A San Diego California Employee Lending Agreement is a legally binding document that outlines the terms and conditions under which an employer lends money or assets to an employee. This agreement serves to establish a clear understanding between the employer and the employee regarding the terms of the loan, including repayment terms, interest rates, and any consequences for non-compliance. The purpose of a San Diego California Employee Lending Agreement is to provide financial assistance to an employee in times of need or for specific purposes, while also ensuring that the borrowed amount is repaid in a timely manner. It typically aims to protect the rights and interests of both parties involved, promoting a fair and transparent lending process. Various types of San Diego California Employee Lending Agreements may exist, depending on the nature of the loan and the specific policies of each employer. Some common examples include: 1. Payroll Advance Agreement: This type of agreement allows employees to request a portion of their future wages in advance to cover unexpected expenses or emergencies. It establishes the terms of repayment, such as deductions from future paychecks over a defined period. 2. Relocation Loan Agreement: When an employee is required to relocate for work purposes, the employer may offer a relocation loan to assist with associated expenses. This agreement outlines the terms of the loan and repayment, which may be deducted from future paychecks or paid back in installments. 3. Educational Loan Agreement: Employers may provide financial support to employees seeking further education or professional development. This agreement outlines the loan amount, interest rates (if any), repayment terms, and any conditions associated with the loan, such as maintaining a minimum GPA or staying with the company for a certain period post-graduation. 4. Equipment Loan Agreement: In certain industries, employers may lend specific equipment or tools to employees for job-related purposes. This agreement specifies the equipment being loaned, duration of the loan, responsibility for maintenance and repair, and any conditions for returning the equipment. San Diego California Employee Lending Agreements are subject to the employment laws and regulations in California, ensuring that both employers and employees are protected throughout the lending process. It is always advisable to consult legal professionals or experienced human resources personnel to ensure compliance with relevant laws and best practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de préstamo de empleados - Employee Lending Agreement

Description

How to fill out San Diego California Acuerdo De Préstamo De Empleados?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft San Diego Employee Lending Agreement without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Diego Employee Lending Agreement by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the San Diego Employee Lending Agreement:

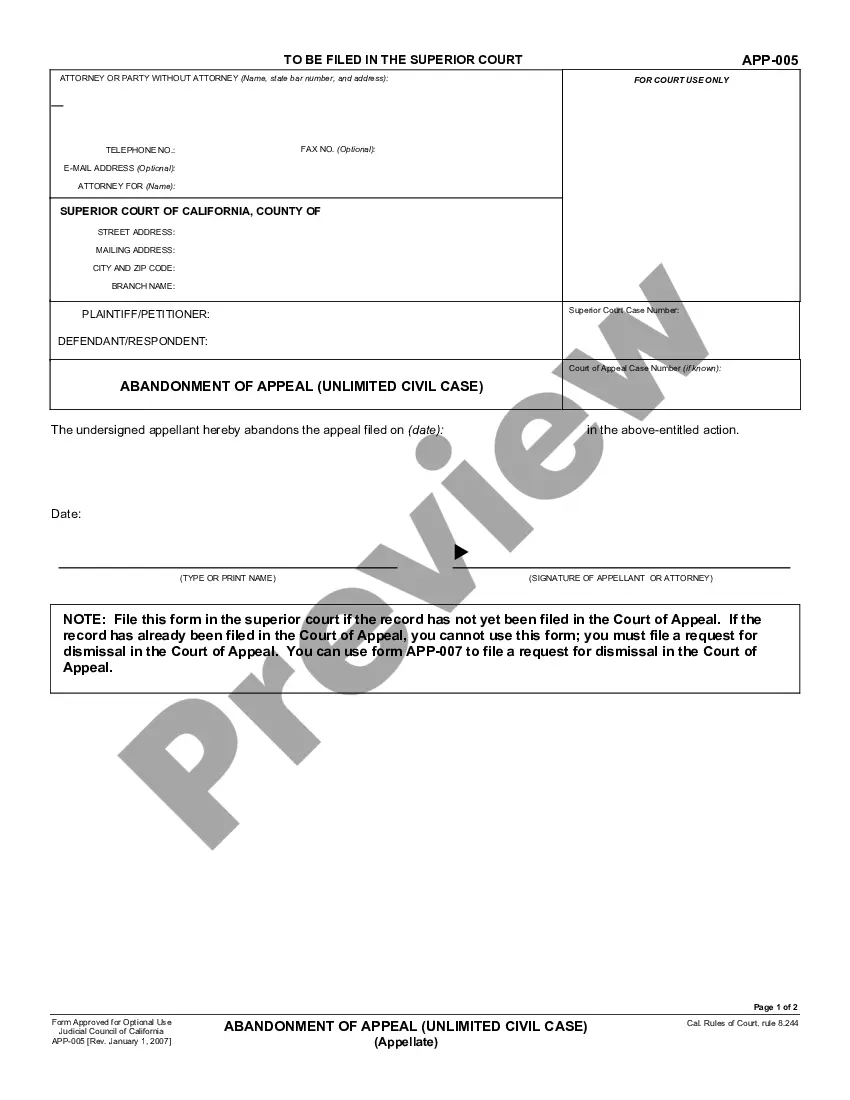

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!