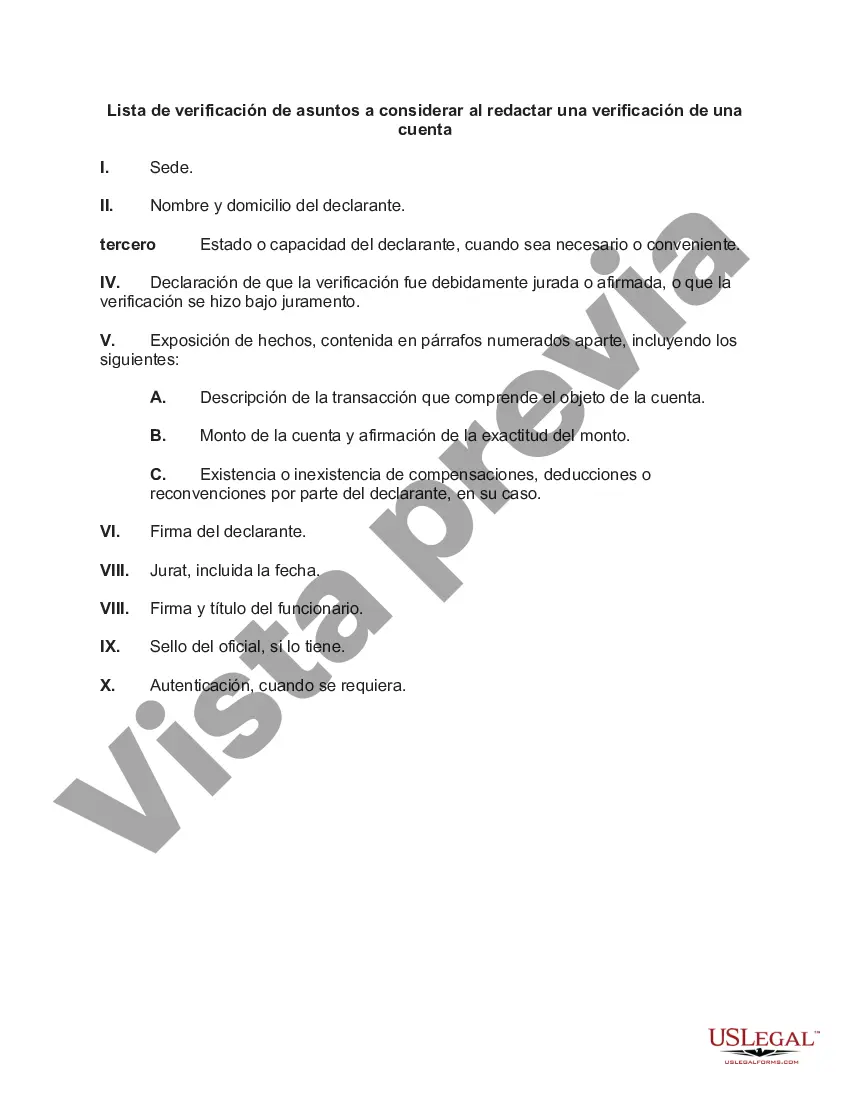

Los Angeles, California is a vibrant and diverse city located on the west coast of the United States. Renowned for its sunny climate, thriving entertainment industry, and cultural diversity, it offers numerous attractions and opportunities for both residents and visitors. When drafting a verification of an account in Los Angeles, California, there are several matters that should be considered to ensure accuracy and legal compliance. Here is a checklist of relevant factors to bear in mind: 1. Identification of Parties: Begin the verification by clearly identifying the account holder and the institution with which they hold the account. Include full names, addresses, contact information, and any unique identifiers such as account numbers. 2. Purpose of Verification: Specify the purpose for which the verification is being conducted. This could include legal proceedings, financial audits, or compliance requirements. 3. Date and Time: Include the date and time of the verification to establish when the process took place and to align it with any relevant events or developments. 4. Verification Methodology: Describe the methodology employed to verify the account. Outline any documents reviewed, interviews conducted, or external sources consulted to ensure accuracy. 5. Verification Statements: Provide a comprehensive overview of the account information that was verified. This should include balances, transactions, account history, and any other relevant details. 6. Legal Compliance: Ensure that the verification process adheres to all applicable laws and regulations. This may include privacy laws, financial reporting requirements, or industry-specific guidelines. 7. Inclusion of Supporting Documents: Attach relevant documents that support the verified account information. These may include bank statements, transaction records, or any other evidence that strengthens the verification. 8. Signatures and Notarization: Obtain signatures from all relevant parties involved in the verification process, including the account holder, verifying authority, and notary public, if required. Different types of Los Angeles, California Checklists of Matters to be Considered in Drafting a Verification of an Account may include: 1. Individual Account Verification: This checklist is specific to verifying individual accounts, ensuring personal financial information is accurately verified and legally compliant. 2. Corporate Account Verification: As the name suggests, this checklist concentrates on the verification of accounts held by businesses or corporations. It may include additional considerations such as shareholder information or financial statements. 3. Legal Proceedings Account Verification: For cases involving legal proceedings, this checklist focuses on gathering and verifying pertinent account information for court purposes, such as divorce settlements or financial disputes. 4. Compliance Account Verification: This type of checklist caters to regulatory compliance requirements, particularly in highly regulated industries such as banking or healthcare. It ensures that accounts meet specific industry standards and guidelines. By considering the above matters and utilizing the appropriate checklist for the type of account being verified, parties involved can ensure a comprehensive and accurate verification process in Los Angeles, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Los Angeles California Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Los Angeles Checklist of Matters to be Considered in Drafting a Verification of an Account, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how to find and download Los Angeles Checklist of Matters to be Considered in Drafting a Verification of an Account.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related document templates or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase Los Angeles Checklist of Matters to be Considered in Drafting a Verification of an Account.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Los Angeles Checklist of Matters to be Considered in Drafting a Verification of an Account, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to cope with an exceptionally difficult situation, we recommend using the services of a lawyer to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!