King Washington Checklist of Matters to be Considered in Drafting a Verification of an Account In legal proceedings, specifically when drafting a verification of an account, it is crucial to consider a comprehensive set of matters to ensure accuracy and validity. The King Washington Checklist offers a detailed compilation of these essential considerations, encompassing various specific types. Let's explore the key elements of this checklist and the different types involved. 1. Accuracy: The verification should accurately reflect the account statements or records being presented, ensuring that all figures, dates, and relevant information are correct. 2. Completeness: All relevant financial transactions, balances, and supporting documentation must be included to provide a complete account overview. 3. Consistency: The verification should maintain consistency with previously submitted or disclosed information, avoiding any conflicting or contradictory statements. 4. Timeliness: The verification should be prepared in a timely manner, considering any specified deadlines or court requirements. 5. Compliance: Ensure that the verification adheres to all legal and regulatory requirements in the jurisdiction where it is being submitted, including any specific formatting or content guidelines. 6. Clarity: The account verification should be drafted in clear and concise language to avoid ambiguity and facilitate understanding by all parties involved. 7. Organization: Maintain a logical and structured format, arranging the information in a manner that assists in easy referencing and comprehension. 8. Supporting Documentation: Include any necessary supporting documentation, such as bank statements, receipts, invoices, or other relevant records, to substantiate the accuracy and validity of the account. Types of King Washington Checklist of Matters to be Considered in Drafting a Verification of an Account: 1. Personal Account Verification: This type of account verification is used for personal financial matters, ensuring accuracy in personal financial records, transactions, and balances. 2. Business Account Verification: Designed specifically for business-related financial matters, this type of verification ensures accurate recording of business transactions, balances, and financial statements. 3. Legal Proceedings Account Verification: When an account verification is required for legal proceedings, this checklist ensures that all matters relevant to the legal case are considered and addressed appropriately. 4. Audit Account Verification: For audits conducted by external parties, this type of verification checklist ensures meticulous examination and verification of all financial records and statements. 5. Tax Account Verification: This checklist type focuses on verifying the accuracy and completeness of financial records, transactions, and balances specifically for tax-related purposes, ensuring compliance with tax laws and regulations. By using the King Washington Checklist of Matters to be Considered in Drafting a Verification of an Account, individuals can ensure that their account verifications are comprehensive, accurate, and legally compliant, regardless of the specific type or purpose of the account being verified.

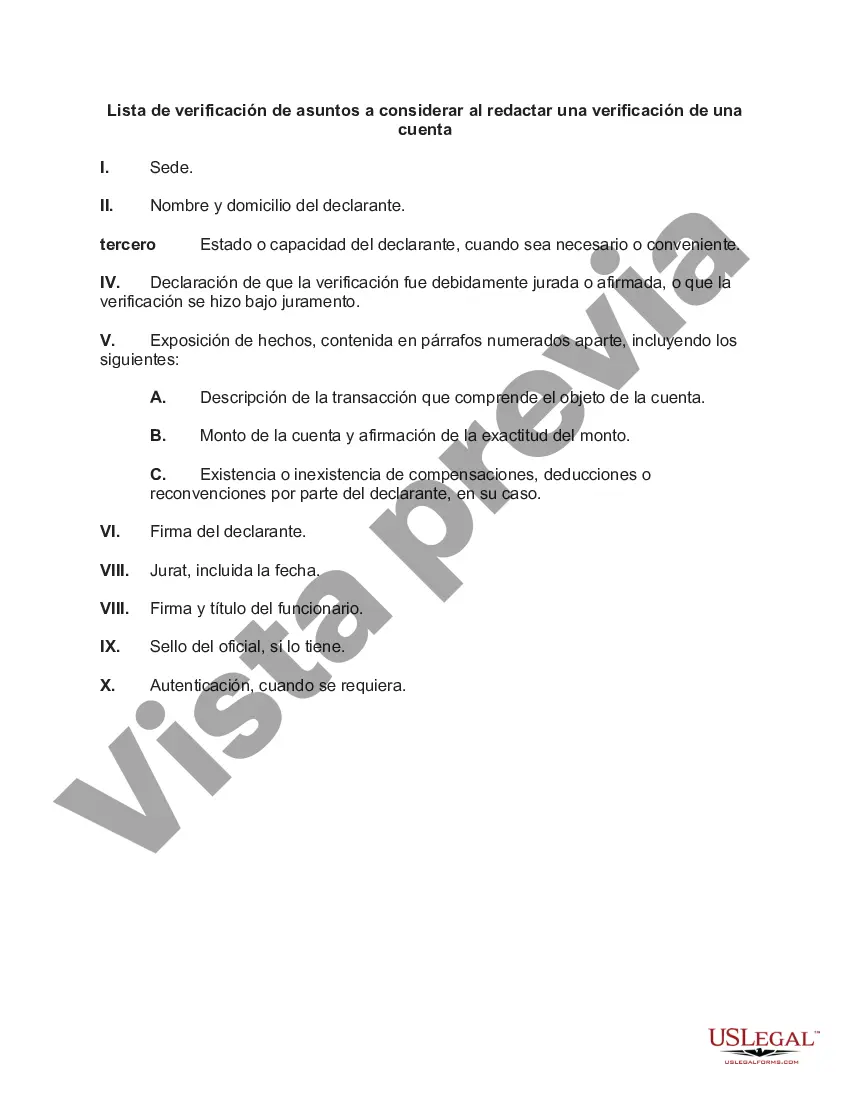

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out King Washington Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft King Checklist of Matters to be Considered in Drafting a Verification of an Account without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid King Checklist of Matters to be Considered in Drafting a Verification of an Account on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the King Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!