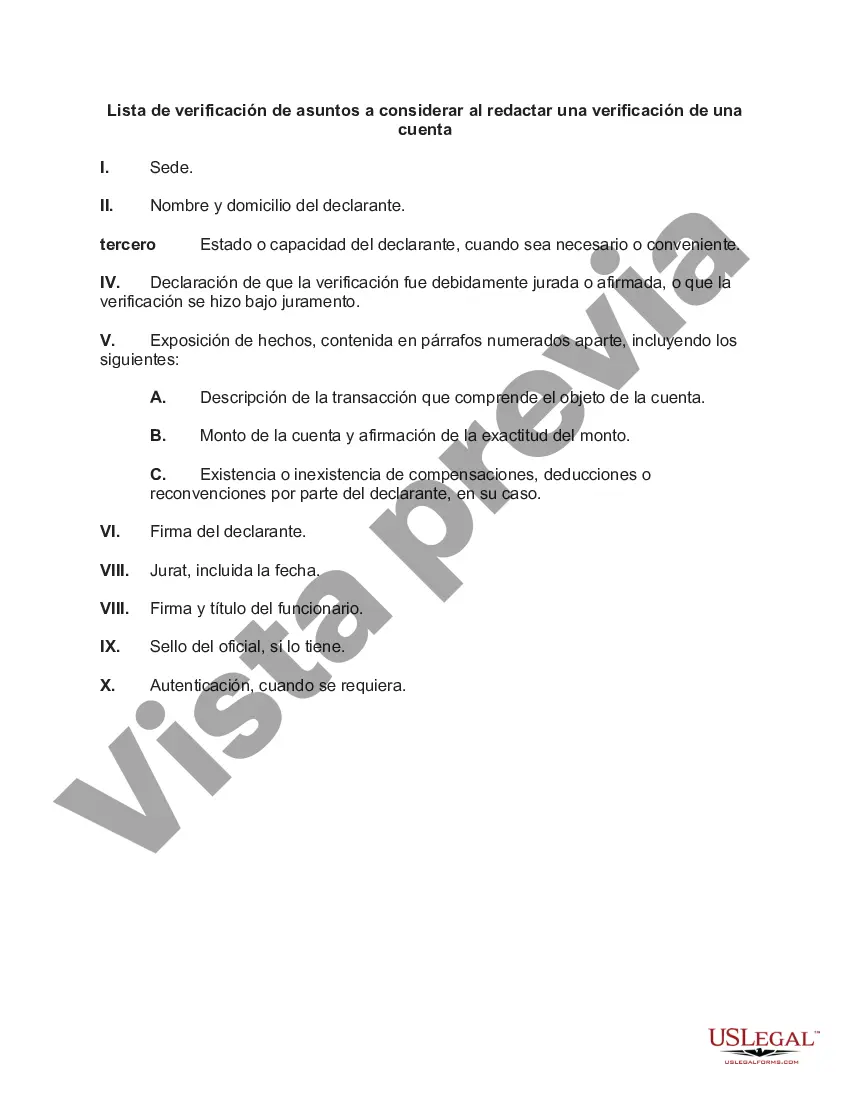

Miami-Dade, Florida is a vibrant and diverse county located in the southeastern part of the state. Known for its beautiful beaches, bustling nightlife, and rich cultural heritage, Miami-Dade is a popular tourist destination and a thriving metropolitan area. When drafting a verification of an account specific to Miami-Dade, there are several important matters to consider. These include: 1. Personal information: Include the account holder's full name, address, contact information, and any other relevant personal details. 2. Account details: Provide a comprehensive overview of the account being verified, including the account number, type of account (e.g., checking, savings, credit card), and the financial institution or bank where the account is held. 3. Transaction history: Summarize the account's transaction history, showcasing the inflows and outflows of funds during a specific period. This helps provide a clear picture of the account's financial activities. 4. Statement of authenticity: Clearly state that the provided information is true and accurate to the best of your knowledge. Additionally, mention that any falsification or misrepresentation may result in legal consequences. 5. Legal compliance: Ensure that the verification of the account abides by all applicable federal and state laws, including any relevant regulations related to financial privacy and data protection. 6. Signatory details: Include the name, title, and contact information of the person responsible for verifying the account. This person should have the authority and knowledge to confirm the account's accuracy. In terms of different types of Miami-Dade Florida checklist of matters to be considered in drafting a verification of an account, two major categories could be identified: 1. Individual Account Verification Checklist: This type of checklist is applicable when verifying an account held by an individual resident or non-resident of Miami-Dade County. It ensures that all necessary information and documentation pertaining to personal accounts are included in the verification process. 2. Business Account Verification Checklist: This checklist is used for verifying accounts held by businesses, corporations, or organizations operating within Miami-Dade County. It includes additional considerations such as the business's legal structure, tax identification number, and authorized signatories. By using keywords such as Miami-Dade Florida, verification of an account, checklist, drafting, and relevant variations of these terms, one can create content that addresses the specific requirements of drafting a verification of an account specific to Miami-Dade County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-13326BG

Format:

Word

Instant download

Description

Account verification is the process of verifying that a new or existing account is owned and operated by a specified real individual or organization.

Miami-Dade, Florida is a vibrant and diverse county located in the southeastern part of the state. Known for its beautiful beaches, bustling nightlife, and rich cultural heritage, Miami-Dade is a popular tourist destination and a thriving metropolitan area. When drafting a verification of an account specific to Miami-Dade, there are several important matters to consider. These include: 1. Personal information: Include the account holder's full name, address, contact information, and any other relevant personal details. 2. Account details: Provide a comprehensive overview of the account being verified, including the account number, type of account (e.g., checking, savings, credit card), and the financial institution or bank where the account is held. 3. Transaction history: Summarize the account's transaction history, showcasing the inflows and outflows of funds during a specific period. This helps provide a clear picture of the account's financial activities. 4. Statement of authenticity: Clearly state that the provided information is true and accurate to the best of your knowledge. Additionally, mention that any falsification or misrepresentation may result in legal consequences. 5. Legal compliance: Ensure that the verification of the account abides by all applicable federal and state laws, including any relevant regulations related to financial privacy and data protection. 6. Signatory details: Include the name, title, and contact information of the person responsible for verifying the account. This person should have the authority and knowledge to confirm the account's accuracy. In terms of different types of Miami-Dade Florida checklist of matters to be considered in drafting a verification of an account, two major categories could be identified: 1. Individual Account Verification Checklist: This type of checklist is applicable when verifying an account held by an individual resident or non-resident of Miami-Dade County. It ensures that all necessary information and documentation pertaining to personal accounts are included in the verification process. 2. Business Account Verification Checklist: This checklist is used for verifying accounts held by businesses, corporations, or organizations operating within Miami-Dade County. It includes additional considerations such as the business's legal structure, tax identification number, and authorized signatories. By using keywords such as Miami-Dade Florida, verification of an account, checklist, drafting, and relevant variations of these terms, one can create content that addresses the specific requirements of drafting a verification of an account specific to Miami-Dade County.