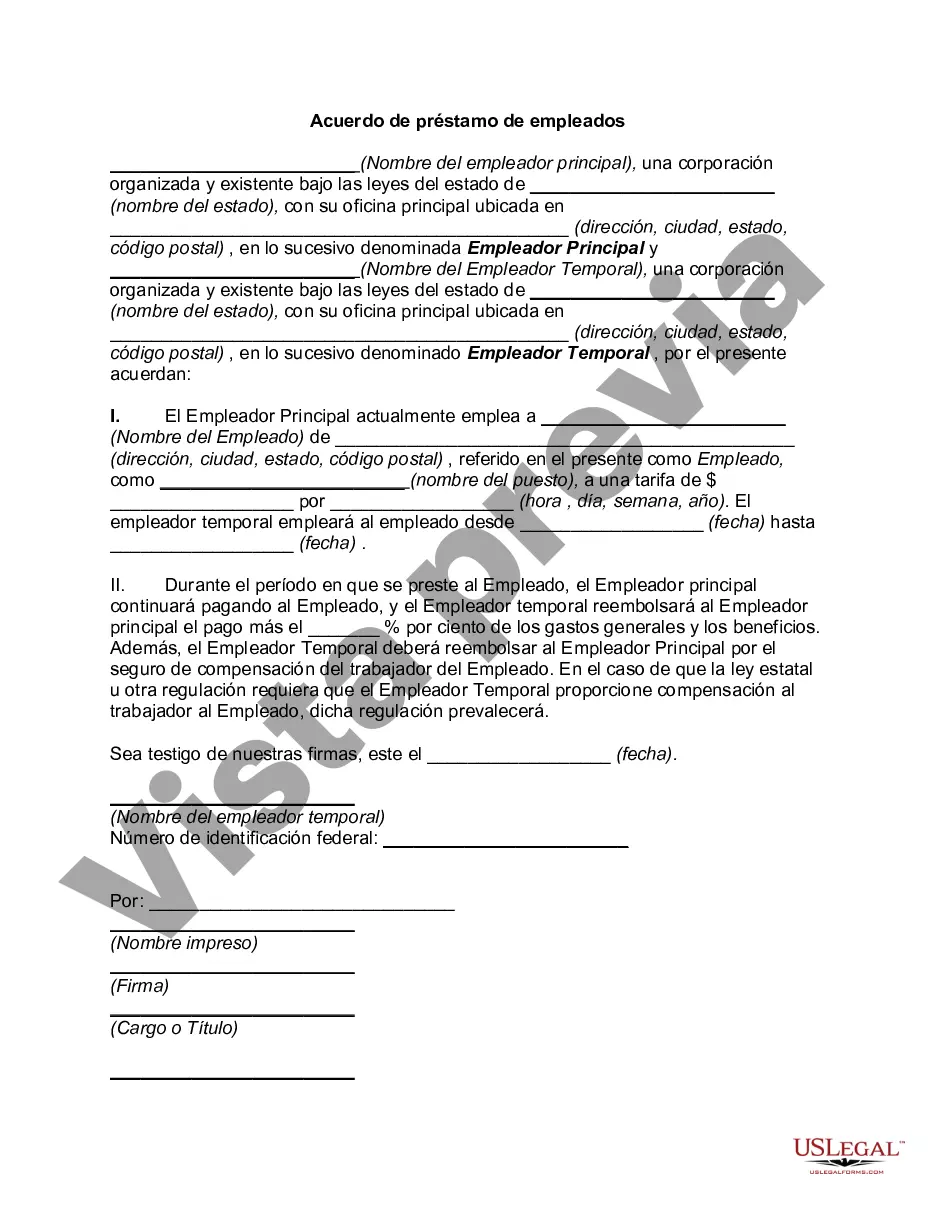

Dallas Texas Employee Lending Agreement is a legal document that outlines the terms and conditions under which employees can borrow money or other assets from their employers in Dallas, Texas. It specifies the borrowing process, repayment terms, interest rates, and any additional fees or penalties associated with the loan. As an employer in Dallas, Texas, it is essential to have a clear and comprehensive Employee Lending Agreement to protect both the company's interests and the employees. This agreement helps ensure that all lending transactions are fair, transparent, and comply with the relevant laws and regulations. Some relevant keywords associated with Dallas Texas Employee Lending Agreement include: 1. Employee loan agreement Dallas 2. Texas employee lending policies 3. Borrowing agreement for Dallas employees 4. Dallas employee loan contract 5. Employee lending terms and conditions Texas 6. Interest rates for employee loans in Dallas 7. Repayment schedule for employee loans in Texas 8. Employee lending policies and procedures Different types of Dallas Texas Employee Lending Agreements can vary depending on the specific loan purpose or asset being provided. Here are a few common variations: 1. Cash Loan Agreement: This type of agreement allows employees to borrow a specific amount of money from their employer. It outlines the repayment schedule, interest rates, and any penalties for late payments. 2. Equipment Loan Agreement: If an employee needs to borrow company-owned equipment temporarily for personal or work-related purposes, this agreement ensures that the terms of use, maintenance responsibilities, and return conditions are clearly defined. 3. Vehicle Loan Agreement: In some cases, employers may provide vehicle loans to employees for business-related use or personal needs. This agreement specifies the terms of use, insurance requirements, repayment terms, and any additional conditions. 4. Educational Loan Agreement: Companies that offer educational assistance or loan programs to employees can have a specific agreement that outlines the terms, eligibility criteria, repayment options, and any requirements for academic progress. In conclusion, Dallas Texas Employee Lending Agreement is a crucial legal document that regulates lending practices between employers and employees in the area. It ensures transparency, fairness, and compliance with local laws. Different types of lending agreements can exist depending on the purpose, such as cash loans, equipment loans, vehicle loans, or educational loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de préstamo de empleados - Employee Lending Agreement

Description

How to fill out Dallas Texas Acuerdo De Préstamo De Empleados?

Creating forms, like Dallas Employee Lending Agreement, to take care of your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for different cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Dallas Employee Lending Agreement form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Dallas Employee Lending Agreement:

- Make sure that your template is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Dallas Employee Lending Agreement isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!