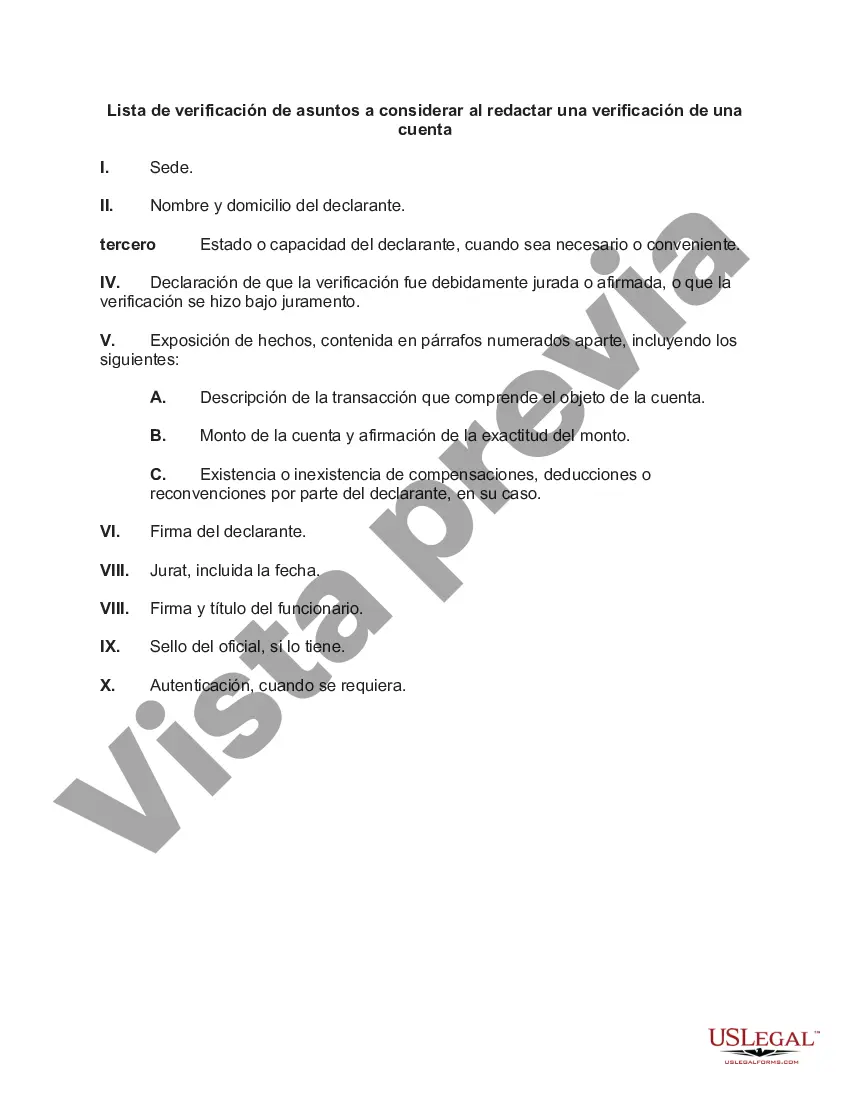

Broward County in Florida is home to a diverse range of individuals and businesses. The bustling county offers a wide array of attractions, including pristine beaches, vibrant cities, and top-notch cultural venues. To ensure accuracy and efficiency when drafting a verification of an account in Broward County, several key matters must be considered. This checklist provides a comprehensive guide to guarantee a thorough and effective verification process, covering critical aspects such as: 1. Identification and Contact Information: — Include the full legal name, address, and contact details of both the account holder and the verifying entity. — Clearly state the relationship between the two parties, such as client and bank or customer and service provider. 2. Account Details: — Specify the account type (e.g., checking, savings, credit card) being verified. — Provide the account number and any additional identifying information such as routing numbers or Pins, if applicable. 3. Statement of Accuracy: — Emphasize the importance of accuracy and truthfulness throughout the verification document. — Use clear and concise language to state that all the information presented in the verification of the account is accurate to the best of your knowledge. 4. Legal Compliance: — Ensure that the verification process adheres to all relevant local, state, and federal laws, including but not limited to privacy regulations (e.g., Gramm-Leach-Bliley Act) and anti-money laundering policies (e.g., Bank Secrecy Act). — Mention any specific regulatory bodies or agencies involved in overseeing account verification activities. 5. Signature and Notarization: — Include spaces for the account holder's signature and date. — Consider whether notarization is required or recommended, depending on the legal or contractual obligations associated with the verification process. In terms of different types of Broward Florida Checklist of Matters to be Considered in Drafting a Verification of an Account, there are no specific variations unique to Broward County. However, it is essential to tailor the verification process to meet the specific requirements of Broward County authorities, financial institutions, or legal entities involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Broward Florida Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Broward Checklist of Matters to be Considered in Drafting a Verification of an Account.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Broward Checklist of Matters to be Considered in Drafting a Verification of an Account will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Broward Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Ensure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Broward Checklist of Matters to be Considered in Drafting a Verification of an Account on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!