Mecklenburg County in North Carolina is an important jurisdiction that requires certain considerations when drafting a verification of an account. This checklist outlines key aspects to be considered while preparing the verification document, ensuring accuracy and adherence to legal requirements. The checklist serves as a helpful reference for legal professionals, accountants, and individuals involved in account verification processes in Mecklenburg County. Here are the critical matters that one should keep in mind when drafting a verification of an account: 1. Parties involved: Clearly identify and mention the names, addresses, and roles of all the parties associated with the account, such as the account holder, account custodian, and any other relevant individuals or entities. 2. Account details: Provide a comprehensive description of the account, including the type (savings, checking, investment, etc.), account number, and branch or financial institution where the account is held. 3. Verification purpose: Specify the purpose of the verification. This could be for legal or administrative matters, such as probate proceedings, divorce settlements, asset evaluations, or financial audits. 4. Account balance: State the current balance of the account and any fluctuations or transactions that have occurred within a specific period, if applicable. Include the date when the balance was last verified. 5. Supporting documents: List the supporting documents that accompany the verification, such as bank statements, transaction records, or any other relevant financial documents. Ensure these documents are properly referenced and attached. 6. Confidentiality and privacy: Address any confidentiality concerns regarding the account and ensure compliance with privacy regulations and guidelines, such as the Gramm-Leach-Bliley Act or the General Data Protection Regulation (if applicable). 7. Notarization and witness: Determine if notarization or witness signatures are required under Mecklenburg County regulations or the specific purpose of the verification. If necessary, ensure that the document includes spaces for notarization or witness signatures. Different Types of Mecklenburg North Carolina Checklist of Matters to be Considered in Drafting a Verification of an Account: 1. Probate verification: This checklist focuses on matters specifically related to a deceased person's account, addressing the requirements for probate proceedings, distribution of assets, and the settlement of the deceased individual's estate. 2. Divorce settlement verification: Tailored for divorce cases, this checklist covers the necessary considerations when verifying marital accounts. It may include items such as identifying joint accounts, determining the equitable division of assets, and verifying financial disclosures provided during divorce proceedings. 3. Financial audit verification: This checklist is designed to ensure compliance with auditing practices, addressing the specific requirements of auditors for verifying financial accounts. It may cover items such as assessing internal controls, evaluating financial competency, and confirming accuracy and completeness of financial records. By following the Mecklenburg North Carolina Checklist of Matters to be Considered in Drafting a Verification of an Account, individuals and professionals can navigate the complex process of account verification effectively and efficiently, promoting transparency, accuracy, and compliance with applicable legal and regulatory standards.

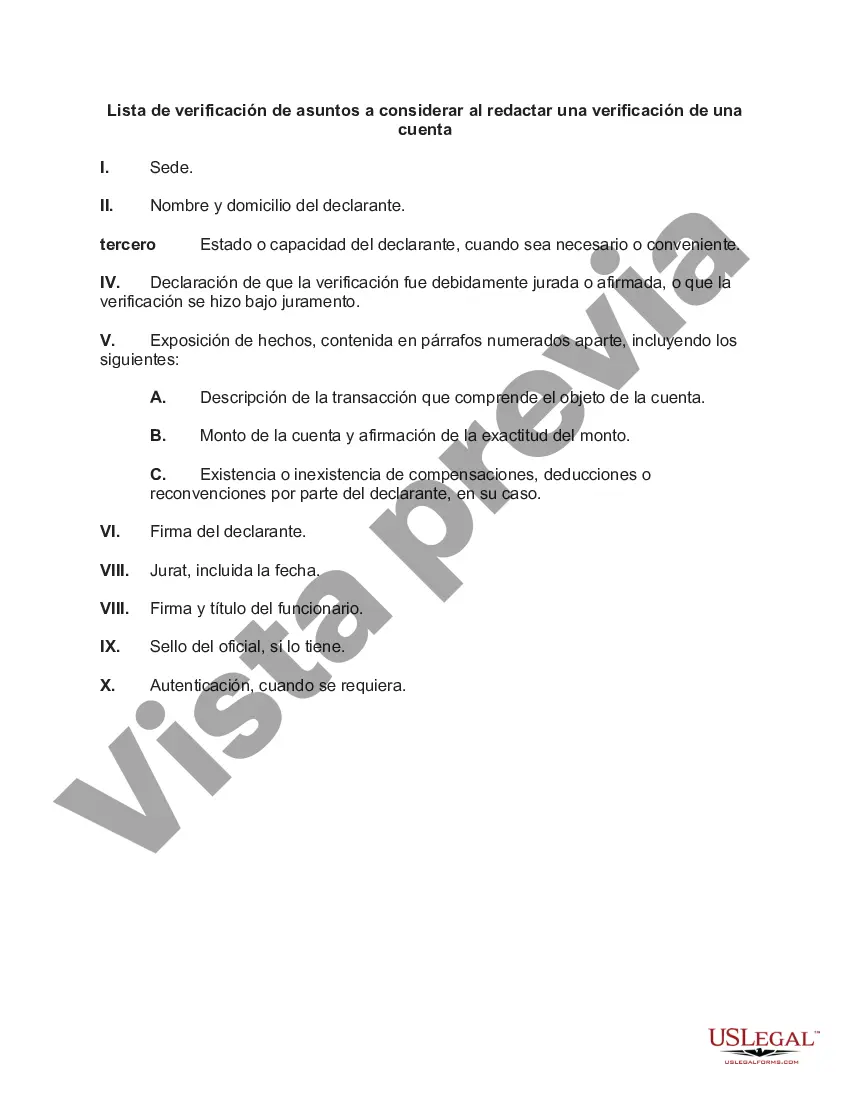

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Mecklenburg North Carolina Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Mecklenburg Checklist of Matters to be Considered in Drafting a Verification of an Account suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Mecklenburg Checklist of Matters to be Considered in Drafting a Verification of an Account, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Mecklenburg Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Mecklenburg Checklist of Matters to be Considered in Drafting a Verification of an Account.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!